- Aug 16, 2011

- 128,470

- 24,294

- 2,180

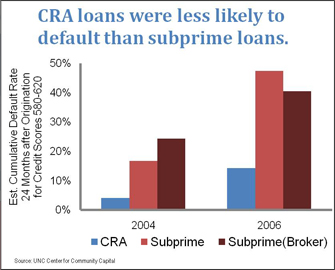

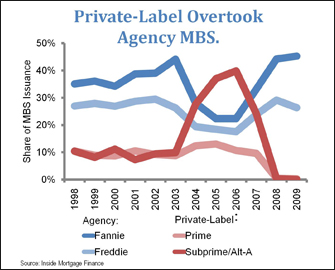

I guess the lefty crackpot never heard of the CRA or the role two well-known GSEs played in pushing the whole mess toward the edge of the cliff. It is a situation set in motion at least as far back as the Clinton administration and with plenty of blame to go around on both sides of the aisle. Mindless partisan hacks like crackpot there can't understand what they don't want to.