Contumacious

Radical Freedom

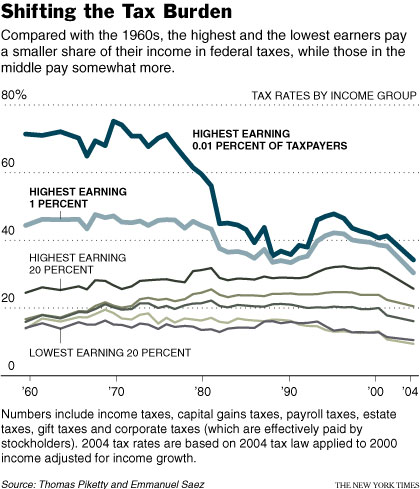

Having the rich pay more in taxes only helps the poor if the government spends the extra money in a wise and responsible way something they do not have a very good history of doing.

A WELFARE STATE = GOVERNMENT BUY THE PEOPLE