Bfgrn

Gold Member

- Apr 4, 2009

- 16,829

- 2,492

- 245

I do use a lot of copy and paste from credible sources to back up my beliefs. What I don't understand is why that should be looked upon as anything other than a strong(er) argument. I am citing either actual history, the beliefs of our founders and ancestors, how they actually governed and why they held their beliefs.

I have great deal of faith in the American people. Our progress as a nation has been crafted by our ancestors from the founding of our nation to our parents generation. I believe they have mostly done a good job creating a nation that is fair to all.

I see a lot of liberal bashing from the right in this country. What is a concrete fact is it was liberal tenets that created this nation. The age of enlightenment created men like our founders who moved away from the divine right of kings and the belief that all men are created equal and had the right to self government. The history of our nation has been a forward movement, not a backward one.

The changes made during the Progressive era did not come from one party. It was a very strong grass roots and bipartisan groundswell of American working people that was necessitated by the harsh and dangerous society created by the industrial revolution and the inequality that existed from the robber barons controlling most of the wealth. Before changes were made during that era, there was no protection of workers. Corporations and industry treated workers like dogs. Workplace deaths were commonplace and occurred on a daily basis, and companies did nothing to improve conditions. They just hired a new worker to replace the the dead one. The families of deceased breadwinners received zero death benefits or public assistance to help them survive.

The New Deal created the largest middle class in our history. It was an era that saw many human rights written into law that protects the family and the hard working common man and woman.

I see a lot of bashing of the Roosevelt family. It is a travesty. The Roosevelts were compassionate and fair people who worked tirelessly to make America great for ALL citizens. Teddy and Franklin were great Presidents who had a very positive impact. First Lady Eleanor Roosevelt was one of America's great humanitarians who worked very hard for the poor and forgotten. But although she was one of the most powerful women in the world, to her grandchildren she was the loving grandma that always had tubs of ice cream in the freezer.

I agree with most of your premise. Where I disagree is that we have moved away from our founders intent. I am sure our founders would approve of most of the improvements We, the People have made to survive in an era TOTALLY different from the one they lived in. The vast majority of American people are no longer farmers tilling their own land. They work for an employer and live in urban and residential areas.

The greatest threat I see to America comes from the right and people like you who want to eliminate the social safety net. Those programs are NOT socialism. They show that America has a humanitarian populace. Programs like Social Security, Medicare and unemployment insurance are basic human rights. They represent the very best of what good government can do. There is nothing evil or sinister about those programs. They do not create dependency, they create independence and a slice of security for people who can't survive on their own.

President Eisenhower dismissed people who think like you in a letter to his brother...

Should any political party attempt to abolish social security, unemployment insurance, and eliminate labor laws and farm programs, you would not hear of that party again in our political history. There is a tiny splinter group, of course, that believes you can do these things. Among them are H. L. Hunt (you possibly know his background), a few other Texas oil millionaires, and an occasional politician or business man from other areas. Their number is negligible and they are stupid.

Well kudos for making your own argument. As Kaz mentioned, the problem is not with using cut and paste in lieu of actually making an argument, but in cutting phrases out of its full context and pasting it in a way that misrepresents what is contained within the full context.

And the further problem as these discussions go is when valid criticism is rated as 'bashing' and an argument for or against something as 'dangerous'. Instead of rebutting a point made, is the use of ad hominem and personal insults to accuse other members of all sorts of silly motives and intent, and the larger issue being argued is ignored. Just as you did with your phrase ". . . people who think like you. . ." Right there you lost all credibility by accusing me of arguing something I have never argued.

Eisenhower's point was not to criticize those who propose reforms or a better way of doing something. His point was that there is a political price to be paid for making sweeping changes and only a negligible few think it can be done without consequence. Eisenhower, I believe, would much disapprove of the way his comment has been taken out of context and used by the left to mean something he did not intend.

Let's look at the phrase within its full context and note the first sentence in the paragraph that establishes the thesis he was addressing.

Now it is true that I believe this country is following a dangerous trend when it permits too great a degree of centralization of governmental functions. I oppose this — in some instances the fight is a rather desperate one. But to attain any success it is quite clear that the Federal government cannot avoid or escape responsibilities which the mass of the people firmly believe should be undertaken by it. The political processes of our country are such that if a rule of reason is not applied in this effort, we will lose everything — even to a possible and drastic change in the Constitution. This is what I mean by my constant insistence upon "moderation" in government. Should any political party attempt to abolish social security, unemployment insurance, and eliminate labor laws and farm programs, you would not hear of that party again in our political history. There is a tiny splinter group, of course, that believes you can do these things. Among them are H.L. Hunt (you possibly know his background), a few other Texas oil millionaires, and an occasional politician or business man from other areas. Their number is negligible and they are stupid.snopes.com President Eisenhower on Social Security

President Eisenhower was very much a small-federal-government Republican and was very much alarmed that the federal government was growing too large and assuming too much authority. But he was of FDR's generation and social security and some other federal programs had not yet been corrupted and had not yet become a problem and he did personally support it even as he sought ways to carefully and effectively reduce federal government in many other areas. He had no way of knowing how social security would be abused and misused and become the huge albatross around the neck of the American people that it has become.

Ike was pretty libertarian actually. Had he lived now, I believe he would also be among those who would see the necessity of not only reforming social security but doing it differently and in more effective and less destructive ways.

You claim I falsely accuse you. So I will ask you point blank:

Foxfire, are you for or against ending Social Security and Medicare?

You highlight one part, but missed a very important point Ike made. We, the People ARE the government. It is what our founding fathers created.

Now it is true that I believe this country is following a dangerous trend when it permits too great a degree of centralization of governmental functions. I oppose this — in some instances the fight is a rather desperate one. But to attain any success it is quite clear that the Federal government cannot avoid or escape responsibilities which the mass of the people firmly believe should be undertaken by it. The political processes of our country are such that if a rule of reason is not applied in this effort, we will lose everything — even to a possible and drastic change in the Constitution. This is what I mean by my constant insistence upon "moderation" in government. Should any political party attempt to abolish social security, unemployment insurance, and eliminate labor laws and farm programs, you would not hear of that party again in our political history. There is a tiny splinter group, of course, that believes you can do these things. Among them are H.L. Hunt (you possibly know his background), a few other Texas oil millionaires, and an occasional politician or business man from other areas. Their number is negligible and they are stupid.

The first highlight is very much in line with what Thomas Jefferson said:

"I willingly acquiesce in the institutions of my country, perfect or imperfect, and think it a duty to leave their modifications to those who are to live under them and are to participate of the good or evil they may produce. The present generation has the same right of self-government which the past one has exercised for itself." --Thomas Jefferson to John Hampden Pleasants, 1824. ME 16:29

Social Security is not being abused. And it is not an albatross around our necks. SS has not added ONE dime to our debt. It is solvent.

It is FALSE beliefs like yours that ARE dangerous to this nation.

Was Abe also of the FDR generation?

"The legitimate object of Government is to do for a community of people whatever they need to have done but cannot do at all, or cannot so well do, for themselves in their separate and individual capacities. But in all that people can individually do as well for themselves, Government ought not to interfere."

President Abraham Lincoln

And see, you stubbornly continue to misrepresent Eisenhower's statement as something that supports YOUR point of view rather than his actual small government point of view.

And as for Social Security and Medicare as it is administered by the federal government, it has been mismanaged to the point that both are more destructive than helpful and have escalated costs of healthcare to unaffordable heights. Both never should have been initiated at the federal level. And if the people wanted the programs, both should have been decided by the people and administered within the various states.

Eisenhower couldn't be anymore clear Foxfire. Does the word STUPID need to be explained to you?

Should any political party attempt to abolish social security, unemployment insurance, and eliminate labor laws and farm programs, you would not hear of that party again in our political history. There is a tiny splinter group, of course, that believes you can do these things. Among them are H.L. Hunt (you possibly know his background), a few other Texas oil millionaires, and an occasional politician or business man from other areas. Their number is negligible and they are stupid.

AGAIN, you present FALSE information...

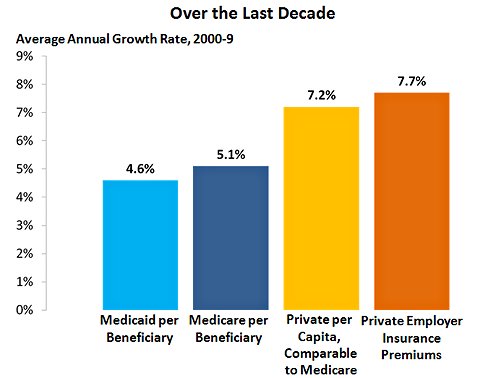

Medicare, Medicaid Far More Cost-Efficient Than Private Insurance

The New England Journal of Medicine reports that Medicare and Medicaid spending has decelerated in recent years, and not just because of the Great Recession. The public programs have seen their cost growth slow significantly compared to private health insurance. And this is expected to continue for the coming decade.

This is so important because, as Paul van de Water of the Center on Budget and Policy Priorities explains, the public debate has focused on transforming Medicare and Medicaid in the coming years, constraining cost in the very programs that are the most cost-efficient. If anything, the opposite should be true, and more and more of the system should be converted into public programs to increase the risk pool, allow for greater bargaining leverage on prices, and provide stability.

These data belie the claim that spending for Medicare and Medicaid is “out of control” and that the programs must be fundamentally restructured by adopting Medicare premium support or converting Medicaid into a block grant.

Medicare and Medicaid spending per enrollee will grow at rates of 3.1 percent and 3.6 percent, respectively, over the next ten years — well below the projected growth rate of 5.0 percent for private insurance and somewhat less than the growth of gross domestic product (GDP) per capita. (See figure.) John Holahan and Stacey McMorrow of the Urban Institute, a nonpartisan research organization, base these estimates on the latest projections of national health expenditures prepared by the Office of the Actuary at the Centers for Medicare & Medicaid Services.

Republican plans – and that of the likes of Erskine Bowles – betray their real agenda by focusing on “runaway health costs” in Medicare and Medicaid, when the real runaway costs come from private insurance (and yes, this ends up affecting the budget because of the large employer deduction on health care plans).

Sarah Kliff tries to pinpoint the cost growth and when, precisely, it slowed. But while we can argue about that, we cannot argue this fact: the cost growth in Medicare and Medicaid, relative to private insurance, is much lower. So any reasonable look at the data would suggest that even if your prime objective was to bend the cost curve, your goal should be to increase Medicare and Medicaid rather than creating a lasting market for private insurance.

link

Need other sources?

Your charts are bullshit.

Private Insurance Is More Efficient than Medicare--By Far Cato Liberty

Is Government More Efficient?

Supporters of a new government program note that private insurers spend resources on a wide range of administrative costs that government programs do not. These include marketing, underwriting, reviewing claims for legitimacy, and profits. The fact that government avoids these expenditures, however, does not necessarily make it more efficient. Many of the administrative activities that private insurers undertake serve to increase the insurers’ efficiency. Avoiding those activities would therefore make a health plan less efficient. Existing government health programs also incur administrative costs that are purely wasteful. In the final analysis, private insurance is more efficient than government insurance.

Administrative Costs

Time magazine’s Joe Klein argues that “the profits made by insurance companies are a good part of what makes health care so expensive in the U.S.and that a public option is needed to keep the insurers honest.” All else being equal, the fact that a government program would not need to turn a profit suggests that it might enjoy a price advantage over for-profit insurers. If so, that price advantage would be slight. According to the Congressional Budget Office, profits account for less than 3 percent of private health insurance premiums. Furthermore, government’s lack of a profit motive may not be an advantage at all. Profits are an important market signal that increase efficiency by encouraging producers to find lower-cost ways of meeting consumers’ needs. The lack of a profit motive could lead a government program to be less efficient than private insurance, not more.

Moreover, all else is not equal. Government programs typically keep administrative expenditures low by avoiding activities like utilization or claims review. Yet avoiding those activities increases overall costs. The CBO writes, “The traditional fee-for-service Medicare program does relatively little to manage benefits, which tends to reduce its administrative costs but may raise its overall spending relative to a more tightly managed approach.”7 Similarly, the Medicare Payment Advisory Commission writes:

[The Centers for Medicare & Medicaid Services] estimates that about $9.8 billion in erroneous payments were made in the fee-for-service program in 2007, a figure more than double what CMS spent for claims processing and review activities. In Medicare Advantage, CMS estimates that erroneous payments equaled $6.8 billion in 2006, or approximately 10.6 percent of payments… . The significant size of Medicare’s erroneous payments suggests that the program’s low administrative costs may come at a price.

CMS further estimates that it made $10.4 billion in improper payments in the fee-for-service Medicare program in 2008.

Medicare keeps its measured administrative-cost ratio relatively low by avoiding important administrative activities (which shrinks the numerator) and tolerating vast amounts of wasteful and fraudulent claims (which inflates the denominator). That is a vice, yet advocates of a new government program praise it as a virtue.

Medicare also keeps its administrative expenditures down by conducting almost no quality-improvement activities. Journalist Shannon Brownlee and Obama adviser Ezekiel Emanuel write:

Some administrative costs are not only necessary but beneficial. Following heart-attack or cancer patients to see which interventions work best is an administrative cost, but it’s also invaluable if you want to improve care. Tracking the rate of heart attacks from drugs such as Avandia is key to ensuring safe pharmaceuticals.

According to the CBO, private insurers spend nearly 1 percent of premiums on “medical management.” The fact that Medicare keeps administrative expenditures low by avoiding such quality-improvement activities may likewise result in higher overall costs—in this case by suppressing the quality of care.

Supporters who praise Medicare’s apparently low administrative costs often fail to note that some of those costs are hidden costs that are borne by other federal agencies, and thus fail to appear in the standard 3-percent estimate. These include “parts of salaries for legislators, staff and others working on Medicare, building costs, marketing costs, collection of premiums and taxes, accounting including auditing and fraud issues, etc.”

Also, Medicare’s administrative costs should be understood to include the deadweight loss from the taxes that fund the program. Economists estimate that it can easily cost society $1.30 to raise just $1 in tax revenue, and it may sometimes cost as much as $2.36 That “excess burden” of taxation is a very real cost of administering (i.e., collecting the taxes for) compulsory health insurance programs like Medicare, even though it appears in no government budgets.

Comparing administrative expenditures in the traditional “fee-for-service” Medicare program to private Medicare Advantage plans can somewhat control for these factors. Hacker cites a CBO estimate that administrative costs are 2 percent of expenditures in traditional Medicare versus 11 percent for Medicare Advantage plans. He writes further: “A recent General Accounting Office report found that in 2006, Medicare Advantage plans spent 83.3 percent of their revenue on medical expenses, with 10.1 percent going to nonmedical expenses and 6.6 percent to profits—a 16.7 percent administrative share.”

Yet such comparisons still do not establish that government programs are more efficient than private insurers. The CBO writes of its own estimate: “The higher administrative costs of private plans do not imply that those plans are less efficient than the traditional FFS program. Some of the plans’ administrative expenses are for functions such as utilization management and quality improvement that are designed to increase the efficiency of care delivery.” Moreover, a portion of the Medicare Advantage plans’ administrative costs could reflect factors inherent to government programs rather than private insurance. For example, Congress uses price controls to determine how much to pay Medicare Advantage plans. If Congress sets those prices at supracompetitive levels, as many experts believe is the case, then that may boost Medicare Advantage plans’ profitability beyond what they would earn in a competitive market. Those supracompetitive profits would be a product of the forces that would guide a new government program—that is, Congress, the political system, and price controls—rather than any inherent feature of private insurance.

Economists who have tallied the full administrative burden of government health insurance programs conclude that administrative costs are far higher in government programs than in private insurance. In 1992,University of Pennsylvania economist Patricia Danzon estimated that total administrative costs were more than 45 percent of claims in Canada’s Medicare system, compared to less than 8 percent of claims for private insurance in the United States. Pacific Research Institute economist Ben Zycher writes that a “realistic assumption” about the size of the deadweight burden puts “the true cost of delivering Medicare benefits [at] about 52 percent of Medicare outlays, or between four and five times the net cost of private health insurance.”

Administrative costs can appear quite low if you only count some of them. Medicare hides its higher administrative costs from enrollees and taxpayers, and public-plan supporters rely on the hidden nature of those costs when they argue in favor of a new government program.

Cost Containment vs. Spending Containment

Advocates of a new government health care program also claim that government contains overall costs better than private insurance. Jacob Hacker writes, “public insurance has a better track record than private insurance when it comes to reining in costs while preserving access. By way of illustration, between 1997 and 2006, health spending per enrollee (for comparable benefits) grew at 4.6 percent a year under Medicare, compared with 7.3 percent a year under private health insurance.” In fact, looking at a broader period, from 1970 to 2006, shows that per-enrollee spending by private insurance grew just 1 percentage point faster per year than Medicare spending, rather than 2.7 percentage points. That still omits the 1966–1969 period, which saw rapid growth in Medicare spending.

More importantly, Hacker’s comparison commits the fallacy of conflating spending and costs. Even if government contains health care spending better than private insurance (which is not at all clear), it could still impose greater overall costs on enrollees and society than private insurance. For example, if a government program refused to pay for lifesaving medical procedures, it would incur considerable nonmonetary costs (i.e., needless suffering and death). Yet it would look better in Hacker’s comparison than a private health plan that saved lives by spending money on those services. Medicare’s inflexibility also imposes costs on enrollees. Medicare took 30 years longer than private insurance to incorporate prescription drug coverage into its basic benefits package. The taxes that finance Medicare impose costs on society in the range of 30 percent of Medicare spending. In contrast, there is no deadweight loss associated with the voluntary purchase of private health insurance.

Hacker nods in the direction of non-spending costs when he writes, “Medicare has maintained high levels of … patient access to care.” Yet there are many dimensions of quality other than access to care. It is in those areas that government programs impose their greatest hidden costs, on both publicly and privately insured patients.

UTTER BULLSHIT dogma and doctrinaire.

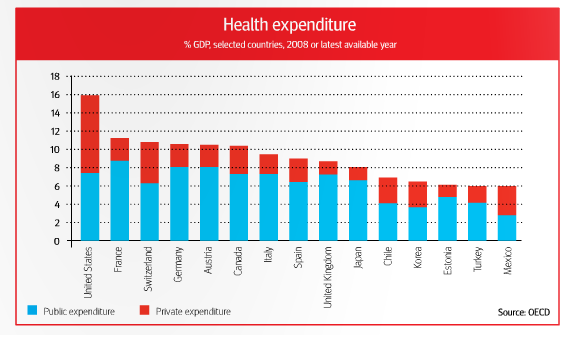

Hey pea brain, health care costs in America are the highest per capita than other industrialized nations.

Can you identify what is different about America's health care system?