Oddball

Unobtanium Member

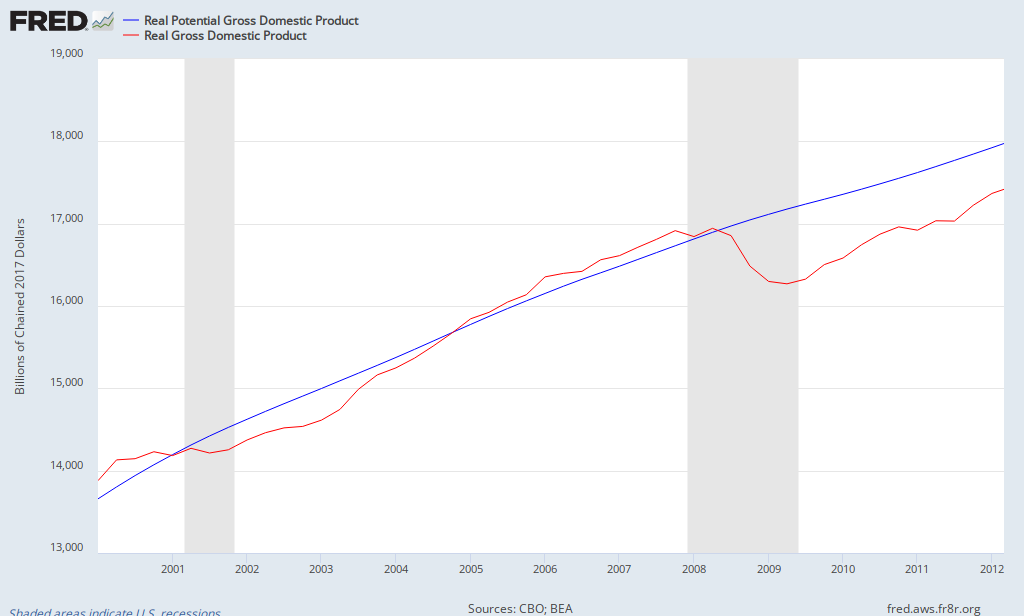

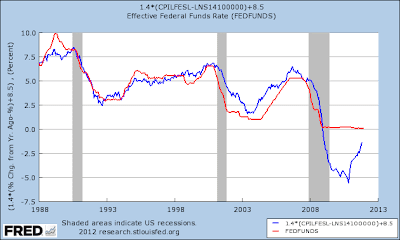

Suddenly, the leftbats have turned into Reaganite supply-siders!....Y'know, the ones who blame the deficits all in Reagan, Bush 41 and every other convenient scapegoat who doesn't have that (D) by their name?By making the economy growing so fast that the permanent increase in the government revenues would quickly outpace the temporary rise in spending.

Un-fuckin'-believable.