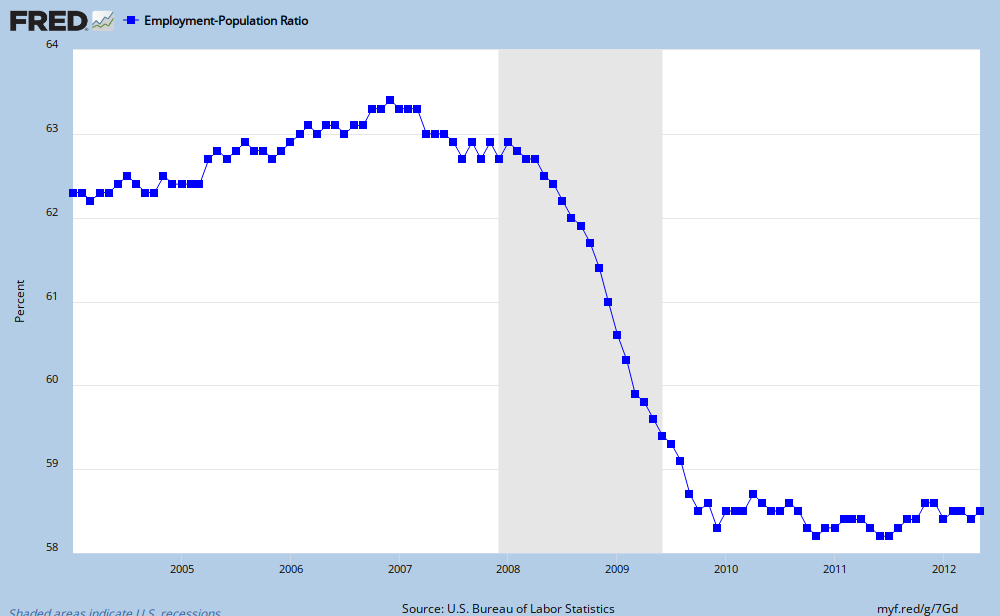

Every month the BLS puts out a monthly report of employment/unemployment. Table A-1 in that report shows the total number of employed and the change over the last couple of months so you can see the direction it's going in. Lately it ain't good, but that's not the point of this post.

When Obama took office in Jan 2009, the BLS summary showed the total employment at approx 142.1 million. As you know, that was in the middle of big numbers of people losing their jobs, losses would continue into 2010, even though Obama pushed for and signed a stimulus bill costing about $862 billion. It was said to be needed immediately, and shovel ready jobs were just waiting for the bill to be signed to go into effect. Here's a link to show the numbers for Jan 2009:

http://www.bls.gov/news.release/archives/empsit_02062009.pdf

So, the bill was signed, but the jobs didn't materialize in the numbers we expected. Then, in June 2009, the recession was said to be over, and economic growth was no longer negative. At that time, the BLS showed total employment to have dropped down to approx 140.2 million, subsequently revised downward to 140.0. Seems to me this is the logical time to start counting jobs created on Obama's watch, considering he got his stimulus bill and then a very large appropriations bill, the largest in our history, passed shortly thereafter. And the Fed obliged by lowering interest rates down to next to zero and also enacted QE1 and QE2, and Twist and Shout, or whatever they called that latest effort. Here's a link to the June 2010 numbers:

http://www.bls.gov/news.release/archives/empsit_07022009.pdf

So, where are we now? The latest BLS numbers say total employment is about 142.3 million. 3 years later, from the end of the recession, we've got about 2 million more employed. And that included part timers who would rather be working fulltime, and the underemployed. I don't think 2 million in 3 years is anywhere near good enough, it doesn't even come close to keeping up with the new workers entering the workforce evey month. And it's not even close to the recoveries from other recessions since WWII.

Question: How does Obama come up with the 4.3 million jobs created? Even the lowest number was 138.6 million in Feb 2010, maybe someone can explain that.

Question: We were supposed to be doing so much better by now, why aren't we? With all the additional spending, low interest rates, QE1 and QE2, WTF? We've been spending money for 3 and a half years like it was going out of style, do you think it's been wisely spent? I don't.

When Obama took office in Jan 2009, the BLS summary showed the total employment at approx 142.1 million. As you know, that was in the middle of big numbers of people losing their jobs, losses would continue into 2010, even though Obama pushed for and signed a stimulus bill costing about $862 billion. It was said to be needed immediately, and shovel ready jobs were just waiting for the bill to be signed to go into effect. Here's a link to show the numbers for Jan 2009:

http://www.bls.gov/news.release/archives/empsit_02062009.pdf

So, the bill was signed, but the jobs didn't materialize in the numbers we expected. Then, in June 2009, the recession was said to be over, and economic growth was no longer negative. At that time, the BLS showed total employment to have dropped down to approx 140.2 million, subsequently revised downward to 140.0. Seems to me this is the logical time to start counting jobs created on Obama's watch, considering he got his stimulus bill and then a very large appropriations bill, the largest in our history, passed shortly thereafter. And the Fed obliged by lowering interest rates down to next to zero and also enacted QE1 and QE2, and Twist and Shout, or whatever they called that latest effort. Here's a link to the June 2010 numbers:

http://www.bls.gov/news.release/archives/empsit_07022009.pdf

So, where are we now? The latest BLS numbers say total employment is about 142.3 million. 3 years later, from the end of the recession, we've got about 2 million more employed. And that included part timers who would rather be working fulltime, and the underemployed. I don't think 2 million in 3 years is anywhere near good enough, it doesn't even come close to keeping up with the new workers entering the workforce evey month. And it's not even close to the recoveries from other recessions since WWII.

Question: How does Obama come up with the 4.3 million jobs created? Even the lowest number was 138.6 million in Feb 2010, maybe someone can explain that.

Question: We were supposed to be doing so much better by now, why aren't we? With all the additional spending, low interest rates, QE1 and QE2, WTF? We've been spending money for 3 and a half years like it was going out of style, do you think it's been wisely spent? I don't.

Last edited: