I don't think that's true, that trade deficits are always detrimental. You could run a deficit with another country for a commodity that you can then use to manufacture and profit from seeling your product.

Say you purchase the foreign resource for $100 and sell it domestically for $250. Don't we have a net increase in GDP, even though we also have a trade deficit?

Concerning a trade deficit of goods vital to the nations production of other goods or service products:

That deficit is a component of the nations entire balance of global trade;

thus that deficit fully participates in the nations trade balances affect upon their GDP.

Regardless of an imported goods extent of national economic benefit, ALL trade deficits are ALWAYS detrimental to their nations GDPs.

GDP is non-judgmental; its an objective aggregate of expenses or prices to create all goods and service products produce throughout the nation during the reporting period.

GDP is dumb; its unable to recognize any advantage between spending for education or for lap dancers.

I have greater confidence in the more arbitrary GDP statistic rather than depending upon bureaucrats discretionary powers and judgments.

Respectfully, Supposn

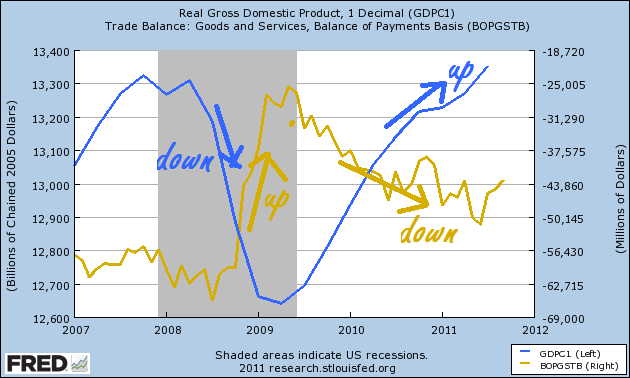

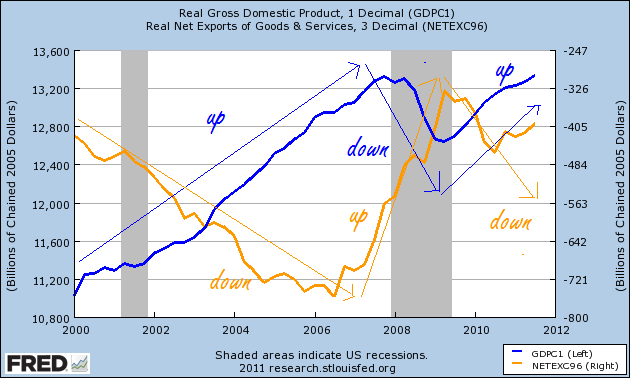

I invite you to check out this link. It shows the correlation between the US trade deficits and GDP from 1980 - 2007. We had some big deficits in there but equally big increases in GDP. Doesn't square with your assertion.

LOL, I have no confidence at all in bureaucrats either.

In Praise Of Trade Deficits