excalibur

Diamond Member

- Mar 19, 2015

- 22,765

- 44,344

- 2,290

And we produce very little fertilizer. Probably environmentalist wackos being the biggest reason why we do not.

BC-Russia-Ukraine-Tensions-Spur-Fears-of-Fertilizer-Sh

(Bloomberg) -- More price hikes for fertilizer — and consequently, food — are on the horizon as escalating tensions between Russia and Ukraine add to fears of global shortages.

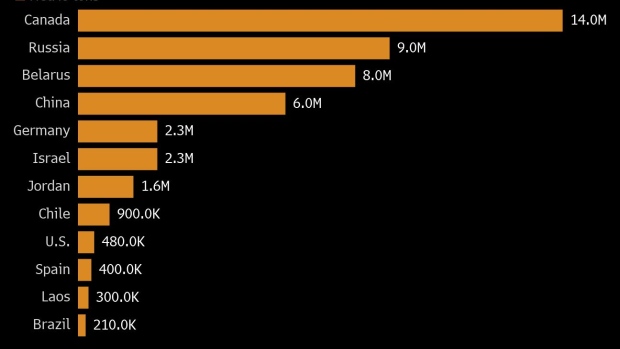

Russia is a low-cost, high-volume global producer for all major fertilizers, and it’s the world’s second-largest producer after Canada of potash, a key nutrient used on major commodity crops and produce. The conflict in the region could disrupt trade flows. U.S.-based Mosaic Co., a major fertilizer producer, warned of shortages in a call with analysts Wednesday.

It all points to rising costs for farmers, who are scaling back on fertilizer use. That will potentially trigger lower crop yields and push prices for food even higher around the world. Food costs are already the most expensive in a decade, according to a United Nations gauge.

“Fertilizer prices are at all time highs, this is really just adding more pressure,” said Patrick Donnelly, senior analyst at Third Bridge. “It’s a very real possibility we see shortages for this coming year especially heading into the North American growing season.”

...

Canadian producers like Nutrien Ltd., the world’s top crop-nutrient supplier, have the ability to ramp up potash capacity in response and are poised to benefit if the conflict amplifies, according to Matt Arnold, an analyst at Edward Jones. Nutrien said earlier this month it could ramp up potash output if sanctions on Belarus have a long-term impact on global supplies. China and India just penned agreements for supplies with Canada’s Canpotex. South American producers rely heavily on fertilizer imports from Russia.

Still, it remains unclear just how much additional supply companies in North America could make in 2022, Donnelly said. It can take months before new capacity would be available for retail sale. If such projects are not underway now, the tonnages wouldn’t be available until the end of the North American growing season, he said.

“Lower export supply would hit the Northern Hemisphere agricultural markets first as their main consumption season occurs in the second quarter,” Alexis Maxwell, an analyst with Bloomberg’s Green Markets said.

www.bnnbloomberg.ca

www.bnnbloomberg.ca

BC-Russia-Ukraine-Tensions-Spur-Fears-of-Fertilizer-Sh

(Bloomberg) -- More price hikes for fertilizer — and consequently, food — are on the horizon as escalating tensions between Russia and Ukraine add to fears of global shortages.

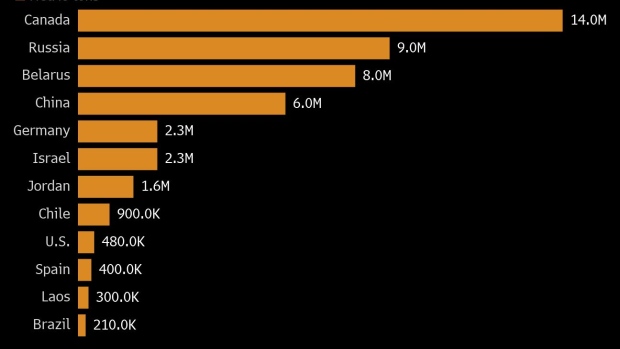

Russia is a low-cost, high-volume global producer for all major fertilizers, and it’s the world’s second-largest producer after Canada of potash, a key nutrient used on major commodity crops and produce. The conflict in the region could disrupt trade flows. U.S.-based Mosaic Co., a major fertilizer producer, warned of shortages in a call with analysts Wednesday.

It all points to rising costs for farmers, who are scaling back on fertilizer use. That will potentially trigger lower crop yields and push prices for food even higher around the world. Food costs are already the most expensive in a decade, according to a United Nations gauge.

“Fertilizer prices are at all time highs, this is really just adding more pressure,” said Patrick Donnelly, senior analyst at Third Bridge. “It’s a very real possibility we see shortages for this coming year especially heading into the North American growing season.”

...

Canadian producers like Nutrien Ltd., the world’s top crop-nutrient supplier, have the ability to ramp up potash capacity in response and are poised to benefit if the conflict amplifies, according to Matt Arnold, an analyst at Edward Jones. Nutrien said earlier this month it could ramp up potash output if sanctions on Belarus have a long-term impact on global supplies. China and India just penned agreements for supplies with Canada’s Canpotex. South American producers rely heavily on fertilizer imports from Russia.

Still, it remains unclear just how much additional supply companies in North America could make in 2022, Donnelly said. It can take months before new capacity would be available for retail sale. If such projects are not underway now, the tonnages wouldn’t be available until the end of the North American growing season, he said.

“Lower export supply would hit the Northern Hemisphere agricultural markets first as their main consumption season occurs in the second quarter,” Alexis Maxwell, an analyst with Bloomberg’s Green Markets said.

BNN Bloomberg – Canada Business News, TSX Today and Interest Rates

Get the latest Canadian business news, TSX updates, interest rates and Bank of Canada coverage. Explore stock market investing and get expert financial insights on investment portfolio strategies.