Baron

Platinum Member

At first to Siberian,

Why Putin steals Russian Gold?

Do he & his gang prepare to flee from Russia?

To avoid any misunderstandings, let’s review some facts: Russia’s gold reserves are among the largest in the world. Definitely within the top five. (In September, Reuters reported Russia’s gold and foreign exchange reserves were the world’s fourth-largest.) Russia is also a top gold producer.

Over the past decade or so, Russia’s gold-mongering has spawned rumors and “reports” (of wildly varying veracity) detailing how Moscow was preparing to unveil a bullion-backed ruble that would torpedo the US dollar. A more believable variant of this theory was that Moscow simply saw gold as dependable store of value as it rid itself of US Treasuries. In January, Bloomberg revealed that Russia’s “multi-year drive to reduce exposure to US assets” had resulted in its gold holdings exceeding its US dollar reserves for the first time on record.

Given Russia’s undeniable penchant for gold, it would be only logical that the Russian government, facing a dizzying array of domestic and geopolitical uncertainties that could trigger severe economic chaos, would be greedily gobbling up all the shiny bullion it could get its hands on.

For example, Pepe Escobar recently suggested Russia might accept payments for oil and gas in gold if it is disconnected from SWIFT.

Pepe Escobar @RealPepeEscobar

Pepe Escobar @RealPepeEscobar

Imperial hawks want to disconnect Russia from SWIFT. So payments for oil and gas will immediately switch to gold. Bring it on.

December 8th 2021

265 Retweets1,089 Likes

Other analysts have made similar claims in the past weeks and months. It’s a very popular theory, this idea that Russia is fiat-phobic and is dreaming of gold, always.

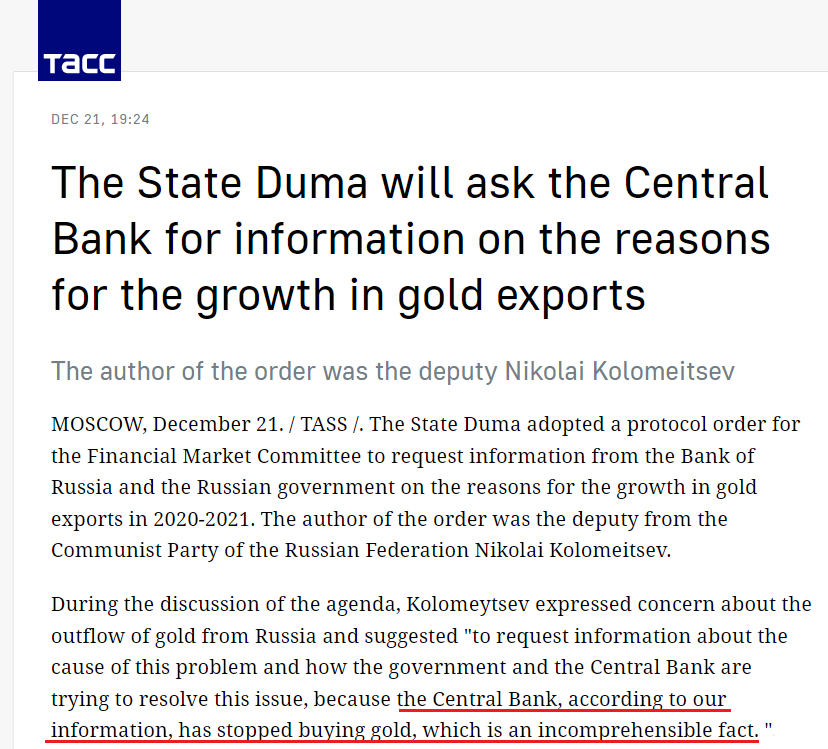

Thing is: the exact opposite is true—at least for now. Russia is being drained of gold to such an unprecedented extent that lawmakers are demanding answers. Russia’s central bank stopped buying gold in April 2020, and gave the greenlight to private banks allowing them to send their gold holdings abroad:

The situation is somewhat unprecedented: nearly all the gold mined in Russia is being flown to London, the epicenter of precious metals trading.

This has been going on for nearly two years, since the start of the coronavirus crisis. In April, Economist Valentin Katasonov gave two big thumbs down to the policy, describing the Bank of Russia’s refusal to buy bullion as “golden giveaways.”

According to Finanz.ru, in October 2020, Russia’s central bank began selling its gold reserves for the first time in thirteen years.

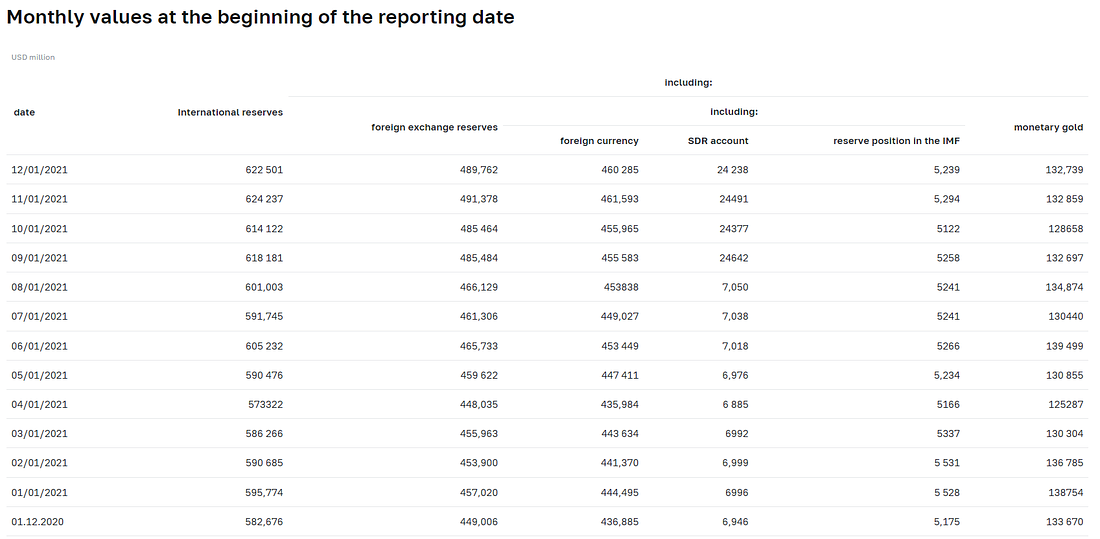

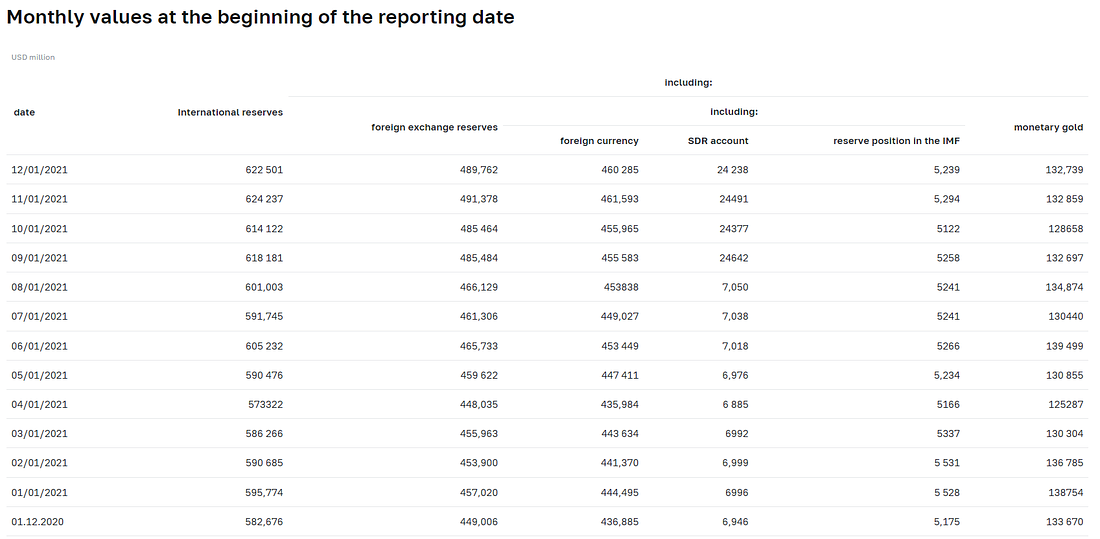

However, according to the Bank of Russia’s website, the value of its gold holdings in USD has only gone down slightly since a year ago. So we’re not talking about a massive sell-off. In fact, gold reserves went up very slightly in November—as we understand it, because the Bank of Russia received a cut from domestic producers. It was technically not a “purchase” though.

in USD terms, no significant change from a year ago

in USD terms, no significant change from a year ago

So the obvious question is: why is Russia betraying its goldbug instincts and swapping bullion for bills?

The country decided to dip into its gold holdings due to a shortage of foreign exchange earnings resulting from the catastrophic collapse in oil and gas prices once COVID hit. (Remember when a barrel of oil was selling for negative dollars?)

After a bit of research into this issue we found the following and easy-to-understand analysis:

So nothing nefarious, right? The international banking cartel isn’t robbing the country of its gold before Hermann Gräf and the Bank of Russia force the digital ruble and the “Sbercoin” on hapless Russians, right? Maybe.

The massive export of gold is perhaps sensible on paper—but still kind of suspicious. Especially when private banks are involved.

For example, in March 2020, more than a ton of non-government gold was flown out of Russia—and apparently in such a panicked state that they left some gold bars on the runway. We’re not even joking.

The potential for foul play became a bit more likely in June, when Russian President Vladimir Putin signed a law easing foreign exchange controls for gold exporters. The loosened regulations mean that sales of precious metals are now exempted from the requirement to credit the proceeds to Russian accounts. The cash can now be kept in Western banks.

As we understand it, this means gold could be mined in Russia and sold in London—with the earnings kept in euros in a Swiss bank account (for example).

Anyway, next time you’re at a cocktail party and someone mentions how Russia is scooping up all the world’s gold, for freedom, you can be that annoying person and say: “Well, actually…”

edwardslavsquat.substack.com

edwardslavsquat.substack.com

Why Putin steals Russian Gold?

Do he & his gang prepare to flee from Russia?

To avoid any misunderstandings, let’s review some facts: Russia’s gold reserves are among the largest in the world. Definitely within the top five. (In September, Reuters reported Russia’s gold and foreign exchange reserves were the world’s fourth-largest.) Russia is also a top gold producer.

Over the past decade or so, Russia’s gold-mongering has spawned rumors and “reports” (of wildly varying veracity) detailing how Moscow was preparing to unveil a bullion-backed ruble that would torpedo the US dollar. A more believable variant of this theory was that Moscow simply saw gold as dependable store of value as it rid itself of US Treasuries. In January, Bloomberg revealed that Russia’s “multi-year drive to reduce exposure to US assets” had resulted in its gold holdings exceeding its US dollar reserves for the first time on record.

Given Russia’s undeniable penchant for gold, it would be only logical that the Russian government, facing a dizzying array of domestic and geopolitical uncertainties that could trigger severe economic chaos, would be greedily gobbling up all the shiny bullion it could get its hands on.

For example, Pepe Escobar recently suggested Russia might accept payments for oil and gas in gold if it is disconnected from SWIFT.

Pepe Escobar @RealPepeEscobar

Pepe Escobar @RealPepeEscobarImperial hawks want to disconnect Russia from SWIFT. So payments for oil and gas will immediately switch to gold. Bring it on.

December 8th 2021

265 Retweets1,089 Likes

Other analysts have made similar claims in the past weeks and months. It’s a very popular theory, this idea that Russia is fiat-phobic and is dreaming of gold, always.

Thing is: the exact opposite is true—at least for now. Russia is being drained of gold to such an unprecedented extent that lawmakers are demanding answers. Russia’s central bank stopped buying gold in April 2020, and gave the greenlight to private banks allowing them to send their gold holdings abroad:

The situation is somewhat unprecedented: nearly all the gold mined in Russia is being flown to London, the epicenter of precious metals trading.

This has been going on for nearly two years, since the start of the coronavirus crisis. In April, Economist Valentin Katasonov gave two big thumbs down to the policy, describing the Bank of Russia’s refusal to buy bullion as “golden giveaways.”

According to Finanz.ru, in October 2020, Russia’s central bank began selling its gold reserves for the first time in thirteen years.

However, according to the Bank of Russia’s website, the value of its gold holdings in USD has only gone down slightly since a year ago. So we’re not talking about a massive sell-off. In fact, gold reserves went up very slightly in November—as we understand it, because the Bank of Russia received a cut from domestic producers. It was technically not a “purchase” though.

in USD terms, no significant change from a year ago

in USD terms, no significant change from a year agoSo the obvious question is: why is Russia betraying its goldbug instincts and swapping bullion for bills?

The country decided to dip into its gold holdings due to a shortage of foreign exchange earnings resulting from the catastrophic collapse in oil and gas prices once COVID hit. (Remember when a barrel of oil was selling for negative dollars?)

After a bit of research into this issue we found the following and easy-to-understand analysis:

The uptick in sales to London were also triggered, at least in part, by uncertainties surrounding Brexit.There are a lot of theories as to why central banks, and Russia in particular, are cutting down gold purchases, but in the case of Russia the reason is simply that they need cash, this according to Jeff Christian, managing partner of CPM Group.

“The Russian government is strapped for cash. It’s facing the pandemic that everybody else is facing, but it was slow to move on it so it’s got serious problems there. It still has sanctions, it doesn’t have a lot of foreign exchange coming in, it’s losing money on every barrel of oil that it sold in Russia,” Christian told Kitco News. It doesn’t have the money to buy gold.

So nothing nefarious, right? The international banking cartel isn’t robbing the country of its gold before Hermann Gräf and the Bank of Russia force the digital ruble and the “Sbercoin” on hapless Russians, right? Maybe.

The massive export of gold is perhaps sensible on paper—but still kind of suspicious. Especially when private banks are involved.

For example, in March 2020, more than a ton of non-government gold was flown out of Russia—and apparently in such a panicked state that they left some gold bars on the runway. We’re not even joking.

The potential for foul play became a bit more likely in June, when Russian President Vladimir Putin signed a law easing foreign exchange controls for gold exporters. The loosened regulations mean that sales of precious metals are now exempted from the requirement to credit the proceeds to Russian accounts. The cash can now be kept in Western banks.

As we understand it, this means gold could be mined in Russia and sold in London—with the earnings kept in euros in a Swiss bank account (for example).

Anyway, next time you’re at a cocktail party and someone mentions how Russia is scooping up all the world’s gold, for freedom, you can be that annoying person and say: “Well, actually…”

Why is Russia sending planes full of gold to London?

The State Duma wants answers as gold pours out of Russia