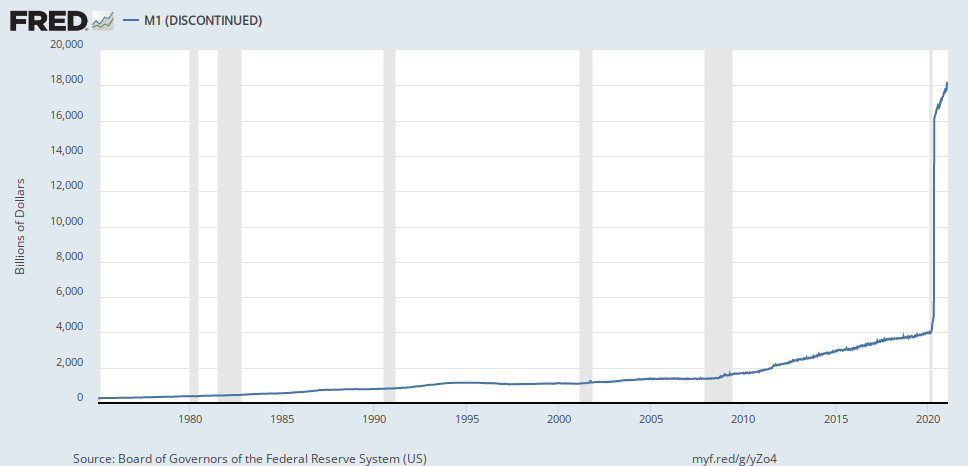

I'm no economist, but it seems to me that if the banks are lending mortgage money at 3% for thirty years, then the smart guys at the bank are not concerned about inflation. I don't understand why not...I don't understand why we don't have runaway inflation right now, but we don't.

And keep in mind, the governments whose currency we are comparing with are all doing the same thing: borrowing their asses off just to stay afloat.

Buy gold? That never seems to pan out.

Food and Fuel are not added into the inflation report because it is too cyclical. But if you do watch the precious metals, they have been going up since FDR first took US off the gold standard. One ounce of gold in 1934 was 20 dollars. In 1999 gold was at 900 dollars an ounce, and when Obama left office it was around 1,400 dollars an ounce. Today it is almost 1,900 a ounce, so the dollar is 95 times less then it was in 1934.

Food and Fuel are not added into the inflation report because it is too cyclical.

You meant too volatile. And you're mistaken.

Consumer Price Index Summary

Transmission of material in this release is embargoed until

8:30 a.m. (ET) December 10, 2020 USDL-20-2218

Technical information: (202) 691-7000 •

cpi_info@bls.gov •

www.bls.gov/cpi

Media Contact: (202) 691-5902 •

PressOffice@bls.gov

CONSUMER PRICE INDEX – NOVEMBER 2020

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent

in November on a seasonally adjusted basis after being unchanged in October,

the U.S. Bureau of Labor Statistics reported today. Over the last 12 months,

the all items index increased 1.2 percent before seasonal adjustment.

The seasonally adjusted increase in the all items index was broad-based, with

no component accounting for more than a quarter of the increase. The

food index

declined in November, as a decrease in the

food at home index more than offset

a small increase in the

food away from home index. The index for

energy rose

in November, as increases in indexes for

natural gas and electricity more than

offset a decline in the index for

gasoline.

The index for all items less

food and

energy increased 0.2 percent in November

after being unchanged the prior month. The indexes for lodging away from home,

household furnishings and operations, recreation, apparel, airline fares, and

motor vehicle insurance all increased in November. The indexes for used cars

and trucks, medical care, and new vehicles all declined over the month.

The all items index rose 1.2 percent for the 12 months ending November, the

same increase as for the period ending October. The index for all items less

food and

energy rose 1.6 percent over the last 12 months, also the same

increase as the period ending October. The

food index rose 3.7 percent over

the last 12 months, while the

energy index fell 9.4 percent.

Consumer Price Index Summary (bls.gov)

Among the many CPI reports they release are "Core CPI",

which excludes food and energy, because their prices are more volatile

than the typical prices measured by the CPI.

In 1999 gold was at 900 dollars an ounce, and when Obama left office it was around 1,400 dollars an ounce.

Today it is almost 1,900 a ounce, so the dollar is 95 times less then it was in 1934.

95% less.