Truthmatters

Diamond Member

- May 10, 2007

- 80,182

- 2,272

- 1,283

- Banned

- #21

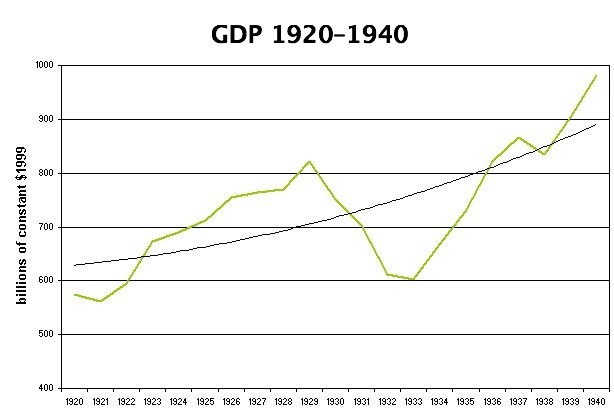

The result of his and his VP who took office after his death and ccontiunued his polices were the Crash of 1929 and the Great Depression.

You guys then did it to us again this time with your idiot insistance that the Free Market solves everthing.

try as you may history just keeps getting in the way of your stupidity.

You guys then did it to us again this time with your idiot insistance that the Free Market solves everthing.

try as you may history just keeps getting in the way of your stupidity.