- Aug 10, 2009

- 168,037

- 16,519

- 2,165

- Banned

- #121

The rich and wealthy always have loop holes created by the holes in the heads of folks like EB and their running dogs.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

The middle class are subsidizing the rich through higher taxes.

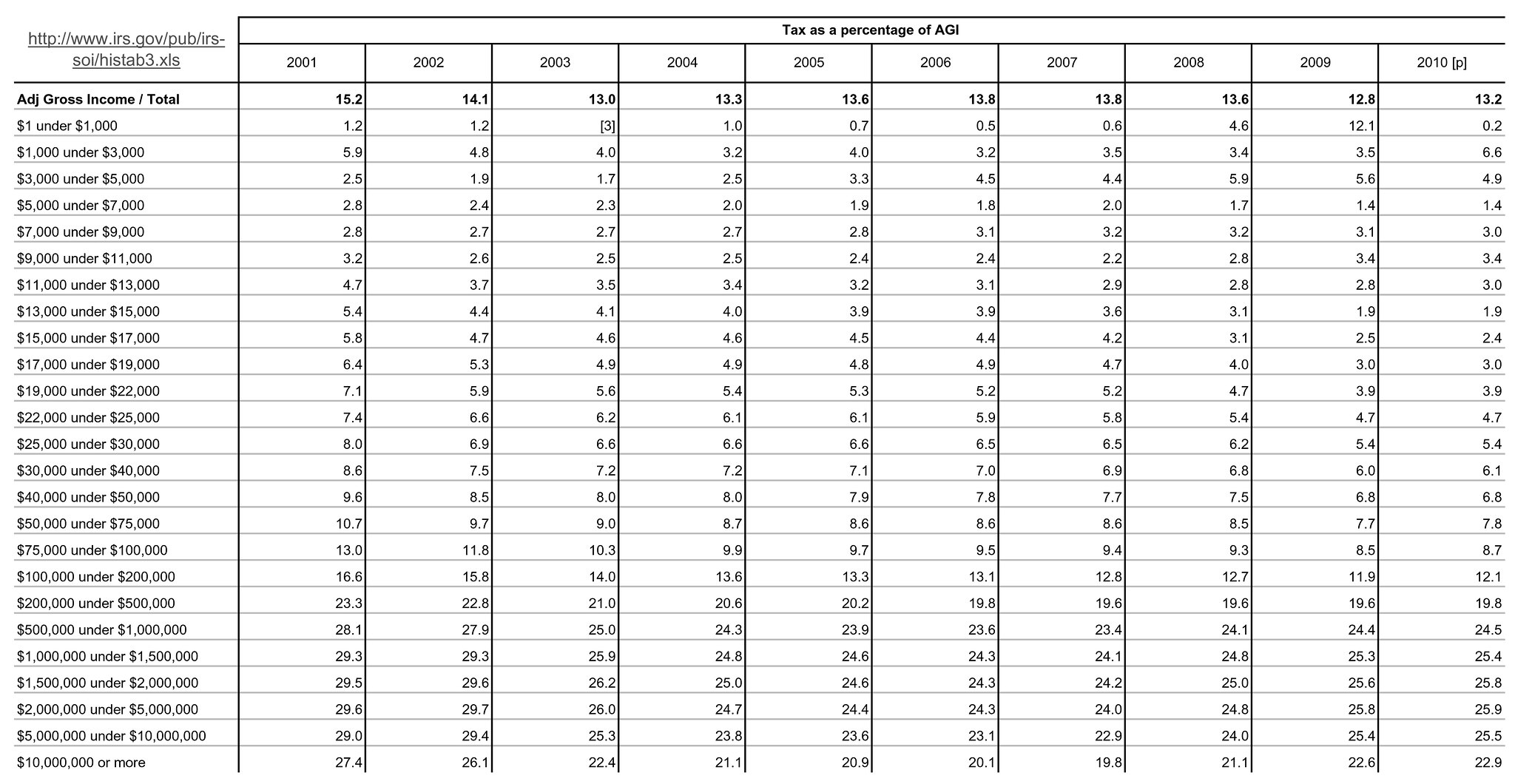

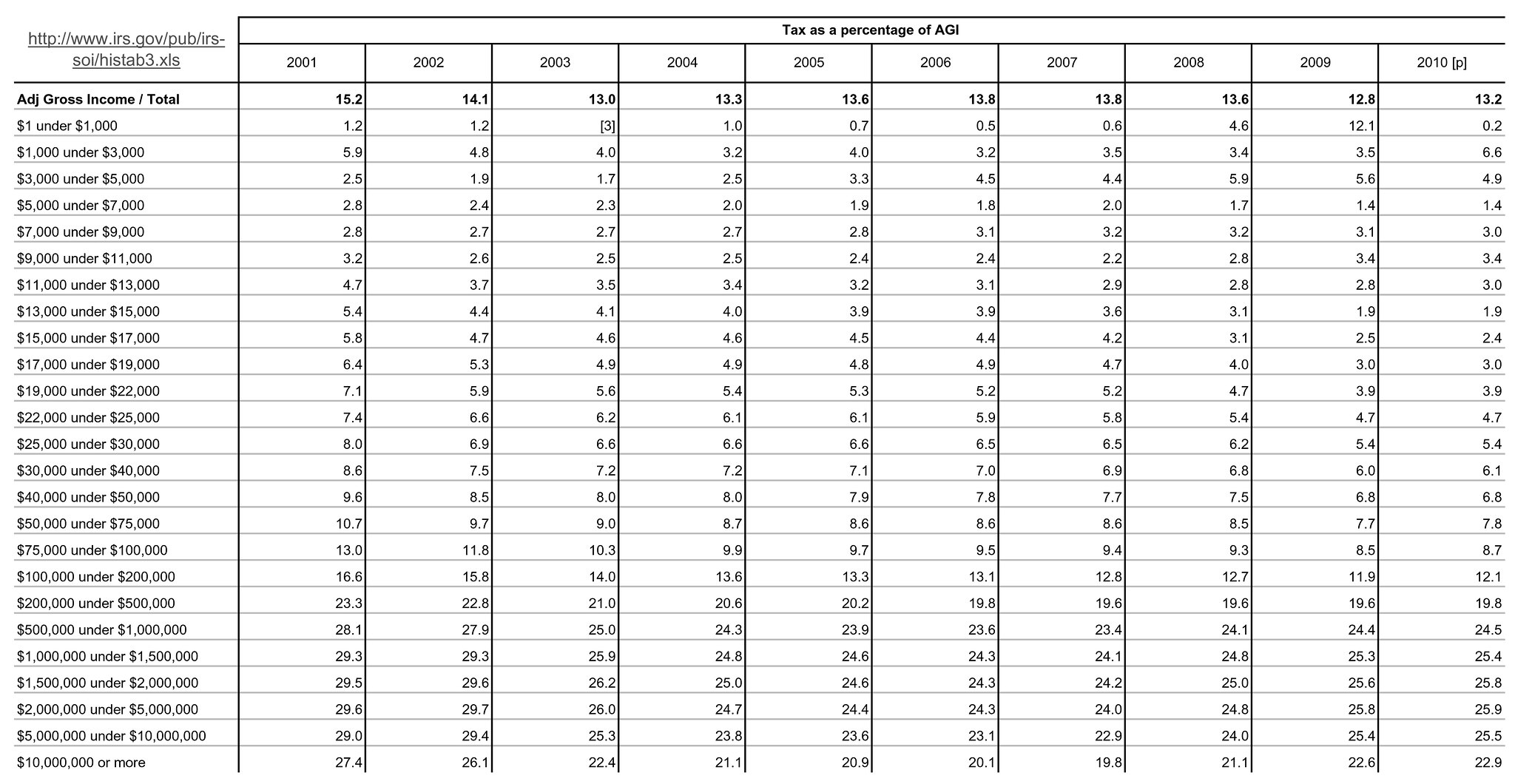

actually the top 1% pay 40% of all federal income taxes!! How unusual that a liberal got it backwards again.

What class action lawsuit dip-shit. The middle class are subsidizing the rich through higher taxes. Not only would the rich lose your fantasy lawsuit, the middle class counter-suit for damages from tax code abuse would strip them of a shit load of their ill-gotten gain from income tax subsidy to the rich. They would never be stupid enough to bring that suit.

Do you have a viable source to prove that the "middle class are subsidizing the rich through higher taxes?

gee I guess not; what a surprise!!

gee I guess not; what a surprise!!

gee I guess not; what a surprise!!

it turns out from your own IRS data that the top 1% pay 40% of all federal income tax now while the top 1% paid only 23% under Reagan.

So the idea that the middle class subsidize the rich is absurd when the middle class pay very little tax let alone anywhere near their fair share.

PLease tell us what % of federal tax the top 1% pay!! or admit to being a liberal without the IQ to do so?

Government agencies typically have 4-6% administrative costs.The government is highly efficient?

At what?

Private companies typically have 25-30% administrative costs.

The difference? Executive pay.

Yet you forget about the multi level bureaucracies.... and not to mention that when you get away from wingers like Krugman, you find that things such as medicare have actually HIGHER administrative costs than private insurance....

But don't let that stand in the way of your preconceived stance

gee I guess not; what a surprise!!

it turns out from your own IRS data that the top 1% pay 40% of all federal income tax now while the top 1% paid only 23% under Reagan.

So the idea that the middle class subsidize the rich is absurd when the middle class pay very little tax let alone anywhere near their fair share.

PLease tell us what % of federal tax the top 1% pay!! or admit to being a liberal without the IQ to do so?

gee I guess not; what a surprise!!

it turns out from your own IRS data that the top 1% pay 40% of all federal income tax now while the top 1% paid only 23% under Reagan.

So the idea that the middle class subsidize the rich is absurd when the middle class pay very little tax let alone anywhere near their fair share.

PLease tell us what % of federal tax the top 1% pay!! or admit to being a liberal without the IQ to do so?

You are just another spastic retard with no clue about business or economics.

I subscribe to the adage that behind every great fortune lies a great crime.What doya want Edward? A socialist revolution?

That is what happens when wealth distribution gets too lopsided.

with 1% paying 40%

of taxes I'm not surprised they want a revolution or at least a court settlement.

Those One Percenters who lament a 40% tax rate are ignoring the 91% rate imposed on their wealth level which existed from FDR's term through the Eisenhower presidency

Presuming you are talking about downward adjustment via loopholes and legitimate deductions, the same situation applies proportionately to the existing rates. So your point is null and void.Those One Percenters who lament a 40% tax rate are ignoring the 91% rate imposed on their wealth level which existed from FDR's term through the Eisenhower presidency

1)of course in those years nobody paid that tax and the government collected less of GDP than they do now with far lower rates.

Yet there are substantially more millionaires and billionaires today than there were back then. So the means of acquisition is not the issue. Acquisition is the issue. I'm not concerned with how you acquired ten billion dollars in assets. I'm concerned with the fact that you've managed to acquire that much money. How you got it is not relevant to the purpose of maintaining a healthy economic balance and social quality.[/quote]2) in those years there was no international competition, now there is tons and we have the highest corporate tax rate in the world to boot !!

It is. You should try it.Isn't thinking fun??

Presuming you are talking about downward adjustment via loopholes and legitimate deductions, the same situation applies proportionately to the existing rates. So your point is null and void.

Yet there are substantially more millionaires and billionaires today than there were back then.

1)of course in those years nobody paid that tax and the government collected less of GDP than they do now with far lower rates.

Presuming you are talking about downward adjustment via loopholes and legitimate deductions, the same situation applies proportionately to the existing rates. So your point is null and void.

Yet there are substantially more millionaires and billionaires today than there were back then.

Dear, inflation makes the dollar worth 10 times what is was then, the population of the world has doubled, and the world is fully integrated economicially so of course there are more millionaires, and more cars, more houses,TV's phones etc etc etc etc.

See why we are 100% certain a liberal will be slow, so very very slow!!

1)of course in those years nobody paid that tax and the government collected less of GDP than they do now with far lower rates.

Presuming you are talking about downward adjustment via loopholes and legitimate deductions, the same situation applies proportionately to the existing rates. So your point is null and void.

dear in 1950 government took 20% today they take 40%!! Sorry

US government spending as percent of GDP - Charts Tables History

do you feel like a liberal now????

This seems a clear violation of the equal protection clause. Does anyone doubt it?

1)of course in those years nobody paid that tax and the government collected less of GDP than they do now with far lower rates.

Presuming you are talking about downward adjustment via loopholes and legitimate deductions, the same situation applies proportionately to the existing rates. So your point is null and void.

dear in 1950 government took 20% today they take 40%!! Sorry

US government spending as percent of GDP - Charts Tables History

do you feel like a liberal now????

Loopholes are there to encourage you to do something positive with your money and the high tax rate was a penalty for doing nothing.