Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Top 10 Ridiculous Examples of Corporate Greed

- Thread starter ScienceRocks

- Start date

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

actually under capitalism you have to care more than any other company in the world for your workers or they quit and move to where they are most cared for. 1+1=2Sometime in the 70s the rich stopped caring about workers.

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

Influence peddling, Citizen's United, money in politics - you may have heard of these things.

yes heard of them but what do they have to do with subject?

CultureCitizen

Silver Member

- Jun 1, 2013

- 1,932

- 140

- 95

Well Norman, it is certainly that way . The problem is that such model is intrinsincly unstable. Very few people pay any attention to the cyclical nature of economy. I will oversimplify here:Sometime in the 70s the rich stopped caring about workers.Or just good business practices that deliver profits to their shareholders

In their utopia shareholders are all that matter.

That's no good for workers or America as we've seen.

But cons will blame liberals as if paying workers a fair wage is why we are broke.

Erm... pretty sure that it's actually the LAW that the CEOs work for the shareholders, not the workers. In all fairness, it would result in a complete disaster if this was the other way around. The shareholders hired the CEO not the workers.

It really is sad how ignorant some people are.

Assume that wages + profits in a year = 100, and a net trade balance of zero.

And that wages represent are 40 and profits 60 and households credits = 0.

Next year assume an increase in production, with stagnant wages so the total is 110, so wages = 40, and proffits 70.

What happens next year ? You will be hit by a recession, because the purchasing power of wages is not enough to sustain the sales.

Now , I am oversimplifying, of course, if you have a trade surplus this will not happen. If households are able to get credit, the crisis will be offset ( untill the credits get to big to pay ) .

Certainly corporations are free to do what they want with their proffits, but that liberty is not without consecuences, and the same goes with the other sectors : banking(credit) and labour (wages) .

Well Norman, it is certainly that way . The problem is that such model is intrinsincly unstable. Very few people pay any attention to the cyclical nature of economy. I will oversimplify here:Sometime in the 70s the rich stopped caring about workers.Or just good business practices that deliver profits to their shareholders

In their utopia shareholders are all that matter.

That's no good for workers or America as we've seen.

But cons will blame liberals as if paying workers a fair wage is why we are broke.

Erm... pretty sure that it's actually the LAW that the CEOs work for the shareholders, not the workers. In all fairness, it would result in a complete disaster if this was the other way around. The shareholders hired the CEO not the workers.

It really is sad how ignorant some people are.

Assume that wages + profits in a year = 100, and a net trade balance of zero.

And that wages represent are 40 and profits 60 and households credits = 0.

Next year assume an increase in production, with stagnant wages so the total is 110, so wages = 40, and proffits 70.

What happens next year ? You will be hit by a recession, because the purchasing power of wages is not enough to sustain the sales.

Now , I am oversimplifying, of course, if you have a trade surplus this will not happen. If households are able to get credit, the crisis will be offset ( untill the credits get to big to pay ) .

Certainly corporations are free to do what they want with their proffits, but that liberty is not without consecuences, and the same goes with the other sectors : banking(credit) and labour (wages) .

Next year assume an increase in production, with stagnant wages so the total is 110, so wages = 40, and proffits 70.

What happens next year ? You will be hit by a recession, because the purchasing power of wages is not enough to sustain the sales.

Exactly! Because corporations never spend their profits, never pay out dividends, never buy back shares.

I heard they put all that money in a big pile and burn it, just so they don't have to give it to workers.

Derp!

CultureCitizen

Silver Member

- Jun 1, 2013

- 1,932

- 140

- 95

Well Norman, it is certainly that way . The problem is that such model is intrinsincly unstable. Very few people pay any attention to the cyclical nature of economy. I will oversimplify here:Sometime in the 70s the rich stopped caring about workers.Or just good business practices that deliver profits to their shareholders

In their utopia shareholders are all that matter.

That's no good for workers or America as we've seen.

But cons will blame liberals as if paying workers a fair wage is why we are broke.

Erm... pretty sure that it's actually the LAW that the CEOs work for the shareholders, not the workers. In all fairness, it would result in a complete disaster if this was the other way around. The shareholders hired the CEO not the workers.

It really is sad how ignorant some people are.

Assume that wages + profits in a year = 100, and a net trade balance of zero.

And that wages represent are 40 and profits 60 and households credits = 0.

Next year assume an increase in production, with stagnant wages so the total is 110, so wages = 40, and proffits 70.

What happens next year ? You will be hit by a recession, because the purchasing power of wages is not enough to sustain the sales.

Now , I am oversimplifying, of course, if you have a trade surplus this will not happen. If households are able to get credit, the crisis will be offset ( untill the credits get to big to pay ) .

Certainly corporations are free to do what they want with their proffits, but that liberty is not without consecuences, and the same goes with the other sectors : banking(credit) and labour (wages) .

Next year assume an increase in production, with stagnant wages so the total is 110, so wages = 40, and proffits 70.

What happens next year ? You will be hit by a recession, because the purchasing power of wages is not enough to sustain the sales.

Exactly! Because corporations never spend their profits, never pay out dividends, never buy back shares.

I heard they put all that money in a big pile and burn it, just so they don't have to give it to workers.

Derp!

I didn't say that , you said it.

So , assume they import machinery to increase production , that doesn't create a larger market. Assume they buy back their own stock, same thing. Assume they open a factory in China, that's probably even worse.

In the best case scenario they could buy capital goods ( e.g. machinery ) in the local market . Now assuming that's what happens , in my example you would get a total production of 110 and wages at 44, which would be an actual increase in the output of labour , although proportionally you would remain with the same ratio ( 60 / 40) .

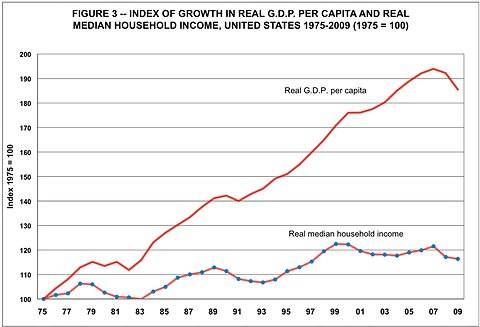

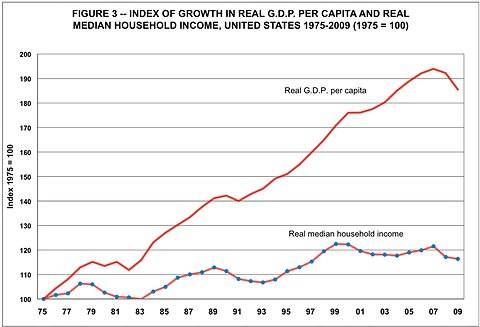

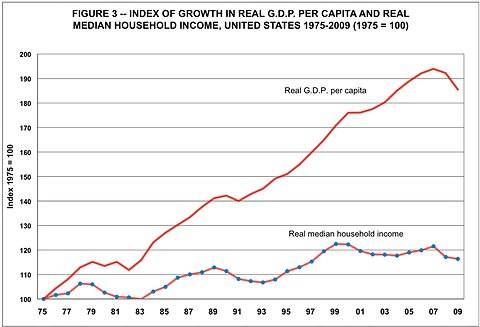

But, this is not what's been happening lately in the U.S. ( in the last 30 years or so ) . Average wages have stagnated while gdp has increased, oh , and of course private debt (specially household debt) has soared.

Big mistake : look at the aggregate figures, not at the individual cases.

Microeconomy and microeconomy are related but are not the same subject at all.

Here you go pal... why do I get the idea that you work in the financial sector ?

Last edited:

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

Next year assume an increase in production, with stagnant wages so the total is 110, so wages = 40, and proffits 70.

What happens next year ? You will be hit by a recession,.

if wages are truly stagnant then you would not increase production because there would be no money with which to buy the increased production.

CultureCitizen

Silver Member

- Jun 1, 2013

- 1,932

- 140

- 95

As I said ( and showed in the charts), this can be offset by household debt (America's case in the last 20 years ) or by net exports increase ( England's case during early industrialization).Next year assume an increase in production, with stagnant wages so the total is 110, so wages = 40, and proffits 70.

What happens next year ? You will be hit by a recession,.

if wages are truly stagnant then you would not increase production because there would be no money with which to buy the increased production.

So indeed, in the US the production has increased ( without a net export increase) supported by an increase in household ( and corporate ) debt.

Well Norman, it is certainly that way . The problem is that such model is intrinsincly unstable. Very few people pay any attention to the cyclical nature of economy. I will oversimplify here:Sometime in the 70s the rich stopped caring about workers.Or just good business practices that deliver profits to their shareholders

In their utopia shareholders are all that matter.

That's no good for workers or America as we've seen.

But cons will blame liberals as if paying workers a fair wage is why we are broke.

Erm... pretty sure that it's actually the LAW that the CEOs work for the shareholders, not the workers. In all fairness, it would result in a complete disaster if this was the other way around. The shareholders hired the CEO not the workers.

It really is sad how ignorant some people are.

Assume that wages + profits in a year = 100, and a net trade balance of zero.

And that wages represent are 40 and profits 60 and households credits = 0.

Next year assume an increase in production, with stagnant wages so the total is 110, so wages = 40, and proffits 70.

What happens next year ? You will be hit by a recession, because the purchasing power of wages is not enough to sustain the sales.

Now , I am oversimplifying, of course, if you have a trade surplus this will not happen. If households are able to get credit, the crisis will be offset ( untill the credits get to big to pay ) .

Certainly corporations are free to do what they want with their proffits, but that liberty is not without consecuences, and the same goes with the other sectors : banking(credit) and labour (wages) .

Next year assume an increase in production, with stagnant wages so the total is 110, so wages = 40, and proffits 70.

What happens next year ? You will be hit by a recession, because the purchasing power of wages is not enough to sustain the sales.

Exactly! Because corporations never spend their profits, never pay out dividends, never buy back shares.

I heard they put all that money in a big pile and burn it, just so they don't have to give it to workers.

Derp!

I didn't say that , you said it.

So , assume they import machinery to increase production , that doesn't create a larger market. Assume they buy back their own stock, same thing. Assume they open a factory in China, that's probably even worse.

In the best case scenario they could buy capital goods ( e.g. machinery ) in the local market . Now assuming that's what happens , in my example you would get a total production of 110 and wages at 44, which would be an actual increase in the output of labour , although proportionally you would remain with the same ratio ( 60 / 40) .

But, this is not what's been happening lately in the U.S. ( in the last 30 years or so ) . Average wages have stagnated while gdp has increased, oh , and of course private debt (specially household debt) has soared.

Big mistake : look at the aggregate figures, not at the individual cases.

Microeconomy and microeconomy are related but are not the same subject at all.

Here you go pal... why do I get the idea that you work in the financial sector ?

So , assume they import machinery to increase production , that doesn't create a larger market.

Because furriners never buy US output with their dollars.

And increased production never leads to lower prices.

Assume they buy back their own stock, same thing.

They bought back my shares, now I have more money to buy goods and services.

why do I get the idea that you work in the financial sector ?

Is it because in moments I can point out your idiocy?

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

As I said ( and showed in the charts), this can be offset by household debt (America's case in the last 20 years ) or by net exports increase ( England's case during early industrialization).

anything can be offset temporarily but under capitalism the system is self-correcting by millions of people in the market place. Under libsocialism the situation gets out of control because a few liberal geniuses in central govt don't have the wisdom of crowds.

CultureCitizen

Silver Member

- Jun 1, 2013

- 1,932

- 140

- 95

Well Norman, it is certainly that way . The problem is that such model is intrinsincly unstable. Very few people pay any attention to the cyclical nature of economy. I will oversimplify here:Sometime in the 70s the rich stopped caring about workers.

In their utopia shareholders are all that matter.

That's no good for workers or America as we've seen.

But cons will blame liberals as if paying workers a fair wage is why we are broke.

Erm... pretty sure that it's actually the LAW that the CEOs work for the shareholders, not the workers. In all fairness, it would result in a complete disaster if this was the other way around. The shareholders hired the CEO not the workers.

It really is sad how ignorant some people are.

Assume that wages + profits in a year = 100, and a net trade balance of zero.

And that wages represent are 40 and profits 60 and households credits = 0.

Next year assume an increase in production, with stagnant wages so the total is 110, so wages = 40, and proffits 70.

What happens next year ? You will be hit by a recession, because the purchasing power of wages is not enough to sustain the sales.

Now , I am oversimplifying, of course, if you have a trade surplus this will not happen. If households are able to get credit, the crisis will be offset ( untill the credits get to big to pay ) .

Certainly corporations are free to do what they want with their proffits, but that liberty is not without consecuences, and the same goes with the other sectors : banking(credit) and labour (wages) .

Next year assume an increase in production, with stagnant wages so the total is 110, so wages = 40, and proffits 70.

What happens next year ? You will be hit by a recession, because the purchasing power of wages is not enough to sustain the sales.

Exactly! Because corporations never spend their profits, never pay out dividends, never buy back shares.

I heard they put all that money in a big pile and burn it, just so they don't have to give it to workers.

Derp!

I didn't say that , you said it.

So , assume they import machinery to increase production , that doesn't create a larger market. Assume they buy back their own stock, same thing. Assume they open a factory in China, that's probably even worse.

In the best case scenario they could buy capital goods ( e.g. machinery ) in the local market . Now assuming that's what happens , in my example you would get a total production of 110 and wages at 44, which would be an actual increase in the output of labour , although proportionally you would remain with the same ratio ( 60 / 40) .

But, this is not what's been happening lately in the U.S. ( in the last 30 years or so ) . Average wages have stagnated while gdp has increased, oh , and of course private debt (specially household debt) has soared.

Big mistake : look at the aggregate figures, not at the individual cases.

Microeconomy and microeconomy are related but are not the same subject at all.

Here you go pal... why do I get the idea that you work in the financial sector ?

So , assume they import machinery to increase production , that doesn't create a larger market.

Because furriners never buy US output with their dollars.

And increased production never leads to lower prices.

Assume they buy back their own stock, same thing.

They bought back my shares, now I have more money to buy goods and services.

why do I get the idea that you work in the financial sector ?

Is it because in moments I can point out your idiocy?

So , assume they import machinery to increase production , that doesn't create a larger market.

Because furriners never buy US output with their dollars.

And increased production never leads to lower prices.

Good grief! Yes they do , but as I said that would only be relevant IF the US trade balance was possitive, which is not.

And yes , sometimes you get lower prices, and sometimes you get higher prices in spite of higher efficiency because commodities increase their prices ( e.g. oil).

Assume they buy back their own stock, same thing.

They bought back my shares, now I have more money to buy goods and services.

Ah... but the devil is in the details isn't it?

How would you spend it ? Treasury bonds ? Insurance ? Foreign currency? Imported goods? Stock from another company?

A house in another country? Another bubling asset?

Not all of the options will create domestic jobs.

Is it because in moments I can point out your idiocy?

Nah, it's probably because you seem to think that macro is applied micro.

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

so what are you proposing be done when increased production and , stagnant wages cause a recession?Not all of the options will create domestic jobs.

.

CultureCitizen

Silver Member

- Jun 1, 2013

- 1,932

- 140

- 95

As I said ( and showed in the charts), this can be offset by household debt (America's case in the last 20 years ) or by net exports increase ( England's case during early industrialization).

anything can be offset temporarily but under capitalism the system is self-correcting by millions of people in the market place. Under libsocialism the situation gets out of control because a few liberal geniuses in central govt don't have the wisdom of crowds.

Well it usually takes a crash or two ( and sometimes more than that ) for it to self correct. I still have to see one case in which a recesion has been solved cutting government spending.

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

Well it usually takes a crash or two ( and sometimes more than that ) for it to self correct..

what?? the market here self-corrects every second of every day thanks to capitalism just as the market self corrects every day in Venezuela thanks to socialism. Guess which is doing better?

CultureCitizen

Silver Member

- Jun 1, 2013

- 1,932

- 140

- 95

so what are you proposing be done when increased production and , stagnant wages cause a recession?Not all of the options will create domestic jobs.

.

Good question Ed.

A) Correct trade deficit,

B) Use helicopter money giving the money directly to the individuals , not to the banks ( this was actually suggested by Milton Friedman and is one of the few points in which I agree with him ). The single condition for this disbursement is that everyone having debt must use it first to cancell its debt.

C) Increase goverment spending in infrastructure ( this is the hardest part). The spending has to be directed in improving the efficiency of resource usage and in allowing corporations to work efficiently. The hard part: which parts of the infrastructure , in which location, aimed at which industries and towards which population groups.

Last edited:

CultureCitizen

Silver Member

- Jun 1, 2013

- 1,932

- 140

- 95

Yes , and Cuba and North Korea are doing even worse, but that's taking the worse examples. France, denmark , sweeden and norway seem to be doing fine.Well it usually takes a crash or two ( and sometimes more than that ) for it to self correct..

what?? the market here self-corrects every second of every day thanks to capitalism just as the market self corrects every day in Venezuela thanks to socialism. Guess which is doing better?

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

Yes , and Cuba and North Korea are doing even worse, but that's taking the worse examples. France, denmark , sweeden and norway seem to be doing fine.Well it usually takes a crash or two ( and sometimes more than that ) for it to self correct..

what?? the market here self-corrects every second of every day thanks to capitalism just as the market self corrects every day in Venezuela thanks to socialism. Guess which is doing better?

france has the per capita income of Arkansas, about our poorest state, and we have 70% of all recent medical patents and silicon valley. without our inventions they have the income of Cuba

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

A) Correct trade deficit,

.

so you'd correct the trade deficit between all individuals cities states and countries according to the dictates of some lib Nazi in govt??

EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

B) Use helicopter money giving the money directly to the individuals

how would this help rather than hurt??

Similar threads

- Replies

- 40

- Views

- 525

- Replies

- 3

- Views

- 139

Latest Discussions

- Replies

- 3K

- Views

- 45K

- Replies

- 91

- Views

- 578

- Replies

- 12

- Views

- 59

Forum List

-

-

-

-

-

Political Satire 8087

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 471

-

-

-

-

-

-

-

-

-

-