Toro

Diamond Member

- Thread starter

- #21

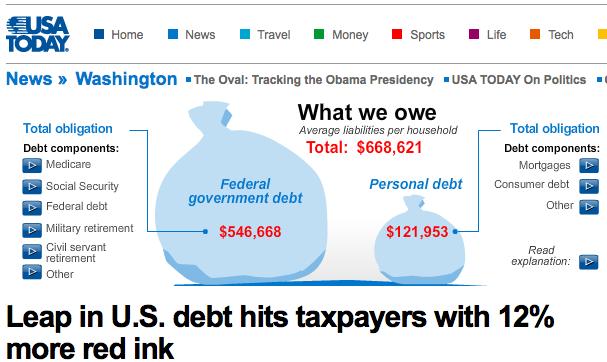

Americans are abysmally stupid when it comes to finances.

Maybe instead of teaching high school kids how to put condoms on bananas we should be teaching them finance.

Its not just Americans.

I was a stock broker in Canada shortly after I left university. I was shocked at how little people saved. I remember having a conversation with this couple in their mid-50s who had $9000 in the bank, and they wanted me to turn that into enough for them to retire on. Stunning.

Stock brokers are likely the reason the couple only had $9000. I save like crazy & like everyone I know lost a mint in the stock market. I am down over $250,000 buying stocks that nearly bankrupted me. I now short the markets at key intervals & buy real assets & have never had my assets make me more, inflation & tax free to boot. Once people figure out the system is rigged & stop playing the game they make real wealth. Smart people finally get off the work hard, pay taxes, & save only to loose value tread mill.

See, if you'd given your money to me, you'd be up 30% since 2007!

The couple hadn't used a broker yet. It was the early 90s.

I do understand your frustration though. I don't think the financial industry always serves its clients well. I talk to brokers, and they tell me that a lot of their retail clientele sold in 2008 at a deep loss and did not come back into the market to profit from the rebound.