Jarhead

Gold Member

- Jan 11, 2010

- 20,670

- 2,378

- 245

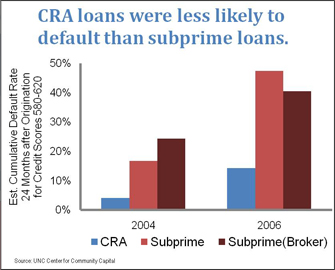

And who allowed those loans to be sold? Who was found to be delinquent in their responsibilities and when it was discovered, who received the support of Frank and who, as chairman of the committee, deemed the report bogus and let things continue as they were?As for the FDIC-insured commercial banks that ran into trouble, the record is also clear: what got them into trouble were not activities restricted by Glass-Steagall. Their problems arose from investments in residential mortgages and residential mortgage-backed securities—investments they had always been free to engage in

I can see why the Rand institute would take that position. The last thing in the world Repubs want is to have the housing collapse attributed to their obsession in repealing Graham Leach.

And while the FDIC banks had always been allowed into mortgage lending, that one sentence highlighted is a bit disingenuous.

Seems like the writer forgot to mention this; their problems arose from investments in residential mortgages an residential mortgage backed securities consisting of poor quality loans. Investments they had always been free to engage in but declined.

There was a reason that legislation was in place. It served a purpose. If you (and others) don't believe it played a major part in the collapse, if you think it was simply coincidence that after this repeal things started to get crazy, that it was just bad timing, then why was it so important to Republicans to repeal that particular law? What did they and their backers gain from the repeal?