Cougarbear

Gold Member

- Jan 29, 2022

- 12,303

- 5,941

- 208

What do you think about this? How would it work?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Of course you are, but if Harris would have suggested it you'd have been all for it. You're as transparent as a freshly washed window.I am against it.

I think there is something you are forgetting. Trump will cut the size and expenditures of the Federal Government. States will have to live within their means too.The Regressive Nature of the U.S. Tariff Code: Origins and Implications

Our findings are emblematic of a more fundamental feature of U.S. tariff policy: tariffs set to meet policy objectives of the past have persisted through vast changes in the economic landscape and, despite their historical origins, are still affecting consumers today.

". . . The burden of a tax results from both the design of a tax and the true economic burden of a tax. A regressive tax is often flat in nature, meaning that the same rate of tax applies (generally) regardless of income. These taxes include most sales taxes, payroll taxes, excise taxes, and property taxes.

Because the same rate of tax applies regardless of one’s income, a lower-income individual may face a higher tax burden than a higher-income individual with the same amount of consumption. . ."

<snip<

". . . Analysis of imposed and threatened U.S. tariffs under the Trump administration (as of December 2018) shows that lower- and middle-income households experience relatively larger drops in after-tax income."

View attachment 1044639

What Is a Regressive Tax?

A regressive tax is one where the average tax burden decreases with income. Low-income taxpayers pay a disproportionate share of the tax burden, while middle- and high-income taxpayers shoulder a relatively small tax burden.taxfoundation.org

Both payroll and tariffs are regressive taxation. So it is sort of a mystery whether the poor and middle class blue collar folks that enabled Trump to win, will benefit or not at this point.

Nope. Wrote plenty of significant checks in my time, but on the years I did, I didn't really mind much as it marked me having a good year. I am not writing significant checks, but if you raise the price of everything I buy, so people that make a lot pay no taxes, I will not be amused.Of course you are, but if Harris would have suggested it you'd have been all for it. You're as transparent as a freshly washed window.

The point of tariffs and protectionism is to protect national industry and promote growth of national self-sufficiency. They are not, and generally never have been primary revenue gathering sources.I think there is something you are forgetting. Trump will cut the size and expenditures of the Federal Government. States will have to live within their means too.

This tariff taxation is very much like we would see with a national sales tax where everyone participates. Right now, the rich write off their expensive homes and toys. They won’t be able to with this method of taxation. And, the IRS will be mostly gone.

fee.org

fee.org

Yes, but at the time we did not have a gargantuan national debt, out of control entitlements, nor were we the policeman of the world.Please note that it was a Democrat that designed the first tax programs aimed at the American citizen.

Read more:

"1894 Income Tax and the Wilson-Gorman Tariff Act. Norman Stein. Prior to the Civil War (1861 - 1865), America's revenue needs were met primarily through tariffs, duties, and other consumption taxes. In 1861, however, Congress adopted an income tax aimed at the nation's most affluent to finance the Civil War.1894 Income Tax and the Wilson-Gorman Tariff Act | Encyclopedia.com

1894 Income Tax and the Wilson-Gorman Tariff Act Norman Stein Source for information on 1894 Income Tax and the Wilson-Gorman Tariff Act: Major Acts of Congress dictionary.www.encyclopedia.com

**********"In 1913, almost 20 years later, the ideas of uniform taxation and equal protection of the law for all citizens were overturned when a constitutional amendment permitting a progressive income tax was ratified. Congress first set the top rate at a mere 7 percent—and married couples were only taxed on income over $4,000 (equivalent to $80,000 today). During the tax debate, William Shelton, a Georgian, supported the income tax “because none of us here have $4,000 incomes, and somebody else will have to pay the tax.” As Madison and Field had feared, the seeds of class warfare were sown in the strategy of different rates for different incomes."The Progressive Income Tax in U.S. History

America’s founders rejected the income tax entirely, but when they spoke of taxes they recognized the need for uniformity and equal protection to allfee.org

"It took the politicians less than one generation to hike the tax rates and fulfill Field’s prophecy. Franklin Roosevelt, using the excuses of depression and war, permanently enlarged the income tax. Under Roosevelt, the top rate was raised—first to 79 percent and later to 90 percent. In 1941, in fact, Roosevelt proposed a 99.5 percent marginal rate on all incomes over $100,000. “Why not?” he said when an adviser questioned him."

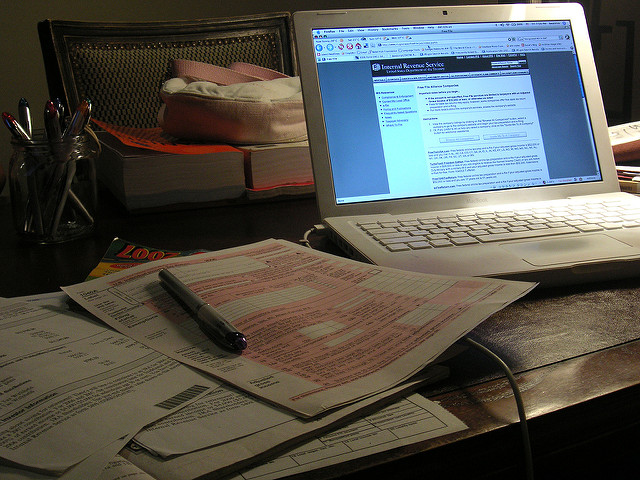

That's how the federal government funded itself before.What do you think about this? How would it work?View attachment 1044632

Please note that it was a Democrat that designed the first tax programs aimed at the American citizen.

Read more:

"1894 Income Tax and the Wilson-Gorman Tariff Act. Norman Stein. Prior to the Civil War (1861 - 1865), America's revenue needs were met primarily through tariffs, duties, and other consumption taxes. In 1861, however, Congress adopted an income tax aimed at the nation's most affluent to finance the Civil War.1894 Income Tax and the Wilson-Gorman Tariff Act | Encyclopedia.com

1894 Income Tax and the Wilson-Gorman Tariff Act Norman Stein Source for information on 1894 Income Tax and the Wilson-Gorman Tariff Act: Major Acts of Congress dictionary.www.encyclopedia.com

**********"In 1913, almost 20 years later, the ideas of uniform taxation and equal protection of the law for all citizens were overturned when a constitutional amendment permitting a progressive income tax was ratified. Congress first set the top rate at a mere 7 percent—and married couples were only taxed on income over $4,000 (equivalent to $80,000 today). During the tax debate, William Shelton, a Georgian, supported the income tax “because none of us here have $4,000 incomes, and somebody else will have to pay the tax.” As Madison and Field had feared, the seeds of class warfare were sown in the strategy of different rates for different incomes."The Progressive Income Tax in U.S. History

America’s founders rejected the income tax entirely, but when they spoke of taxes they recognized the need for uniformity and equal protection to allfee.org

"It took the politicians less than one generation to hike the tax rates and fulfill Field’s prophecy. Franklin Roosevelt, using the excuses of depression and war, permanently enlarged the income tax. Under Roosevelt, the top rate was raised—first to 79 percent and later to 90 percent. In 1941, in fact, Roosevelt proposed a 99.5 percent marginal rate on all incomes over $100,000. “Why not?” he said when an adviser questioned him."

~~~~~~Yes, but at the time we did not have a gargantuan national debt, out of control entitlements, nor were we the policeman of the world.

All of these objectives will not, in the long run, be possible with the semi-socialist government we adopted with FDR.

Tariffs are a type of taxWhat do you think about this? How would it work?View attachment 1044632

The price of everything you buy has been raised for 4 years, didn't you notice?Nope. Wrote plenty of significant checks in my time, but on the years I did, I didn't really mind much as it marked me having a good year. I am not writing significant checks, but if you raise the price of everything I buy, so people that make a lot pay no taxes, I will not be amused.