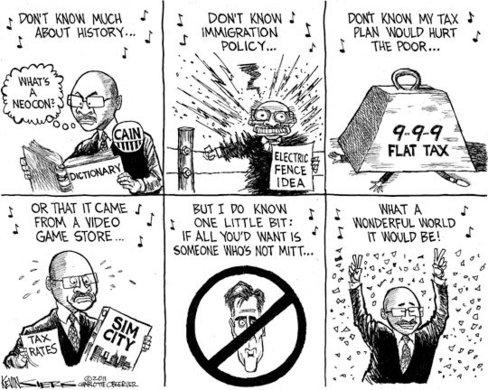

This is fantastic, your support of the plan is just as complete and well thought out as the plan is!!!i like the 9-9-9 plan.

it is short, so i don't have to read much.

it is easy to understand, because i am familiar with the number 9.

and it is cool. three times the number nine! yeehaw!

what a coincidence.