Dad2three

Gold Member

Forget having a serious debate with that mental midget. You post figures and facts and get "George Bush lied us into war and crashed the economy!"

Not possible.

So Bush didn't crash the economy by ignoring regulator warnings, fighting all 50 states on predatory lending and allowing the Bankster to flood the market with cheap money with his SEC rule change in 2004?

The "turmoil in financial markets clearly was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007," the President's Working Group on Financial Markets OCT 2008

No the gotta have everything now generation who took out loans they knew they couldn't afford crashed the economy.

Weird, I thought those Banksters were the ones signing the checks? Creating the underwriting standards?

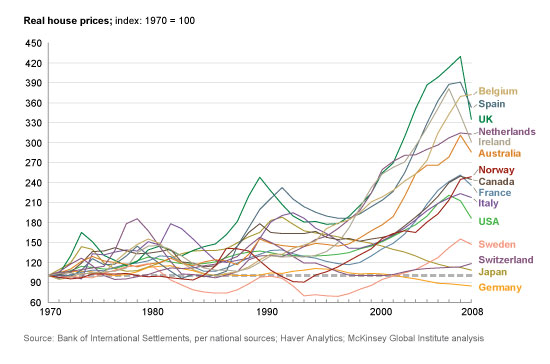

Banks used cheap capital to create a bubble. Their lending strategies fueled and fed off the housing bubble, and they did so using mortgage products whose performance was premised on continued growth of that bubble.

Regulators and policymakers enabled this process at virtually every turn. Part of the reason they failed to understand the housing bubble was willful ignorance: they bought into the argument that the market would equilibrate itself. In particular, financial actors and regulatory officials both believed that secondary and tertiary markets could effectively control risk through pricing.

http://www.tobinproject.org/sites/tobinproject.org/files/assets/Fligstein_Catalyst of Disaster_0.pdf

DUBYA FOUGHT ALL 50 STATE AG'S IN 2003, INVOKING A CIVIL WAR ERA RULE SAYING FEDS RULE ON "PREDATORY" LENDERS!

Dubya was warned by the FBI of an "epidemic" of mortgage fraud in 2004. He gave them less resources. Later in 2004 Dubya allowed the leverage rules to go from 12-1 to 33-1 which flooded the market with cheap money!