NYcarbineer

Diamond Member

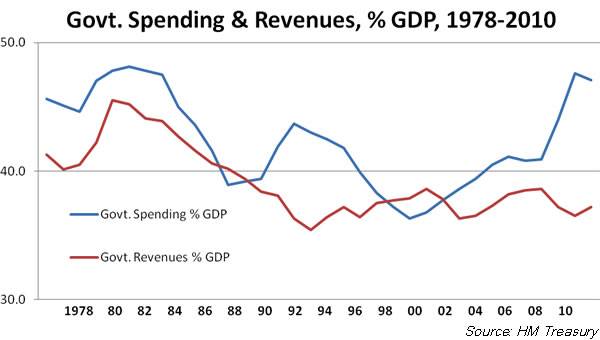

Same reason a dog licks his balls.They spend more than they take in.Every GOP president in the past 30 years has generated revenue from deficit spending.

Then you should spend all of your life savings.....see how much revenue that generates for you........

The American people have massive levels of debt. Why do you suppose that is?

Why?

Ok, so the individual American consumer is irresponsible.