JGalt

Diamond Member

- Mar 9, 2011

- 79,185

- 102,428

- 3,635

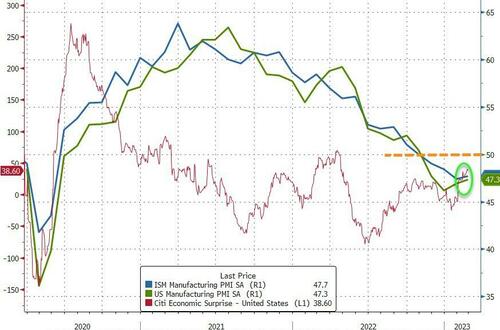

February's US manufacturing surveys are indicating that we're heading for stagflation, while the Biden administration is in complete denial.US Manufacturing Surveys Signal Stagflation Resurgence In February

"Despite the market's 'tightening' of policy, February saw US Macro data surprising dramatically and serially to the upside and while many of the regional Fed surveys have signaled economic slowdowns, the national Manufacturing survey data from ISM and PMI today were expected to rise (but both to remain in contraction sub-50).

S&P Global's US Manufacturing PMI February final printed 47.4, below the flash 47.7, but above January's 46.9

ISM's US Manufacturing February printed , versus expectations of 48.0, from January's 47.4

That is the 4th straight month of US Manufacturing contraction (sub-50 prints) with S&P Global seeing slowing orders, weaker production, and prices re-accelerating. ISM data also showed a huge jump in Prices Paid, back above 50, while new orders rose but remain below 50 for the 6th straight month...

All of the ISM Manufacturing's drivers were negative MoM...

Which is reflected in the respondents' comments:

- “Expect the first half of 2023 in the U.S. to be slower than the second half. Expect slower orders throughout 2023 for Europe.”

- “A slowdown in new housing construction and concerns of a slowing economy have customers delaying purchases in an effort to destock."

- “Business and new orders are softening, and customers are pushing out current orders.”

US Manufacturing Surveys Signal Stagflation Resurgence In February | ZeroHedge