That doesn’t make any goddamn sense. Anything we could have done would have brought war-torn America to being an economic powerhouse? That’s just ridiculous.Then tax them. In the 1945 the industrial base of the developed world, except for the US was lying in smoldering ruins, anything we did in the 50's would have worked great.Un yeah. That’s what makes sense economically. The rich must be taxed. They must be taxed the highest. Obviously there is such a thing as too high, but Bernie’s is nowhere near that. Hell, in the 50’s their tax rate was 90% and that was a time of great economic growth.You have to be an idiot to believe republicans explain anything about how to make policy. Bernie actually has details on how to pay for his programs.meaning the burning bullshit that spewed from his communist mouth !! lots of promises with no explanation on how to achieve his anti capitalist dream ! you see folks there is a simple reason Bernie hates capitalism ......he was a lazy deadbeat looser that could not hold a job until until he got into politics ! its no wonder he hates successful business that provide jobs for millions of people , he couldnt even successfully be employed by one much less create and run one !

Yeah, just like every other Socialist Commie: Tax the rich.

And nobody paid those 90% rates. Would you work for a dollar if you only got to keep a dime of it, and that dime was going to be cut by the State Tax rate?

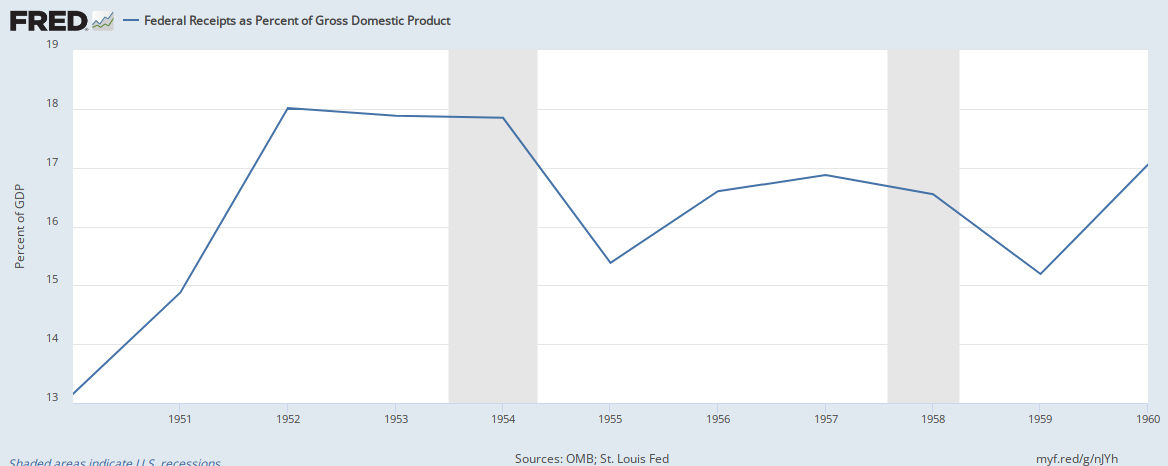

No matter the tax rate, we seem to be able to sustain a tax rate of 17% of GDP

Get much higher than that and we tip into recession.

Here is the reason why the tax rate was 90%, and yes, they paid that. Because their wealth was limited, the wealthy were incentivized to invest in labor and productivity in order to make more money. Nowadays, the wealthy are investing less and less into labor so wages remain stagnant. This is because there is no incentive for them to invest. The ridiculous tax cuts they get from republicans makes it easier to become richer because of the ridiculous amount of money they save. All they have to do is kick back and just pay less in taxes. Meanwhile, wages continue to remain stagnant while the cost of living has skyrocketed.

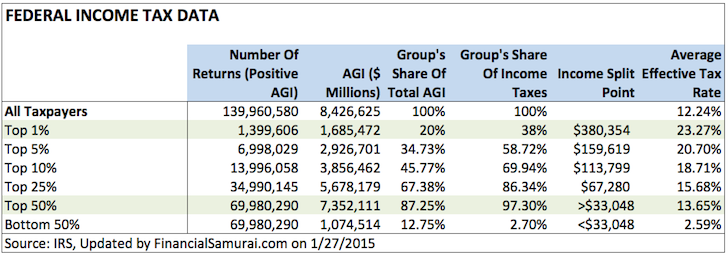

The low tax percentage of GDP we have has serious downsides. One is that insufficient revenue drives up the deficit because these tax cuts aren’t paid for. Also that percentage reflects a high tax burden on the poor and middle class that don’t have the luxury of generous deductions and loopholes that rich people have.