NYcarbineer

Diamond Member

Damn, what a bunch of wimp ass Conservatives. Let us take the real Fiscal Conservative route. The tax cuts expire for all. That would make a real dent in future deficits. Then let see that the corperations actually pay taxes.

But all we are going to hear on this crocodile tears for the poor millionaires. In the meantime, the unemployment rate is up to 9.8, and a bunch of peoples unemployment checks will run out about Christmas time. A real gift from our oh so Christian Conservatives.

The reason we are in this mess is because the Democraps intentionally spent us into it.

Why would they do that?

Answer: To get to the point where we must allow the Bush Tax-cuts to expire.

That's all this is about.

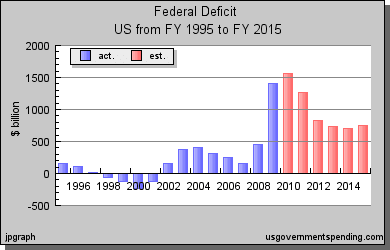

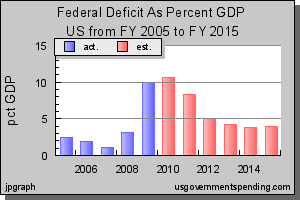

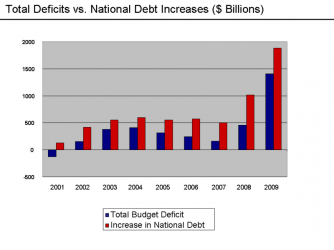

Then how do you explain the deficits from 2002 to 2008?