How many mortgage loan officers on here? Besides me.

Banks did red line. I saw it. I was told what areas were acceptable to the lender I worked for.

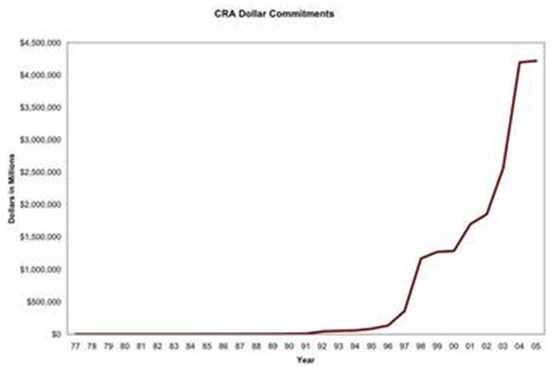

The CRA ( Community Reinvestment Act) was designed to keep banks and only banks from accepting a communities deposits but not offer any or very little loan products.

In other words; reinvest in the community you are doing business in.

I know this will be hard for some of you right wing idiots to understand, however it was mortgage brokers who started the sub prime loan boom. After the deregulation allowed anyone with money to come into the mortgage market.

And this will really blow your mind. A mortgage broker does no real banking. They do not accept deposits. Therefore they were never regulated by CRA requirements.

And from the little I read of the link. Obama went after Citibank. Notice the work BANK at the end. They were CRA regulated and they did redline.

It is so easy to twist and turn this subject, just like it was so easy to twist and turn mortgage loans. And just like those that bought into a sub prime loans, many people are buying into the bull shit that is the rethug story of the housing crisis.

But facts are facts. And the truth isn't just another side of a lie.; (Thanks to whoever said that.)

You would of had to of been there. I was.

Banks did red line. I saw it. I was told what areas were acceptable to the lender I worked for.

The CRA ( Community Reinvestment Act) was designed to keep banks and only banks from accepting a communities deposits but not offer any or very little loan products.

In other words; reinvest in the community you are doing business in.

I know this will be hard for some of you right wing idiots to understand, however it was mortgage brokers who started the sub prime loan boom. After the deregulation allowed anyone with money to come into the mortgage market.

And this will really blow your mind. A mortgage broker does no real banking. They do not accept deposits. Therefore they were never regulated by CRA requirements.

And from the little I read of the link. Obama went after Citibank. Notice the work BANK at the end. They were CRA regulated and they did redline.

It is so easy to twist and turn this subject, just like it was so easy to twist and turn mortgage loans. And just like those that bought into a sub prime loans, many people are buying into the bull shit that is the rethug story of the housing crisis.

But facts are facts. And the truth isn't just another side of a lie.; (Thanks to whoever said that.)

You would of had to of been there. I was.