ilia25

I can do math

- Jan 12, 2012

- 1,859

- 100

- 48

- Thread starter

- #21

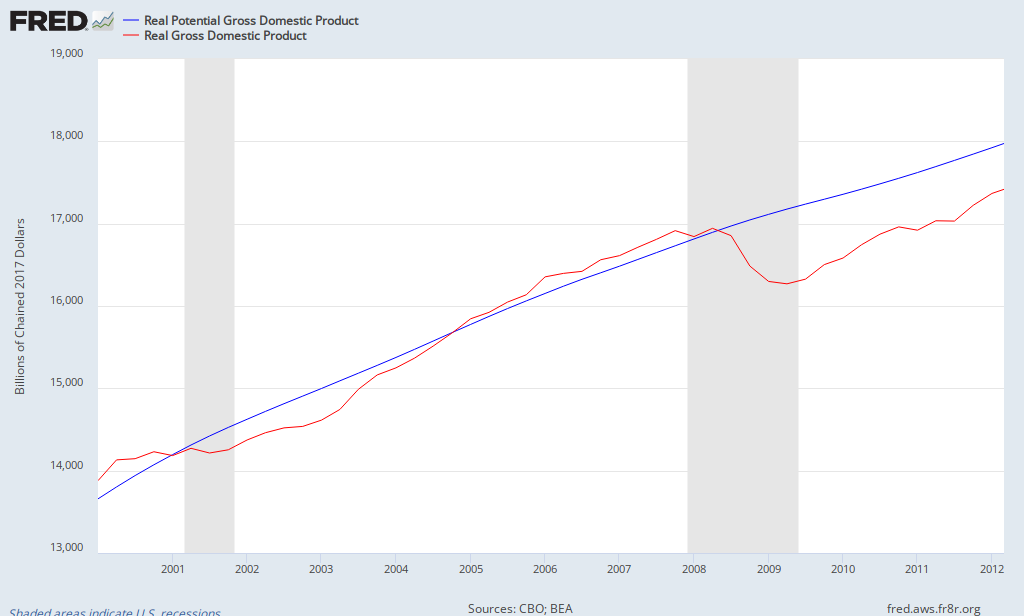

How does the government spend more, which automatically increases the debt, decrease the debt.

By making the economy growing so fast that the permanent increase in the government revenues would quickly outpace the temporary rise in spending.

Sorry, you lack the comprehension to have this conversation.

Why, I can clearly see that mindless repeating of slogans is all that you are capable of.