- Thread starter

- #221

Here is more.Woodrow Wilson, POTUS in 1913, and his Progressives did that.

Same time as instituting the Income Tax.

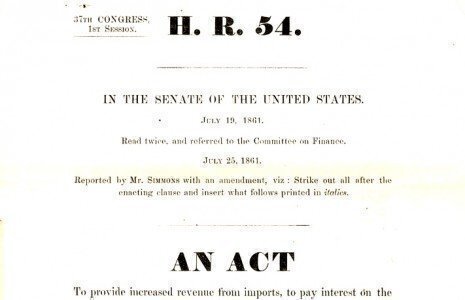

Most people aren’t big fans of a national income tax, but it was on this day back in 1861 that the first one was levied by the new President, Abraham Lincoln. It only lasted 10 years, and many people thought it would never return.

But after years of arguing and a few court battles, the federal income tax we all know returned for good in 1913, with the ratification of the 16th Amendment.

Lincoln’s national income tax was a direct reaction to the military needs of the Civil War, and he could only tax the northern states. He was also able to impose the tax without passing a constitutional amendment.

After asking his cabinet if the income tax was constitutional, Lincoln met with Congress in a special joint session on July 4, 1861, to hammer out the details of the tax law.

Lincoln’s cabinet and fellow Republicans had determined that since it did not tax property directly, the income tax was an indirect tax, and it was not subject to Article I of the Constitution, which said that direct taxes must be apportioned according to the population of each state.