task0778

Diamond Member

The following posts from me in this thread are excerpts from a free newsletter that John Mauldin sends out weekly and shows up in my email inbox. I don't get the sense that he is being political about this one way or the other, he's a financial investment guy who is interested in green more than red or blue. If anyone has comments or other perspectives, please share. I think we all should have some sense of what lies ahead, after the pandemic has been reduced or eliminated. Some say there will be a virus rebound next winter, maybe so but I am not commenting on that cuz the data is so sparse. IOW, nobody knows. So, here we go:

Actually, let’s start with some good news. I talked with Dr. Joseph Kim of Inovio yesterday. They are beginning the initial safety/immune response phase human trials of a vaccine which should show data in June, and they should be in a larger phase 2/3 trial as early as July/August. Inovio plans (but isn’t promising) to have a million vaccinations ready by year-end, and is looking for even higher capacity.

Many other vaccine trials are underway around the world, too. Dr. Kim named several he was familiar with, some of which are also beginning human trials. They use different mechanisms but with the same end goal. He is hopeful some will work, saying, “Look, think of it like 71 shots on goal. The more we try the more likely we are to score.” Of those, probably 10 or so will look promising enough to draw funding.

Vaccine production capacity will be key. We will need millions per week and eventually billions per year. This is a global crisis and must be treated globally. Dr. Kim thinks people will likely need multiple vaccinations, probably every other year, but we just don’t know yet.

.

.

If you want to know the future, some say to look at China. The coronavirus originated there and China was the first to impose the kind of restrictions now common elsewhere. The virus had already spread rapidly through that highly dense urban population before lockdown measures.

What we see is that after 2–3 months of ruthlessly enforced lockdown, the virus receded enough to let people leave home and businesses begin reopening. The downtime created massive unemployment, disruption, and lost income that will take years to recover. Daily life is still heavily constrained, consumer spending is nowhere near what it was and will probably remain so until a vaccine is available. We don’t yet see anything that looks like a V-shaped economic recovery in China.

Unfortunately, I think the US and Europe will follow a similar course. We will learn a lot in the next couple of weeks as some areas begin reopening. The key question: Can they do so without hospitalizations and deaths spiking higher? If so, maybe we can have a modified but somewhat normal summer. But there is a real risk of having to clamp down again if it doesn’t work.

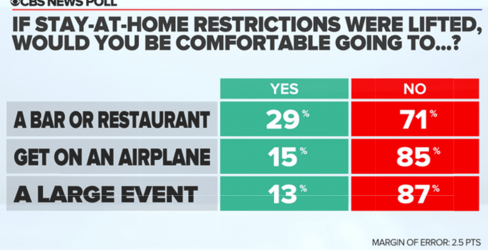

The economic trajectory is also uncertain but only in the sense that we don’t know how bad it will be. I am sure you’ve seen poll data like this from CBS News.

Source: CBS News

There are other surveys with different timelines and activities but they all point in the same general direction. This is not going to be like turning on a light switch.

Absent miraculous breakthroughs, the economic pain is only just beginning. We are going to see entire industries either wiped out or hastily transformed.

www.mauldineconomics.com

www.mauldineconomics.com

I don't know that many people are aware that economic recovery could be be harder and take longer than anticipated. Please consider my next post.

Actually, let’s start with some good news. I talked with Dr. Joseph Kim of Inovio yesterday. They are beginning the initial safety/immune response phase human trials of a vaccine which should show data in June, and they should be in a larger phase 2/3 trial as early as July/August. Inovio plans (but isn’t promising) to have a million vaccinations ready by year-end, and is looking for even higher capacity.

Many other vaccine trials are underway around the world, too. Dr. Kim named several he was familiar with, some of which are also beginning human trials. They use different mechanisms but with the same end goal. He is hopeful some will work, saying, “Look, think of it like 71 shots on goal. The more we try the more likely we are to score.” Of those, probably 10 or so will look promising enough to draw funding.

Vaccine production capacity will be key. We will need millions per week and eventually billions per year. This is a global crisis and must be treated globally. Dr. Kim thinks people will likely need multiple vaccinations, probably every other year, but we just don’t know yet.

.

.

If you want to know the future, some say to look at China. The coronavirus originated there and China was the first to impose the kind of restrictions now common elsewhere. The virus had already spread rapidly through that highly dense urban population before lockdown measures.

What we see is that after 2–3 months of ruthlessly enforced lockdown, the virus receded enough to let people leave home and businesses begin reopening. The downtime created massive unemployment, disruption, and lost income that will take years to recover. Daily life is still heavily constrained, consumer spending is nowhere near what it was and will probably remain so until a vaccine is available. We don’t yet see anything that looks like a V-shaped economic recovery in China.

Unfortunately, I think the US and Europe will follow a similar course. We will learn a lot in the next couple of weeks as some areas begin reopening. The key question: Can they do so without hospitalizations and deaths spiking higher? If so, maybe we can have a modified but somewhat normal summer. But there is a real risk of having to clamp down again if it doesn’t work.

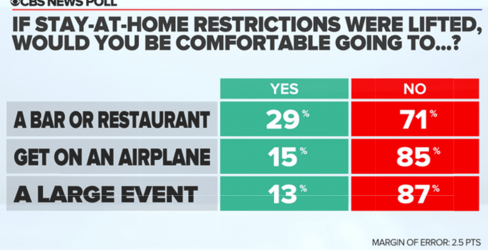

The economic trajectory is also uncertain but only in the sense that we don’t know how bad it will be. I am sure you’ve seen poll data like this from CBS News.

Source: CBS News

There are other surveys with different timelines and activities but they all point in the same general direction. This is not going to be like turning on a light switch.

Absent miraculous breakthroughs, the economic pain is only just beginning. We are going to see entire industries either wiped out or hastily transformed.

Viral Thoughts

If you want to know the future, some say to look at China. The coronavirus originated there and China was the first to impose the kind of restrictions now common elsewhere. The virus had already spread rapidly through that highly dense urban population before lockdown measures. We don’t yet see...

I don't know that many people are aware that economic recovery could be be harder and take longer than anticipated. Please consider my next post.