Neubarth

At the Ballpark July 30th

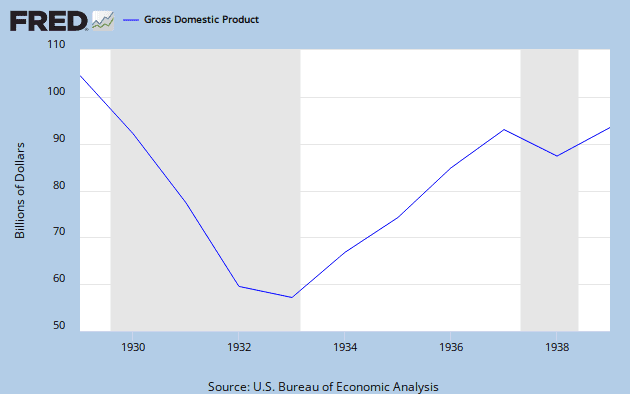

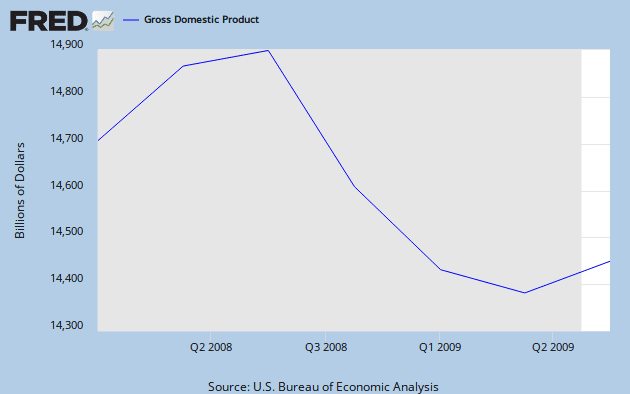

Economists Warn: Another Great Depression is Coming

It is being dubbed as the Great Depression 2 and all fingers are pointing toward Wall Street as the ultimate culprit of our impending total meltdown.

Former IMF chief economist, Simon Johnson said, the financial industry has effectively captured our government and is blocking essential reform.

He adds that if we cannot break its suffocating grip on Washington, we will not be able to stop the Great Depression 2.

Johnson is not alone in his prediction. Phrases like; "capitalism-without-morals are being recited by other economic gurus who are frustrated by what they see as imminent. Columbia University Professor and Nobel Prize economist, Joseph Stiglitz, is among them. Stiglitz said, "the financial sector will only try to circumvent whatever new regulations we put in place. We will simply have a short respite before the next crisis."

What we are experiencing now is only a small taste of what is on the horizon, and it is only the arrogance of the American attitude that prevents so many from seeing it.

Economists warn: Another great depression is likely

It is being dubbed as the Great Depression 2 and all fingers are pointing toward Wall Street as the ultimate culprit of our impending total meltdown.

Former IMF chief economist, Simon Johnson said, the financial industry has effectively captured our government and is blocking essential reform.

He adds that if we cannot break its suffocating grip on Washington, we will not be able to stop the Great Depression 2.

Johnson is not alone in his prediction. Phrases like; "capitalism-without-morals are being recited by other economic gurus who are frustrated by what they see as imminent. Columbia University Professor and Nobel Prize economist, Joseph Stiglitz, is among them. Stiglitz said, "the financial sector will only try to circumvent whatever new regulations we put in place. We will simply have a short respite before the next crisis."

What we are experiencing now is only a small taste of what is on the horizon, and it is only the arrogance of the American attitude that prevents so many from seeing it.

Economists warn: Another great depression is likely