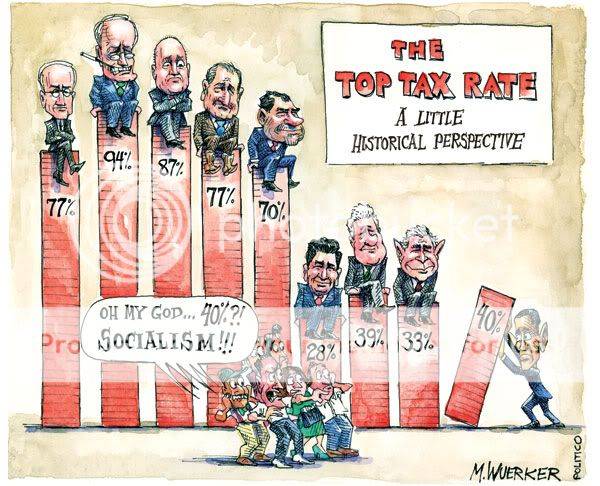

Let's look at those top rates for inflation adjusted income in 2010 dollars:

1918, top tax rate of 77% applies to income over $14.4M

1944, top tax rate of 94% applies to income over $2.477M

1947, top tax rate of 86.45% applies to income over $1.955M

1964, top tax rate of 77% applies to income over $2.8M

1971, top tax rate of 70% applies to income over $1,076M

1988, top tax rate of 28% applies to income over $54,825 (note, not millions anymore)

1994 top tax rate of 39.6% applies to income over $367,761

The Bush era top tax rate is 35% not 33% - 2003 applies to taxable income over $369,608

Obama's tax rate of 39.6% will applies to incomes over $375,700 (this doesn't include the additional SS and Medicare surcharges of 3.8% to be added as well).

The top rates no longer apply to the uber rich - they apply to upper middle class families in urban areas. Why they should be punished with 94% tax rates is beyond me.

It's also important to note that the total tax burden on the median American family as a percent of income has more than doubled since the 1950s. The justification for taxes to be imposed on The Rich is just a pretext to spread them over a broader population over time.

Sources:

Historical Top Tax Rate

TPC Tax Topics | 2010 Budget -* Tax Increases on High-Income Taxpayers

CPI Inflation Calculator