I assume you've read Krugman (1998b), his paper establishing the liquidity trap in a DGE model? Go through and read it again but notice that the most immediate solution is just setting a level target.

http://web.mit.edu/krugman/www/bpea_jp.pdf

If you haven't read the paper, the basic gist is this: if expectations about the future price level are fixed, then any expansion of the monetary base in this period will just be held. If interest rates are stuck at zero, printing more money does nothing. Again, the key assumption is that expectations of the price level remain stuck. He fully acknowledges that if the central bank can credibly commit to tolerating a higher price level in the future, monetary expansion will in fact be able to affect output.

So then he concludes with the idea that if interest rates are stuck at zero, a "liquidity trap", then government should try to affect output with fiscal stimulus. Now to me it seems extremely obvious: no, the central bank can just level target and then it doesn't loose traction in a "liquidity trap".

I have no idea why on earth he would recommend fiscal stimulus rather than level targeting. Which do you think is easier: having congress organise and pass legislation for counter-cyclical spending every time interest rates hit zero (which they're likely to in all future recessions), or having the central bank do their fucking job?

Well, first let me say that I completely agree with you -- the Fed must do its fucking job. But there problems:

1) The Fed does not do its fucking job. And, as Mankiw has put it, "If Chairman Bernanke ever suggested increasing inflation to, say, 4 percent, he would quickly return to being Professor Bernanke".

2) Why it has to be either stimulus, or inflation? And what if 4% inflation is not enough?

First off, the entire point of an independent central bank is that they're supposed to be insulated from that kind of political pressure.

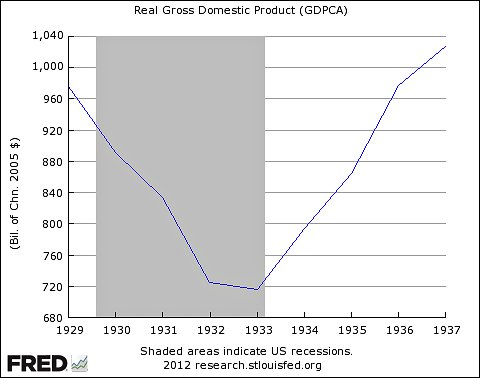

Second, you don't have to raise the inflation target. I was talking about targeting the

level. Specifically, targeting the level of nominal spending; which Krugman, among many others, have recently endorsed. We don't need to increase target

rate of inflation, just return the

level of nominal income back near its pre-recession trend line.

But, again, I agree completely -- 2% inflation is simply too low. This is not the first time we at zero lower bound. But since we are at 2%, we are in the liquidity trap.

Right but the point is that there's no such thing as "the liquidity trap". To quote Ben Bernanke, it's a "self-induced paralysis". It's not that monetary policy can't be expansionary at the zero lower bound, it's that the central bank is

unwilling to engage in expansionary monetary policy.

Again, Krugman is in favour of NGDP level targeting. Yet he's still thrashing the point about fiscal stimulus. Does it make any sense to you (it certainly doesn't to me) that he insists on advocating fiscal stimulus? Fiscal stimulus requires the government to take consolidated action

every time there is a recession. Congress has to agree on and successfully pass a stimulus package

every recession. With NGDPLT, congress just has to pass an amendment to the Federal Reserve Act once, changing the Fed's mandate. In fact, the Fed can adopt level targeting voluntarily, but so far they're clearly unwilling to take necessary action. So if congress has to do something, isn't it clearly better to have them do the thing that only requires them to cooperate once?