NYcarbineer

Diamond Member

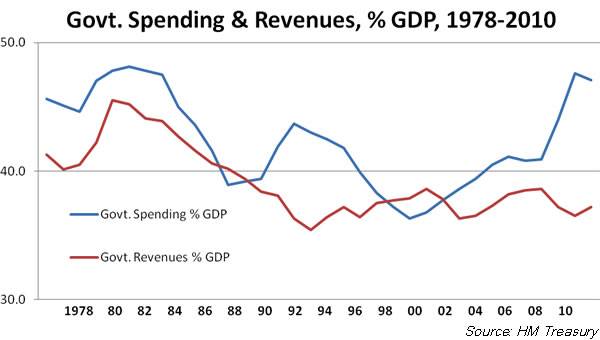

Yeah, those were just "extraneous events".But the toggle switch in your noggin can't process things like Katrina, 9/11, housing meltdown, banking crisis, etc.I guessed you ignored my post showing that 4 of the 7 times in the last 54 years that revenues fell occurred during the Bush administration.Indeed, it is remarkable that federal revenue as a percentage of GDP only dropped about 3% even though tax rates were slashed by at least 6% overall (I'm deliberately low-balling here). From 2004 to 2008 fedrev as a percentage of GDP was only about 3% less on average than it was from 1995-2000.

When you cut taxes, you expect that federal revenue as a percentage of GDP could very well dip a bit, depending on several factors, but that does not change the fact that federal revenue skyrocketed after the Bush tax cuts and saw the largest four-year increase in recent history.

Oh right, Bush always gets extra credit for extraneous events. Strangely no other president does.

Jesus.

How did Katrina hurt the economy? Unemployment was 5% when Katrina hit, and stayed under 5% for the next 2 years.

)

)