Got it, MORE crap from the low life conservative. I'm shocked, shocked I tell you

I know, it wasn't the overproduction of the 20's, the 'markets will take care of themselves' of Harding/Coolidge that caused the GOP great recession, it was FDR and Hoover *shaking head*

Sorry Bubba, only the low informed types who buy into Ayn Rand's fiction believes AEI, CATO,etc rewriting of history

Stocks lost 90% of their value by the time FDR came into office, thousands of banks had failed and unemployment was over 24%, BUT it was FDR who caused it? lol

Sorry, my minor in history against you and your right wing garbage says YOU are full of it...

No, FDR's heavy-handed meddling in the marketplace escalated a disaster into a catastrophe.

The depression during the Harding/Coolidge administration lasted months. Like my bud Crusader Frank likes to say, the Great Depression lasted longer than the biblical seven lean years.

Got it, you don't understand the 1920-21 recession versus the GOP's great depression

1921 and All That

Every once in a while I get comments and correspondence indicating that the right has found an unlikely economic hero: Warren Harding. The recovery from the 1920-21 recession supposedly demonstrates that deflation and hands-off monetary policy is the way to go.

But have the people making these arguments really looked at what happened back then? Or are they relying on vague impressions about a distant episode, with bad data, that has been spun as a confirmation of their beliefs?

OK, Im not going to invest a lot in this. But even a cursory examination of the available data suggests that 1921 has few useful lessons for the kind of slump were facing now.

Brad DeLong has recently written up a clearer version of a story Ive been telling for a while (actually since before the 2008 crisis) namely, that theres a big difference between inflation-fighting recessions, in which the Fed squeezes to bring inflation down, then relaxes and recessions brought on by overstretch in debt and investment. The former tend to be V-shaped, with a rapid recovery once the Fed relents; the latter tend to be slow, because its much harder to push private spending higher than to stop holding it down.

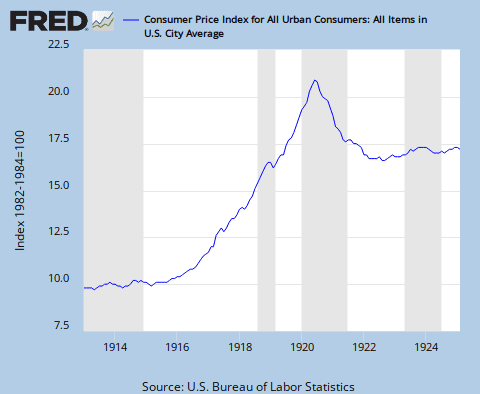

And the 1920-21 recession was basically an inflation-fighting recession although the Fed was trying to bring the level of prices, rather than the rate of change, down. What you had was a postwar bulge in prices, which was then reversed:

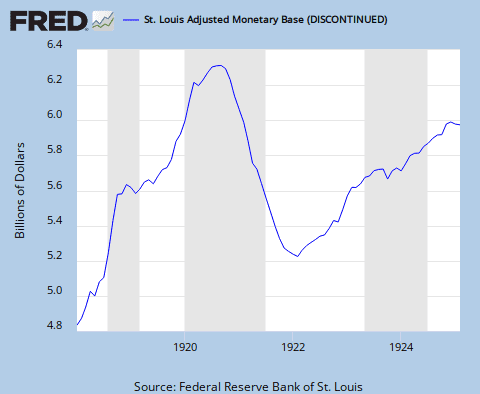

Money was tightened, then loosened again:

.....All of this has zero relevance to an economy in our current situation, in which the recession was brought on by private overstretch, not tight money, and in which the zero lower bound is all too binding.

So do we have anything to learn from the macroeconomics of Warren Harding? No.

MORE HEE

http://krugman.blogs.nytimes.com/2011/04/01/1921-and-all-that/?_php=true&_type=blogs&_r=0