I understand why it's confusing. I've spent much of my career in and around the pension fund industry. And even there, many people don't understand how SS works.

Including -- Apparently you.. Where is the "shortfall" getting financed? WHO EXACTLY is paying for it?

Don't disappoint me. You can't be that stupid..

No, I understand it. I've made a good living at it.

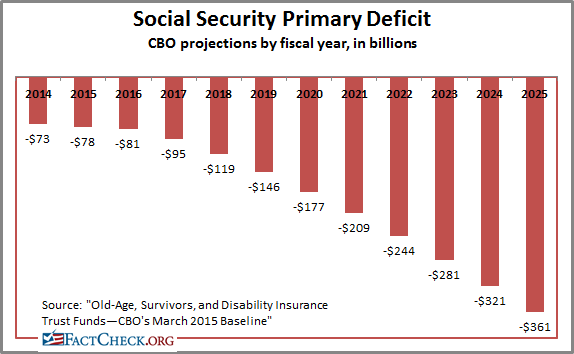

As I've explained a few times, the deficit is financed by Treasury debt. I agree with you. There is an additional $53 billion in Treasury securities that are issued to cover the deficits in the SS trusts.

But if the government issued Treasury securities to deposit in the Trusts rather than crediting and debiting non-marketable liabilities like SS currently does, the government would have to issue ~$930 billion in Treasury securities. And because the total debt of the Treasury = Treasury securities + non-marketable liabilities, total government debt wouldn't change.

People PAY you to do financial analysis? OF COURSE the debt would change. OVER TIME. Not just looking at a single year transaction.. .

If continual interest had actually been ISSUED on those "bonds" (which they are not) -- then the debt would be already BOOKED over those 30 years and TRANSFERED to liquid assets within the funds. Folks living today and their children wouldn't be paying a 2nd time for the same

STOLEN dollar of interest on the surplus.

The fact that NO interest was paid on that debt is clear proof that this is nothing like a "bond fund investment". And asserting THAT as a financial guy could get you in trouble..

This is only ONE way that the surplus could have been RESPONSIBLY managed all those years to leave something in the "trust fund" to defer future costs. The other 2 example CLEARLY would have reduced our current and future liabilities by miles..

But to DO those things. Congress critters risked uncovering their felonious theft in the explanations. And NOBODY in the swamp is that brave..