Moonglow

Diamond Member

There are no chickens buying real estate anywhere.I can see that. In the chicken capital of America, not many chickens buy elegant homes.

Last edited:

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

There are no chickens buying real estate anywhere.I can see that. In the chicken capital of America, not many chickens buy elegant homes.

There are no chickens buying real estate anywhere.

Dane County, in southern Wisconsin.In what real estate market do you live?

Some people don't care for the risk and volatility of other investments. I'm a 'nervous nellie', so my dough is in insured savings instruments and A rated or better short-term annuities.Only suckers keep their money in banks they make little to no interest.

Mine increased by 3 percent. Next year it will be 4 percent if interest rates hold.And everyone's retirement investments fell between 12% - 30%.

But but but Biden says it's one of the best economies ever!!

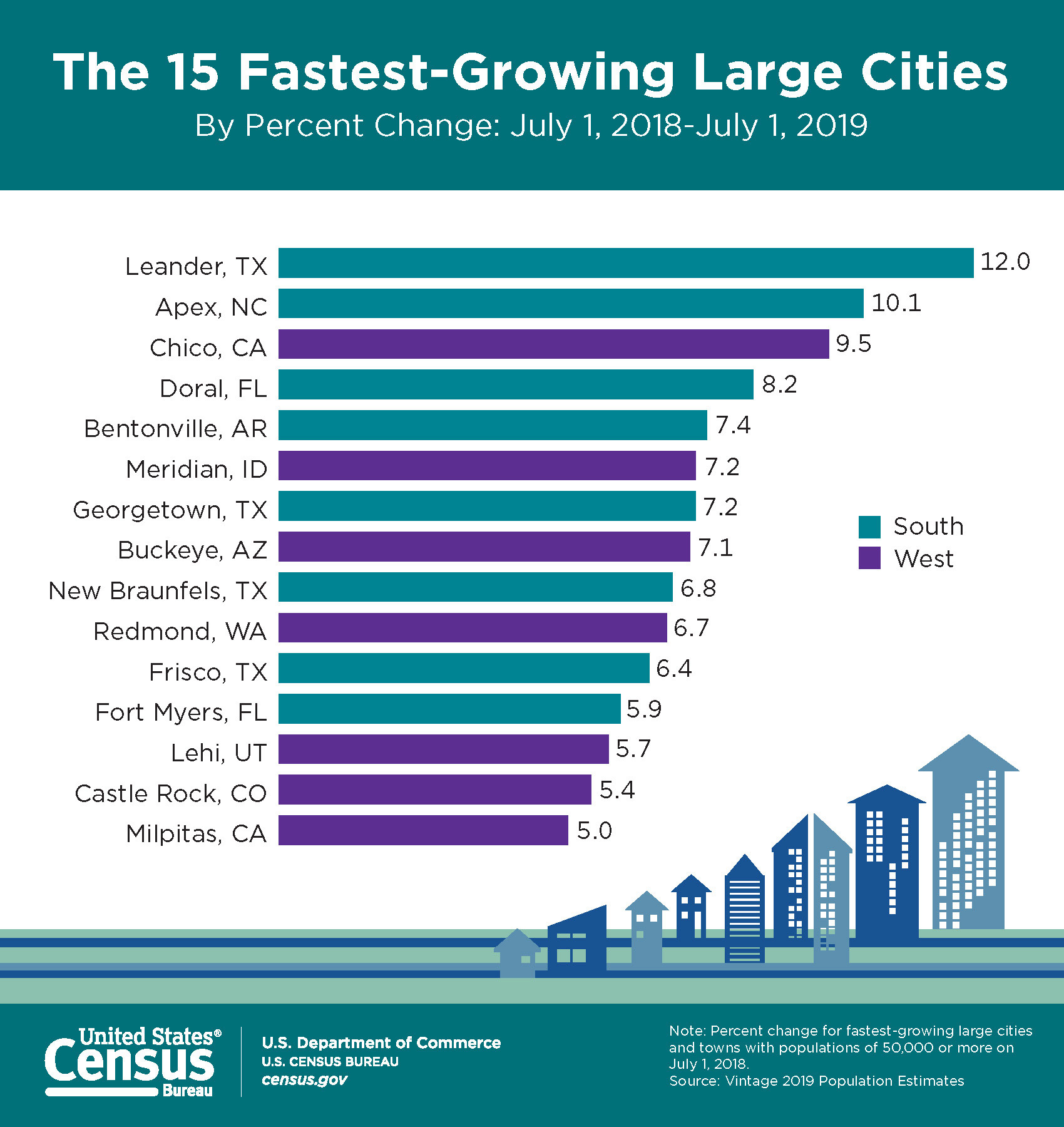

I have managed to make 1000% on real estate investments in the area since 1998...

Doubt that.I have managed to make 1000% on real estate investments in the area since 1998...

I bought an 8-unit in 1994 with $20,000 of my own money plus $20,000 that I borrowed from my boss. 18 years later the building had put $500,000 in the bank for me in rents, appreciation, and interest. That's a 25-fold increase of my original investment from one property. If I had invested in more properties as I went along the gain on that $20,000 would be in the $millions.Doubt that.

Unless you chose some AMAZING deals - a 1000% gain is virtually unheard of.

1000% gain on 100,000 would be $1,000,000.

Pretty sure you are not a millionaire.

Sure it is.He said since 1998. Not farfetched.

The profit isn't figured by the price of the real estate but what you had to invest to get it, the down payment. From there you leverage the equity to acquire more properties without putting any more of your own money in. Reread my post #29.Sure it is.

Unless you bought some exceptionally high value land, prior to it being high valued, you are not going to get a 1000% return.

That is 10 fold. Even in 20 years that is super exceptional

yeah no... if you get a 1000% return on a real estate investment and all you paid was a down payment - the IRS will be at your door by the end of the day.The profit isn't figured by the price of the real estate but what you had to invest to get it, the down payment. Reread my post #29.

Do I need a nametag to be a millionaire or some special attribute of formality?Doubt that.

Unless you chose some AMAZING deals - a 1000% gain is virtually unheard of.

1000% gain on 100,000 would be $1,000,000.

Pretty sure you are not a millionaire.

I have managed to make 1000% on real estate investments in the area since 1998...

We're talking over a period of many years. My return on investment was 25X over 18 years. Invested $20,000, return after taxes was $500,000. Most long-term owners of rental property would be similar. Moonglow indicated 24 years.yeah no... if you get a 1000% return on a real estate investment and all you paid was a down payment - the IRS will be at your door by the end of the day.

If it were that easy... everyone would do it.

Not that 1000% is impossible, it isn't... but it is extremely rare. 10 fold money?

You put down $30,000, and turn around a make a $300,000 profit? RARE.

It happens... but "all the time"... hell no.

Millionaires (net worth) are a dime a dozen. I'm one, it's no big deal.Doubt that.

Unless you chose some AMAZING deals - a 1000% gain is virtually unheard of.

1000% gain on 100,000 would be $1,000,000.

Pretty sure you are not a millionaire.