.[/B] All those no money down, no interest for a year, low teaser rate loans? All the loans made without checking a borrowers income or employment history? All made in the private sector, without any support from Fannie and Freddie.

of course thats 100% stupid or a big lie. Fanny/Freddie had big advantage over private sector because they had govt support and lower rates. So, they took many of the good customers and forced the other to take the bad customers. Nevertheless Fan Fred bought tons of bad mortgages too! You are little better than a liar.

For instance, as George Mason University economist Russ Roberts explains in his paper Gambling with Other Peoples Money:

Fannie and Freddie bought 25.2% of the record $272.81 billion in subprime MBS [mortgage-backed securities] sold in the first half of 2006, according to Inside Mortgage Finance Publications, a Bethesda, MD-based publisher that covers the home loan industry.

In 2005, Fannie and Freddie purchased 35.3% of all subprime MBS, the publication estimated. The year before, the two purchased almost 44% of all subprime MBS sold.

In addition, lawmakers in both parties enacted policies directed at increasing home ownership rates, resulting in lower mortgage underwriting standards for Fannie and Freddie. Roberts notes that from 2000 on, Fannie and Freddie bought loans with low FICO scores, loans with very low down payments, and loans with little or no documentation

LIAR. You are using Ed Pinto's (AEI) 'math' the one NO ONE with a brain believes, EXCEPT his cohort in the lie, Peter Wallison, and the AEI/KOCH RELATED GROUPS

" Russ Roberts. Mercatus Center at George Mason University "

Center for Public Integrity reported in 2011, mortgages financed by Wall Street from 2001 to 2008 were 4½ times more likely to be seriously delinquent than mortgages backed by Fannie and Freddie

December 24, 2011

The Big Lie About The Financial Crisis: The Professors Who Promote It

A lot of prestigious "academics" who promote the lie about Fannie and Freddie causing the financial crisis are paid by right wing think tanks.

In his New York Times column, "The Big Lie," referring to The Big Lie about Fannie and Freddie causing the financial crisis, Joe Nocera writes:

"You begin with a hypothesis that has a certain surface plausibility. You find an ally whose background suggests that hes an expert; out of thin air, he devises data. You write articles in sympathetic publications, repeating the data endlessly; in time, some of these publications make your cause their own...Soon, the echo chamber you created drowns out dissenting views; even presidential candidates begin repeating the Big Lie.

Thus has Peter Wallison, a resident scholar at the American Enterprise Institute, and a former member of the Financial Crisis Inquiry Commission, almost single-handedly created the myth that Fannie Mae and Freddie Mac caused the financial crisis. His partner in crime is another A.E.I. scholar, Edward Pinto."

http://www.nytimes.com/2011/12/24/opinion/nocera-the-big-lie.html?hp

Pinto's work was thoroughly debunked by the Financial Crisis Inquiry Commission. The FCIC did what Wallison, Pinto and their advocates consistently refuse to do; they refuse to look at loan performance--delinquencies, defaults, losses on liquidation--on a comparative basis.

http://fcic-static.law.stanford.edu...ata and Comparison with Ed Pinto Analysis.pdf

It's worthwhile to mention the "academics" at some of America's most prestigious institutions, who lend a veneer of credibility to the Big Lie by citing Wallison's and Pinto's "research" as an authoritative source:

Columbia University, Charles Calomiris

Berkeley, Dwight Jaffee

University of Chicago, Raghuram Rajan

Harvard, Gregory Mankiw

NYU, Lawrence J. White

NYU, Viral V. Acharya

NYU, Matthew Richardson

NYU, Stijn Van Nieuwerburgh

Boston University, Laurence Kotlikoff

University of Texas, Austin, Jeffrey Friedman

George Mason University, Anthony Sanders

Many of these "scholars" get paid to agree with one another. Sanders, White, and Jaffee, along with Peter Wallison, are colleagues at the Mercatus Center,

Economists Sound Off on GSE Reform | Mercatus

which was founded and funded by the Koch Brothers.

Mercatus Center - SourceWatch

Calomiris and Mankiw are also colleagues of Wallison at the American Enterprise Institute.

You have to feel sorry for the students who pay thousands and thousands of dollars to take classes from these guys.

Other academics are colleagues of Wallison's at the AEI who, though they don't specifically cite his work, support the false narrative that Fannie and Freddie were the central cause of the financial crisis:

University of Chicago, Ray Ball

University of Chicago, Kenneth W. Dam

University of Chicago, Christian Leuz

Loyola University Chicago, George G. Kaufman

University of Pennsylvania, Richard J. Herring

University of Pennsylvania, Marshall E. Blume

Stanford, Kenneth E. Scott

Carnegie Mellon, Chester Spatt"

And there was a contemporaneous bubble in commercial real estate AND SUBPRIME AUTO LOANS that F&F had nothing to do with.

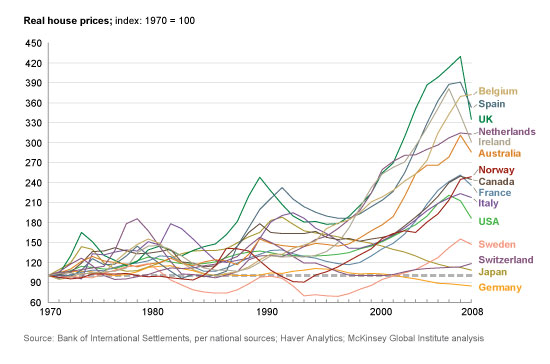

Moreover the UK, Iceland, Ireland, Spain, and Denmark crises have no government institutions analogous to Fannie Mae, Freddie Mac, or Ginnie Mae.

On the other hand Canada does have an institution very similar to Fannie/Freddie/Ginnie (the Canada Mortgage and Housing Corporation), and high levels of government support in the mortgage markets. And yet Canada, unlike the United States and other countries that experienced housing bubbles, did not have a major surge in unregulated lending and new product types, as private-label securitization remained negligible:

http://www.americanprogress.org/wp-content/uploads/issues/2010/08/pdf/canadian_banking.pdf

No, the GSEs Did Not Cause the Financial Meltdown (but thats just according to the data)

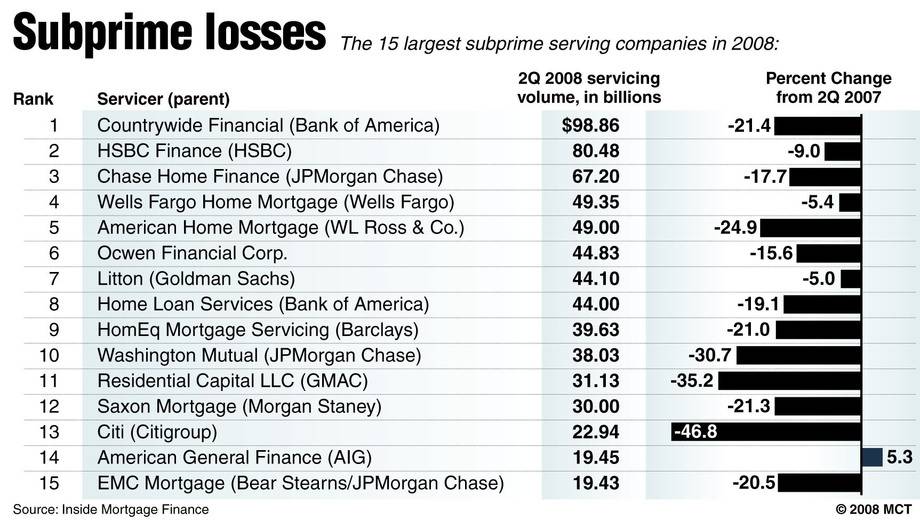

1. Private markets caused the shady mortgage boom:

Heres some data to back that up: More than 84 percent of the subprime mortgages in 2006 were issued by private lending institutions

Private firms made nearly 83 percent of the subprime loans to low- and moderate-income borrowers that year.

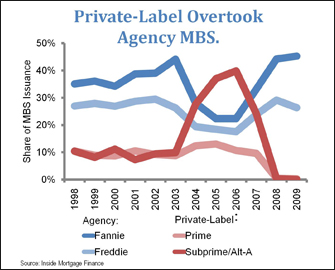

As Center For American Progresss David Min pointed out to me, the timing doesnt work at all:

But from 2002-2005, [GSEs] saw a fairly precipitous drop in market share, going from about 50% to just under 30% of all mortgage originations. Conversely, private label securitization [PLS] shot up from about 10% to about 40% over the same period. This is, to state the obvious, a very radical shift in mortgage originations that overlapped neatly with the origination of the most toxic home loans.

2. The governments affordability mission didnt cause the crisis:

3. There is a lot of research to back this up and little against it

4. Conservatives sang a different tune before the crash: Conservative think tanks spent the 2000s saying the exact opposite of what they are saying now...

5. Expanding the subprime loan category to say GSEs had more exposure makes no sense: Some argue that the GSEs had huge subprime exposure

if you create a new category that supposedly represents the risks of subprime more accurately. This new high-risk category is associated with a consultant to AEI named Ed Pinto, and his analysis deliberately blurs the wording on high-risk and subprime in much of his writings. David Min broke down the numbers, and I wrote about it here. Heres a graphic from Mins follow-up work, addressing criticism:

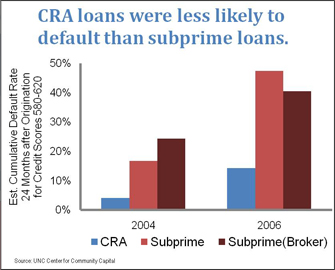

Even this high risk category isnt risky compared to subprime and it looks like the national average. When you divide it by private label, the numbers are even worse. Private label loans have defaulted at over 6x the rate of GSE loans, as well as the fact that private label securitization is responsible for 42% of all delinquencies despite accounting for only 13% of all outstanding loans (as compared to the GSEs being responsible for 22% of all delinquencies despite accounting for 57% of all outstanding loans). The issue isnt this fake high risk category, it is subprime and private label origination.

6. Even some Republicans dont agree with this argument: The three Republicans on the FCIC panel rejected the blame the GSEs/Congress approach to explaining the crisis in their minority report. Indeed, they, and most conservatives who know this is a dead end, tend to take a its a whole lot of things, hoocoodanode? approach.

Peter Wallison blamed the GSEs when he served as the fourth Republican on the FCIC panel. What did the other three Republicans make of his argument?

Check out these released FCIC emails from the GOP members. They are really fun, because you can see the other Republicans doing damage control and debating whether Wallison and Pinto were on the take for making this argument because the argument makes no sense when looking at the data.

There are lots of great quotes

: Re: peter, it seems that if you get pinto on your side, peter cant complain. But is peter thinking idependently [sic] or is he just a parrot for pinto?, I cant tell re: who is the leader and who is the follower,

Maybe this email is reaching you too late but I think wmt [William M. Thomas] is going to push to find out if pinto is being paid by anyone. And then theres the infamous event where Wallison emailed his fellow GOP member: Its very important, I think, that what we say in our separate statements not undermine the ability of the new House GOP to modify or repeal Dodd-Frank.

lmaorog

Hey Mayor Bloomberg! No, the GSEs Did Not Cause the Financial Meltdown (but thats just according to the data) | The Big Picture

The idea that they were leading this charge is just absurd, said Guy Cecala, publisher of Inside Mortgage Finance, an authoritative trade publication. Fannie and Freddie have always had the tightest underwriting on earth

They were opposite of subprime.

economic conservative (AKA- voodoo economics) supporter.

economic conservative (AKA- voodoo economics) supporter.