America needs a giant dose of competition. Americans need more spending power.

http://www.economist.com/news/brief...ds-giant-dose-competition-too-much-good-thing

http://www.economist.com/news/brief...ds-giant-dose-competition-too-much-good-thing

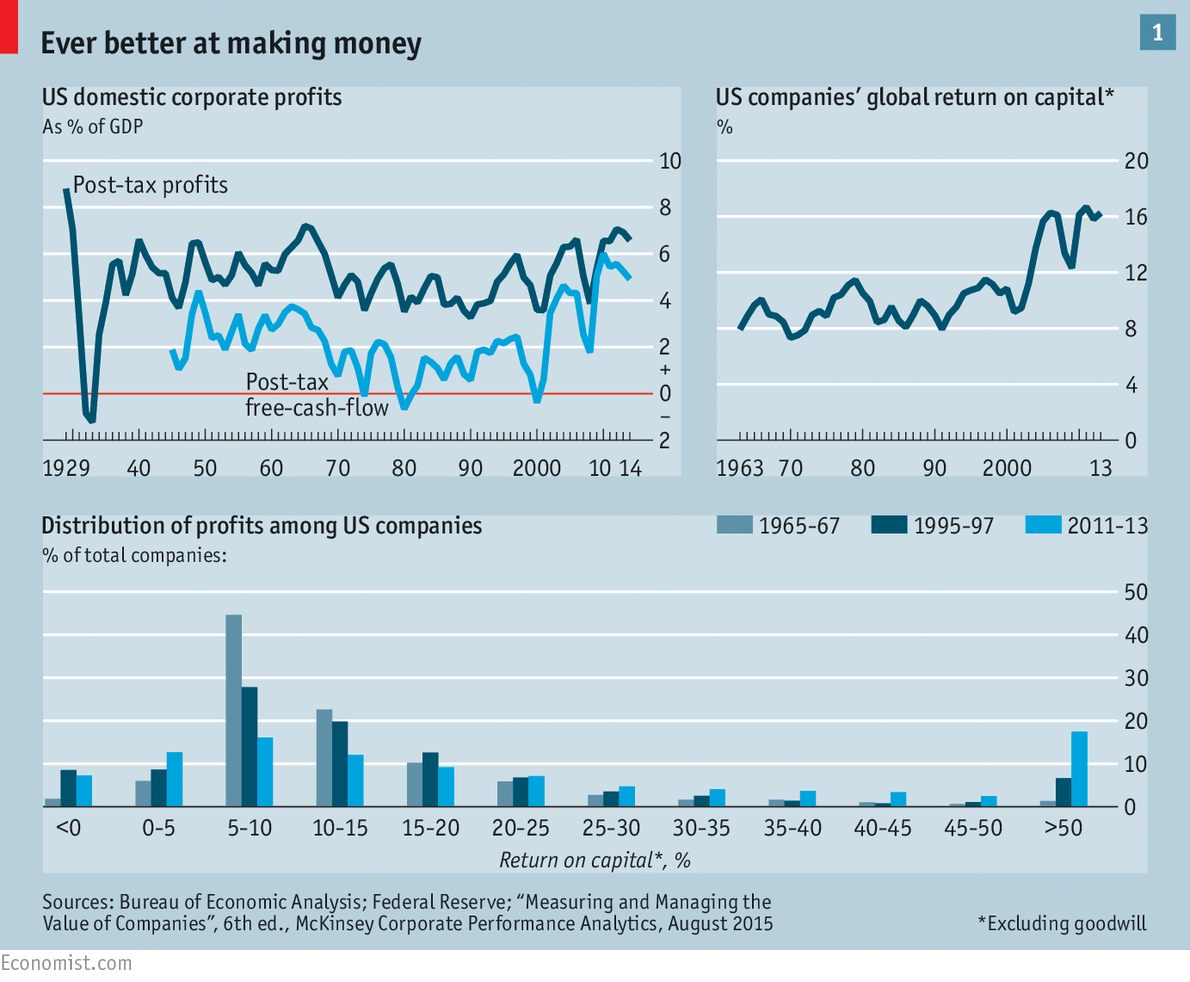

The last year has seen a slight dip in aggregate profits because of the high dollar and the effect of the oil price on energy firms. But profits are at near-record highs relative to GDP (see chart 1) and free cash flow—the money firms generate after capital investment has been subtracted—has grown yet more strikingly. Return on capital is at near-record levels, too (adjusted for goodwill). The past two decades have seen most firms make more money than they used to. And more firms have become very profitable.

An intense burst of consolidation will boost their profits more. Since 2008 American firms have engaged in one of the largest rounds of mergers in their country’s history, worth $10 trillion. Unlike earlier acquisitions aimed at building global empires, these mergers were largely aimed at consolidating in America, allowing the merged companies to increase their market shares and cut their costs. The companies in question usually make no pretence of planning to pass the savings they make this way on to their customers; take their estimates of the synergies involved at face value and profits in America will rise by a further 10% or so.

Profits are an essential part of capitalism. They give investors a return, encourage innovation and signal where resources should be invested. Their accumulation allows investment in bold new ventures. Countries where profits are too low—Japan, for instance—can slip into morbid torpor. Firms that ignore profits, such as China’s state-run enterprises, lurch around like aimless zombies, as likely to destroy value as to create it.

But high profits across a whole economy can be a sign of sickness. They can signal the existence of firms more adept at siphoning wealth off than creating it afresh, such as those that exploit monopolies. If companies capture more profits than they can spend, it can lead to a shortfall of demand. This has been a pressing problem in America. It is not that firms are underinvesting by historical standards. Relative to assets, sales and GDP, the level of investment is pretty normal. But domestic cash flows are so high that they still have pots of cash left over after investment: about $800 billion a year.

High profits can deepen inequality in various ways. The pool of income to be split among employees could be squeezed. Consumers might pay too much for goods. In a market the size of America’s prices should be lower than in other industrialised economies. By and large, they are not. Though American companies now make a fifth of their profits abroad, their naughty secret is that their return-on-equity is 40% higher at home.

Most explanations of America’s high profits draw on national-accounts data which show that the fall in the share of output going to workers over the past decade is equivalent to about 60% of the rise in domestic pre-tax profits. Scholars typically have three explanations for this: technology, which has allowed firms to replace workers with machines and software; globalisation, which has made it easier to shift production to lower cost countries; and a decline in trade-union membership.