iamwhatiseem

Diamond Member

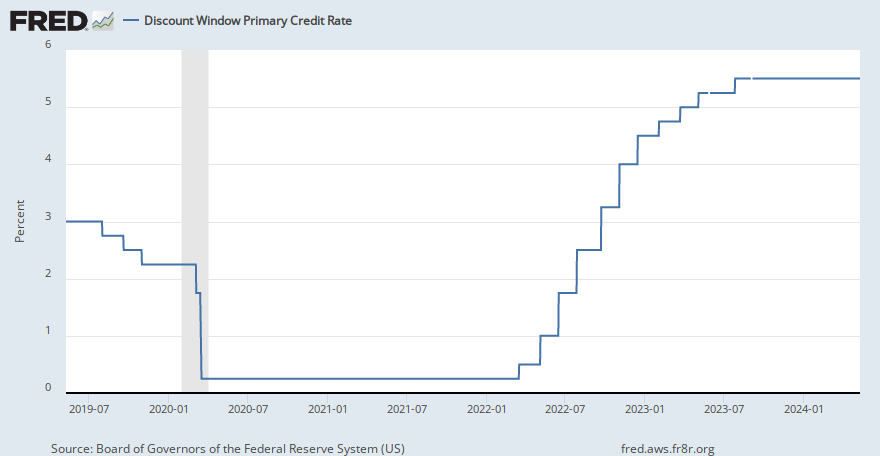

Telling.During his State of the Union address on Tuesday, Biden made the following statement:

By the end of this year, the deficit will be down to less than half what it was before I took office.

The only president ever to cut the deficit by more than one trillion dollars in a single year.

That sounds great..until you realize the fricking deficit is still in the stratosphere.

The federal deficit skyrocketed to $3.132 trillion in Trump's last year in office. So even if Biden got the deficit down to half that amount, it would still be $1.5 trillion!

Not even in Obama's worst year was it that high.

]

I really don't see anything for Biden to brag about.

I realize it will take time to reduce the deficit down to what Trump inherited when he took office. Trump inherited a half trillion dollar deficit and set about doubling that in his first two years when he and the GOP had full control.

If Biden is able to achieve getting the deficit down to half a trillion in four years, then I will be impressed. Though it took Obama eight years to go from one trillion to half a trillion. Biden has a much bigger mountain to climb.

Sources for this topic:

Remarks of President Joe Biden – State of the Union Address As Prepared for Delivery | The White House

United States Capitol Madam Speaker, Madam Vice President, our First Lady and Second Gentleman. Members of Congress and the Cabinet. Justices of thewww.whitehouse.gov

Fiscal Data Explains the National Deficit

Check out @FiscalService Fiscal Data’s new national deficit page! #NationalDeficitdatalab.usaspending.gov

:max_bytes(150000):strip_icc()/us-deficit-by-year-3306306_final-6fe17db00c73413eb26c0888ba0b5952.png)

U.S. Budget Deficit by Year Compared to GDP and Debt

The federal budget deficit rises when government spending is high, such as during wars or recessions. Budget deficits cause the national debt to grow.www.thebalance.com

And what is telling is that the media coverage on this doesn't mention that a decrease of half would still be the highest ever due to Covid gross spending.

:max_bytes(150000):strip_icc()/fed-funds-rate-history-highs-lows-3306135-FINAL-48fa8848036b4de59930b3435915742a.jpg)

:max_bytes(150000):strip_icc()/interestonthedebt-1048fe1af7e348c08b6a99c7ee53b1b2.jpg)