Yes Democrat policies deliver failure 100% of the time. The usual suspects will be trotted out, weather, kiosks, George Bush, but the truth is we have Euro style regulation and taxation so we get Eurostyle economies with high unemployment and slow growth. 0.2% growth is not going to cut it.

U.S. Economy Stalls in the First Quarter - Yahoo Finance

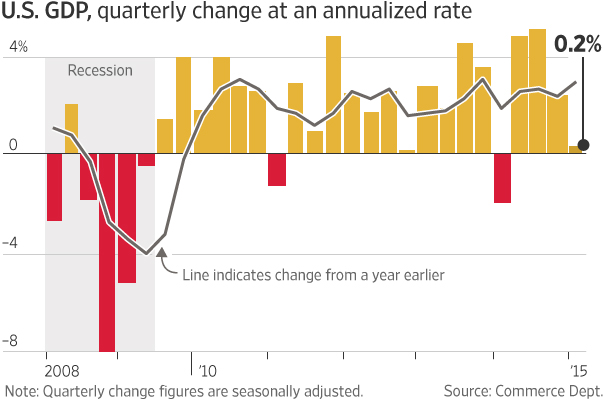

The world’s largest economy sputtered to a near-halt in the first quarter, choked by slumping U.S. business investment and exports.

Gross domestic product, the volume of all goods and services produced, rose at a 0.2 percent annualized rate after advancing 2.2 percent the prior quarter, Commerce Department data showed Wednesday in Washington. The median forecast of 86 economists surveyed by Bloomberg called for a 1 percent gain. Consumer spending, the biggest part of the economy, rose 1.9 percent, a little better than projected

U.S. Economy Stalls in the First Quarter - Yahoo Finance

The world’s largest economy sputtered to a near-halt in the first quarter, choked by slumping U.S. business investment and exports.

Gross domestic product, the volume of all goods and services produced, rose at a 0.2 percent annualized rate after advancing 2.2 percent the prior quarter, Commerce Department data showed Wednesday in Washington. The median forecast of 86 economists surveyed by Bloomberg called for a 1 percent gain. Consumer spending, the biggest part of the economy, rose 1.9 percent, a little better than projected