US Weighs Ban on Charging Buyers for Lender Title Insurance

(Bloomberg) -- A top US consumer watchdog is considering whether to bar mortgage bankers from charging homebuyers for title insurance that protects the lenders, ending a long-standing industry practice.Most Read from BloombergUS Sees Missile Strike on Israel By Iran, Proxies as ImminentUS Slams...

4

Austin Weinstein and Katanga Johnson

Wed, April 10, 2024 at 4:50 PM EDT·5 min read

US Weighs Ban on Charging Buyers for Lender Title Insurance

(Bloomberg) -- A top US consumer watchdog is considering whether to bar mortgage bankers from charging homebuyers for title insurance that protects the lenders, ending a long-standing industry practice.

The Consumer Financial Protection Bureau’s plan is still in the early stages, according to people familiar with the matter. The agency will begin to lay the groundwork for the measure in a broad request for information on closing costs, including title insurance and other fees, that will be released as soon as this month, they said. Any final proposal on closing costs, including title insurance, would not come until 2025, one of the people said.

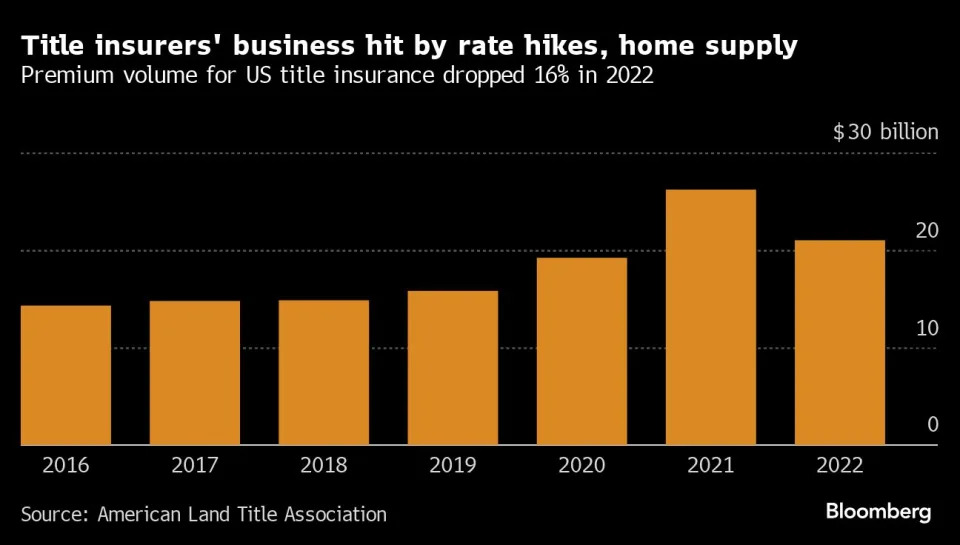

If approved, it may offer at least some relief to Americans struggling to purchase affordable homes due to limited inventory, elevated prices and closing costs, and 11 interest-rate hikes since March 2022. But it would also draw strong opposition from mortgage lenders and title insurers grappling with a housing market slump that has squeezed profits.

“Reducing the homeowner’s closing costs is excellent policy, provided the lender cannot recover that cost in another way from the homebuyer through some other fee or a higher rate,” Maria Vullo, who was superintendent of New York’s Department of Financial Services from 2016 to 2019, said in an interview. “A title insurance policy for the lender protects the lender’s interest. I think it is a positive, pro-consumer, pro-homeowner policy to say that the lender has to pay for it themselves.”

It's baffling to me that the people who propose these laws don't realize that the bank/business/whatever will just find another way to pass the cost on. Increase another cost, add a new fee, whatever. Over what, something that is a fraction of 1 percent of the cost of a house?

In other words....."We can't charge title insurance to cover our asses anymore. But we can add a quarter point to everyone's rate..."