georgephillip

Diamond Member

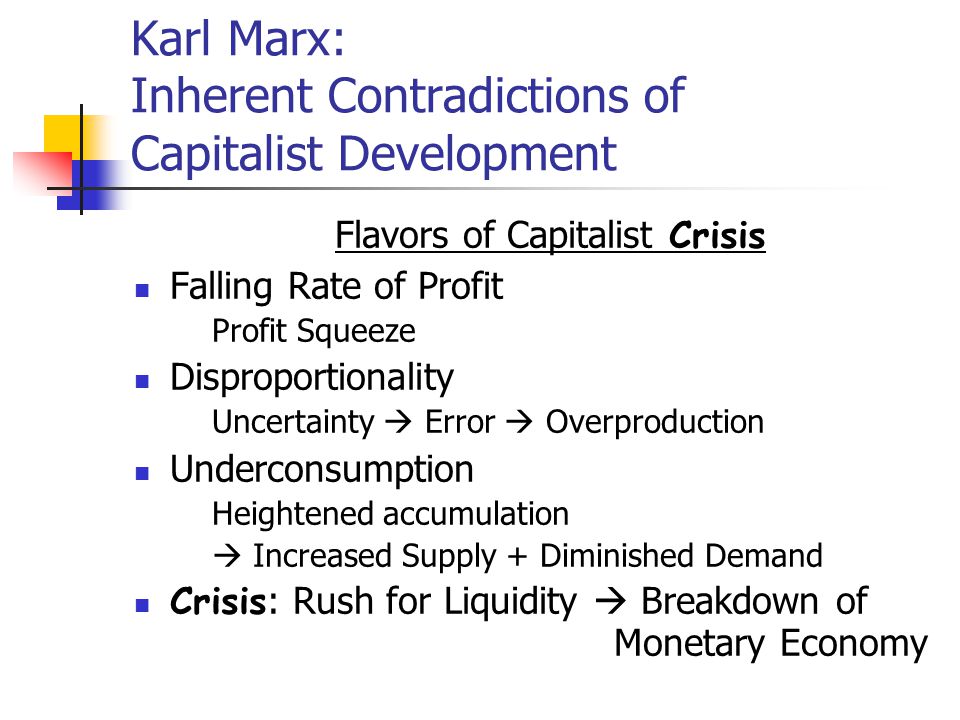

If it's true the internal logic of the capitalist system is seen most clearly in the Great Depression, then the normal condition of the mature capitalist system is stagnation and rampant speculation:

Monthly Review | The Triumph of Financial Capital

"Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirlpool of speculation. When the capital development of a country becomes a byproduct of the activities of a casino, the job is likely to be ill-done."

J.M. Keynes

"Financial capital, once cut loose from its original role as a modest helper of a real economy of production to meet human needs, inevitably becomes speculative capital geared solely to its own self-expansion.

"In earlier times no one ever dreamed that speculative capital, a phenomenon as old as capitalism itself, could grow to dominate a national economy, let alone the whole world.

"But it has.

"This is the reality we face today. (June, 1994)

"Its dire consequences are visible on all sides, from 35 million unemployed in the advanced industrial countries to deepening poverty and destitution in the Third World and unchecked ecological deterioration everywhere."

Monthly Review | The Triumph of Financial Capital

"Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirlpool of speculation. When the capital development of a country becomes a byproduct of the activities of a casino, the job is likely to be ill-done."

J.M. Keynes

"Financial capital, once cut loose from its original role as a modest helper of a real economy of production to meet human needs, inevitably becomes speculative capital geared solely to its own self-expansion.

"In earlier times no one ever dreamed that speculative capital, a phenomenon as old as capitalism itself, could grow to dominate a national economy, let alone the whole world.

"But it has.

"This is the reality we face today. (June, 1994)

"Its dire consequences are visible on all sides, from 35 million unemployed in the advanced industrial countries to deepening poverty and destitution in the Third World and unchecked ecological deterioration everywhere."