radical right

Platinum Member

- Feb 26, 2017

- 31,750

- 3,768

- 430

- Banned

- #621

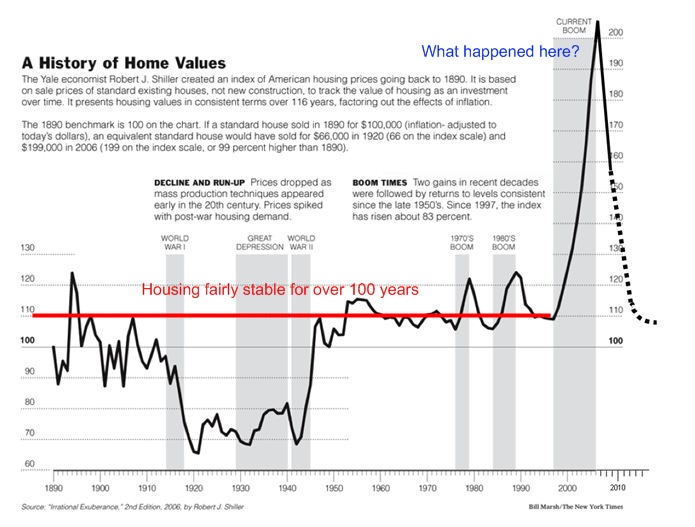

Don't you want to apologize for doubting me when I said that Bill 'the rapist' Clinton added 41% to the national debt?

Remember how you ran from that post?

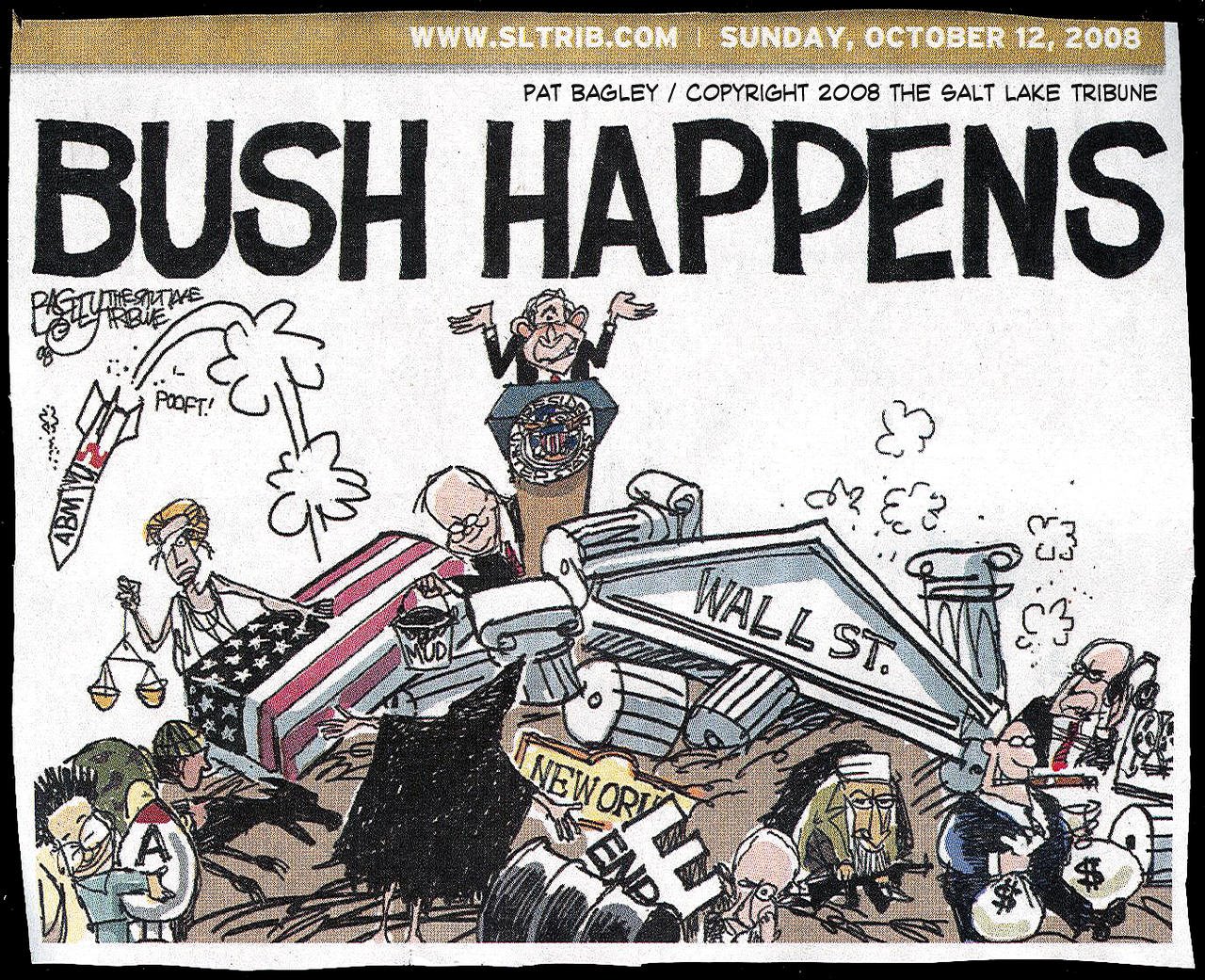

Apologize. That means Clinton added less to the national debt than anybody since Eisenhower. Clinton inherited deficits from "read my lips" Bush, and turned them into surpluses. So compare Clinton's 41% to Regans 300%, Bush's 200%

Yeah, i'm proud of Clinton's 41%.