Truthmatters

Diamond Member

- May 10, 2007

- 80,182

- 2,272

- 1,283

- Banned

- #41

Lets remember that Cohen and Boot are both conservatives

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

And where would you say the excess funds that the administration is pouring into the system fit in? Would this be on the order of "artificially low interest rates"?

This is from a Buchanan article:

"Obama is repeating the failed policies of Hoover and FDR, by refusing to let prices fall. Obama, with his intervention to prop up housing prices and Bernanke with his gushers of money to bail out bankrupt banks and businesses are creating a new bubble that will burst even more spectacularly."

Have you read the prognostications that there will be second, more severe, leg of this downturn, and that every trillion the government adds, adds a year to the recovery?

I'm not sure how Buchanan could claim prices didn't fall -- there was massive deflation during the GD, and prices fell on the order of 25% I believe.

That's not what he said.

" by refusing to let prices fall" means that policy attempted to support the failing areas of the economy. That is the mistake that Hoover and FDR made. As for our current President, economic policy is subsidiary to ideology. He wants the power of government to produce a country where all the people live on the same 'plateau."

To those of us who are Conservative, it smacks of " from each according to his ability, to each according to his needs." It destroys the desire to work hard and achieve. As Senator Schumer said" the time of traditional values is over."

And, as Marlon Brando said in "Apocalypse,' 'the horror, the horror."

I'm fogetting nothing here , you and your little misers friend just amke things up.

Now tell me how the Post WWI economy was heading for a depression again?

Did someone steal the cork out of your lunch?

I think you are " fogetting" the letter 'r' at least.

So much to teach, so little time. Post WWI was the Wilson recession of 1920-21. Harding performed excellently as a recession-fighter by allowing prices to fall, wages to fall- and thus led to full employment, and by July of '21 we were on our way to the "Roaring Twentiies."

Note: Harding did the exact opposite of the policies of Hoover, FDR, and President Obama. Judge the results for yourself.

If that is beyond you, just take my word for it.

As a gesture of my humanity, I add this for your edification:

"For all the differences between the United States and Europe, we share a common challenge: how to improve the social well-being of our citizens without a massive growth in the size and intrusiveness of government. We're convinced that conservatism--properly understood--offers the surest road to social justice." Rick Santorum

I personally wouldn't take the temporal argument of the early 1920s in isolation to make deductions of tax policy and economic growth. There are too many examples were they opposite has occurred, including the current decade. The '50s and '60s were times of strong average real growth (better than anything since) but periods when top tax rates were up to 91%. For that matter, low taxes did not prevent the 1929 depression, and the tax increase passed in 1932 did not prevent the economy from growing again in 1934.

I'm not sure how Buchanan could claim prices didn't fall -- there was massive deflation during the GD, and prices fell on the order of 25% I believe.

That's not what he said.

" by refusing to let prices fall" means that policy attempted to support the failing areas of the economy. That is the mistake that Hoover and FDR made.

What were Hoover (finally back to him, now I got the right guy) policies that attempted to support failing areas of the economy?

I agree that FDR engaged in an immediate Govt intervention program in 1933. However, by 1934 the economy was finally growing again, so I have a hard time seeing that as a particular failure.

As for our current President, economic policy is subsidiary to ideology. He wants the power of government to produce a country where all the people live on the same 'plateau."

To those of us who are Conservative, it smacks of " from each according to his ability, to each according to his needs." It destroys the desire to work hard and achieve. As Senator Schumer said" the time of traditional values is over."

And, as Marlon Brando said in "Apocalypse,' 'the horror, the horror."

I have not seen anything by Obama that suggests that all people live on the same level. He's talking about a tax increase to 40%, which we had in the 90s yet somehow folks continued to work hard and achieve. Which they actually did in the 50s and 60s with top tax rates of 70 and up to 91%.

The result of his and his VP who took office after his death and ccontiunued his polices were the Crash of 1929 and the Great Depression.

You guys then did it to us again this time with your idiot insistance that the Free Market solves everthing.

try as you may history just keeps getting in the way of your stupidity.

I'd take the 2 year free market solution to a Depression of your 15 year fascist solution to a Depression any day.

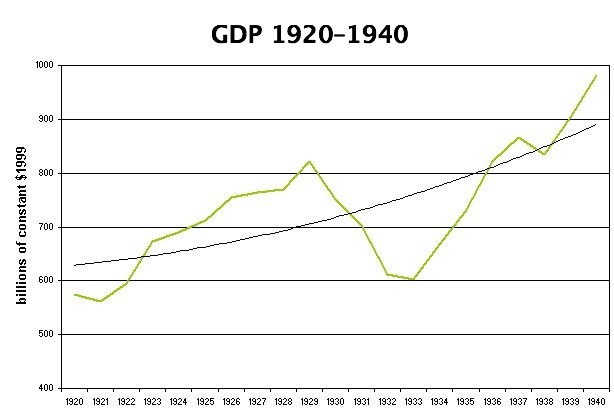

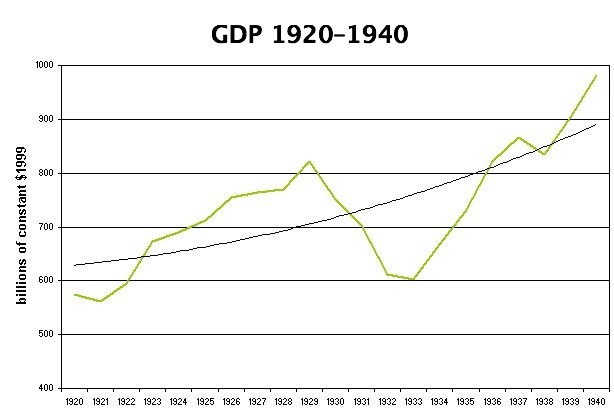

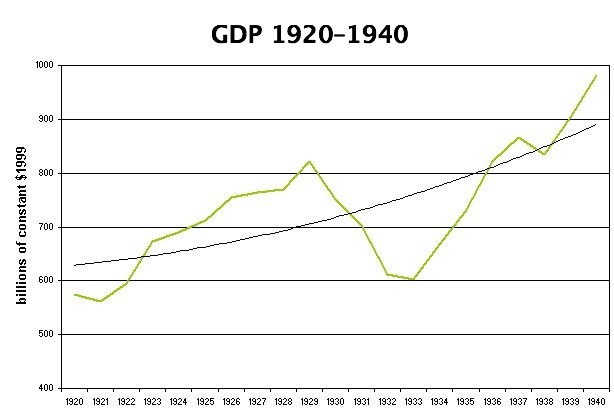

The problem was that (despite the low tax rates Harding had passed) GDP had fallen 25% real over three years before the fascist solution happened in 1933 (now we are getting to the point my previous post is relevant again!)

The '20 recession was anything like that in terms of GDP decline. It was a post war recession, caused by the sudden decline in war production (similar to the post WWII recession), as opposed to a financial system meltdown (like the GD and current recession). As was the case post WWII, industry was able to retool to consumer goods and got cranking again in relatively short order.

By 1933, the economy had falled by a huge amount over three years. Like today, taxes were already low. Low taxes had not prevented the GD, and, like today, a cash starved Govt was not able cut taxes further. The problem in the GD wasn't that people didn't have money (tho lots didn't) but that those that had the $$ weren't spending it.

If the folks getting tax cuts don't spent the extra money, tax cuts only marginally stimulate the economy.

Hoovers Solutions were mostly volunteer programs he negociated with the Corporations.

He did not use legislative solutions until very late in his term.

Thus the too little too late comments that are always made about his policies.

There are many like this Woods liar that try very hard to change the past by rewriting about it for politcal reasons.

I'd take the 2 year free market solution to a Depression of your 15 year fascist solution to a Depression any day.

The problem was that (despite the low tax rates Harding had passed) GDP had fallen 25% real over three years before the fascist solution happened in 1933 (now we are getting to the point my previous post is relevant again!)

The '20 recession was anything like that in terms of GDP decline. It was a post war recession, caused by the sudden decline in war production (similar to the post WWII recession), as opposed to a financial system meltdown (like the GD and current recession). As was the case post WWII, industry was able to retool to consumer goods and got cranking again in relatively short order.

By 1933, the economy had falled by a huge amount over three years. Like today, taxes were already low. Low taxes had not prevented the GD, and, like today, a cash starved Govt was not able cut taxes further. The problem in the GD wasn't that people didn't have money (tho lots didn't) but that those that had the $$ weren't spending it.

If the folks getting tax cuts don't spent the extra money, tax cuts only marginally stimulate the economy.

That's assuming that spending money in the here and now is the bedrock of economic growth, but it is not.

The idea of people spending in the future is cause for people to invest in new capital production today, and the ratio between spending now and spending in the future is altered by interest rates.

It doesn't matter how much money was in the economy (of course, the more there is, the more capital production that happens, and the more production, the more wealth is created for the cycle to repeat over and over), since the allocation of resources were in all the wrong places in 1929. Tax cuts can only encourage growth, but it can't resolve inbalances that occur as a result of artificial manipulation of interest rates. It can certainly ease the pain felt by the restructuring of the economy, though.

The problem was that (despite the low tax rates Harding had passed) GDP had fallen 25% real over three years before the fascist solution happened in 1933 (now we are getting to the point my previous post is relevant again!)

The '20 recession was anything like that in terms of GDP decline. It was a post war recession, caused by the sudden decline in war production (similar to the post WWII recession), as opposed to a financial system meltdown (like the GD and current recession). As was the case post WWII, industry was able to retool to consumer goods and got cranking again in relatively short order.

By 1933, the economy had falled by a huge amount over three years. Like today, taxes were already low. Low taxes had not prevented the GD, and, like today, a cash starved Govt was not able cut taxes further. The problem in the GD wasn't that people didn't have money (tho lots didn't) but that those that had the $$ weren't spending it.

If the folks getting tax cuts don't spent the extra money, tax cuts only marginally stimulate the economy.

That's assuming that spending money in the here and now is the bedrock of economic growth, but it is not.

If folks don't spend money and buy products, pretty hard to see how that fosters economic growth, short or long term.

The idea of people spending in the future is cause for people to invest in new capital production today, and the ratio between spending now and spending in the future is altered by interest rates.

We've had plenty of capital. That hasn't been a problem.

It doesn't matter how much money was in the economy (of course, the more there is, the more capital production that happens, and the more production, the more wealth is created for the cycle to repeat over and over), since the allocation of resources were in all the wrong places in 1929. Tax cuts can only encourage growth, but it can't resolve inbalances that occur as a result of artificial manipulation of interest rates. It can certainly ease the pain felt by the restructuring of the economy, though.

I could certainly agree that resources were misallocated in 1929, though I'm not sure how interest rates caused that misallocation. Low tax rates in 1929 thru 1932 certainly did not encourage growth or ease the pain of the GD.

Hoovers Solutions were mostly volunteer programs he negociated with the Corporations.

He did not use legislative solutions until very late in his term.

Thus the too little too late comments that are always made about his policies.

There are many like this Woods liar that try very hard to change the past by rewriting about it for politcal reasons.

That's why it's hard for anyone to take you seriously. You call the man a liar without listening to him for a second.

Hoover was, in fact, Harding's commerce secretary who urged Harding to intervene on the falling wages, and thankfully, Harding had not and the depression ended shortly thereafter. However, Hoover, when he was elected President, kept wages artificially high, in that deflationary environment, and that caused mass unemployment. Couple that with Hoover blocking the restructuring needed to rid the economy of the Fed created imbalances, and you can see why this Depression lasted a lot longer than the one in the 1920s.

What were Hoover (finally back to him, now I got the right guy) policies that attempted to support failing areas of the economy?

"Far from a free-market idealist, Hoover was an ardent believer in government intervention to support incomes and employment. This is critical to understanding the origins of the Great Depression. Franklin Roosevelt didn't reverse course upon moving into the White House in 1933; he went further down the path that Hoover had blazed over the previous four years. That was the path to disaster."

" Hoover, not Roosevelt, who initiated the practice of piling up big deficits to support huge public-works projects."

"Public projects undertaken by Hoover included the San Francisco Bay Bridge, the Los Angeles Aqueduct, and Hoover Dam. The Republican president won plaudits from the American Federation of Labor for his industrial policy, which included jawboning business leaders to refrain from cutting wages as the economy fell."

I agree that FDR engaged in an immediate Govt intervention program in 1933. However, by 1934 the economy was finally growing again, so I have a hard time seeing that as a particular failure.

"...for turning a panic into the worst depression of modern times. As late as 1938, after almost a decade of governmental "pump priming," almost one out of five workers remained unemployed. What the government gave with one hand, through increased spending, it took away with the other, through increased taxation. But that was not an even trade-off. As the root cause of a great deal of mismanagement and inefficiency, government was responsible for a lost decade of economic growth."

http://online.wsj.com/article/SB122576077569495545.html

As for our current President, economic policy is subsidiary to ideology. He wants the power of government to produce a country where all the people live on the same 'plateau."

To those of us who are Conservative, it smacks of " from each according to his ability, to each according to his needs." It destroys the desire to work hard and achieve. As Senator Schumer said" the time of traditional values is over."

And, as Marlon Brando said in "Apocalypse,' 'the horror, the horror."

I have not seen anything by Obama that suggests that all people live on the same level. He's talking about a tax increase to 40%, which we had in the 90s yet somehow folks continued to work hard and achieve. Which they actually did in the 50s and 60s with top tax rates of 70 and up to 91%.

Saving money is where banks get capital to loan out. Savings, not spending, is how economies grow. That's why Singapore, through their forced savings system, has had growth almost unparalleled in that area of the world.

Hoovers Solutions were mostly volunteer programs he negociated with the Corporations.

He did not use legislative solutions until very late in his term.

Thus the too little too late comments that are always made about his policies.

There are many like this Woods liar that try very hard to change the past by rewriting about it for politcal reasons.

That's why it's hard for anyone to take you seriously. You call the man a liar without listening to him for a second.

Hoover was, in fact, Harding's commerce secretary who urged Harding to intervene on the falling wages, and thankfully, Harding had not and the depression ended shortly thereafter. However, Hoover, when he was elected President, kept wages artificially high, in that deflationary environment, and that caused mass unemployment. Couple that with Hoover blocking the restructuring needed to rid the economy of the Fed created imbalances, and you can see why this Depression lasted a lot longer than the one in the 1920s.

The man is a liar, one example of it is that it was a recession and not a depression in 1921.

There is NO reason to listen to ANYONE from Mises because they are designed to LIE for political reasons.

Saving money is where banks get capital to loan out. Savings, not spending, is how economies grow. That's why Singapore, through their forced savings system, has had growth almost unparalleled in that area of the world.

Well, yes and no.

Savings are critical to fund investment and research and development but if no one spends, then an economy will not grow, period. It can't.

For example, Japan has one of the highest savings rates in the world and it has not grown for nearly a generation.

Singapore also grew because the government opened to trade, welcomed investment, spent heavily on education and became a banking center, not least of which in benefited from the government elites in China who ripped off their country to bank in secrecy in the city-state.

Its a political hack think tank