Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Senate approves $15,000 tax credit for homebuyers

- Thread starter Chris

- Start date

I need to sell my house to my daughter, then have her sell it back to me, then sell it back to her, then buy it back, etc etc. If we do this often enough we will both be rich, and have a free house.

Amanda

Calm as a Hindu cow

- Nov 28, 2008

- 4,426

- 1,011

- 48

I need to sell my house to my daughter, then have her sell it back to me, then sell it back to her, then buy it back, etc etc. If we do this often enough we will both be rich, and have a free house.

OMG, would that work?

Wanna get in on trading houses?I need to sell my house to my daughter, then have her sell it back to me, then sell it back to her, then buy it back, etc etc. If we do this often enough we will both be rich, and have a free house.

OMG, would that work?

- Nov 29, 2008

- 25,786

- 11,295

- 940

Is that like trading reps and thank you?Wanna get in on trading houses?I need to sell my house to my daughter, then have her sell it back to me, then sell it back to her, then buy it back, etc etc. If we do this often enough we will both be rich, and have a free house.

OMG, would that work?

Can we pin your ears back?

Is that like trading reps and thank you?Wanna get in on trading houses?OMG, would that work?

Can we pin your ears back?

No

and

No

Great, another potentially how many pages of bloated bureaucratic stuff for the tax code? And how can the taxpayers who've already filed for 08 take advantage of this? Or, is it for the 09 taxes, will it wait till next year thus negating jumpstarting anything?

Those who support the income tax in it's current form are either corrupt politicians, or simply too stupid to be allowed to breed.

Those who support the income tax in it's current form are either corrupt politicians, or simply too stupid to be allowed to breed.

So 15,000.00 tax credit for homebuyers?

Questions?

1. Does one have to have to have income or money to buy these homes?

2. Does one actually have to have a job to buy these homes?

3. Does one actually have to have a credit score to buy these homes?

Or are we back to giving anyone with a heart beat a mortgage loan guaranteed by the American taxpayer, now with a $15,000 tax credit?

Questions?

1. Does one have to have to have income or money to buy these homes?

2. Does one actually have to have a job to buy these homes?

3. Does one actually have to have a credit score to buy these homes?

Or are we back to giving anyone with a heart beat a mortgage loan guaranteed by the American taxpayer, now with a $15,000 tax credit?

Last edited:

highly doubtfulI need to sell my house to my daughter, then have her sell it back to me, then sell it back to her, then buy it back, etc etc. If we do this often enough we will both be rich, and have a free house.

OMG, would that work?

- Nov 29, 2008

- 25,786

- 11,295

- 940

So 15,000.00 tax credit for homebuyers?

Questions?

1. Does one have to actually qualify for these home loans?

2. Does one actually have to have a job to buy these homes.

3. Does one actually have to have a credit score to buy these homes?

Or are we back to giving anyone with a heart beat a mortgage loan backed by the American taxpayer, now with a $15,000 tax credit?

Obviously if one did not have an income one would not need or be able to use a $15,000.00 tax credit.

The question should be how many individuals actually have to pay $15,000.00 in income taxes a year?

It's more bs from the congressional math magicians.

Last edited:

even a slug like you should be able to sell the odd doublewide under these conditions.

xsited1

Agent P

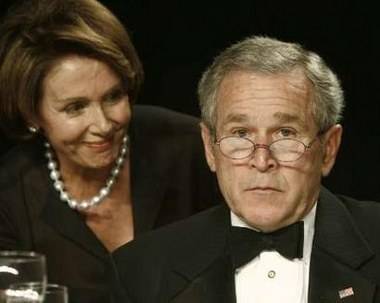

The Democrats agreed with the Republicans. Good thing Pelosi is in the House.

So 15,000.00 tax credit for homebuyers?

Questions?

1. Does one have to actually qualify for these home loans?

2. Does one actually have to have a job to buy these homes.

3. Does one actually have to have a credit score to buy these homes?

Or are we back to giving anyone with a heart beat a mortgage loan backed by the American taxpayer, now with a $15,000 tax credit?

Obviously if one did not have an income one would not need or be able to use a $15,000.00 tax credit.

The question should be how many individuals actually have to pay $15,000.00 in income taxes a year?

It's more bs from the congressional math magicians.

Well, I think they need to clarify this before they start handing out more of our dollars, don't you?

The way they ran Fannie/Freddie is what got us into this mess in the first place. And in fact, mortgage money was given out to people who only needed to have a heart beat to qualify--which was backed by the American taxpayer.

Not many people pay $15,000 per year in income taxes. So that would mean that this would be a year after year until their $15,000 tax credit is used up.

Or does the liberal wing--"everyone deserves homeownership" jump in here & go back to lending mortgage money to people who do not qualify & then hand them a tax "rebate" check in the amount of $15,000?

After what we have witnessed our government doing, that would not surprise me in the least.

how can you be so sure of that?No one is loaning money to people who don't qualify.

That won't happen any time soon.

its happened before

Epsilon Delta

Jedi Master

Socialists!

Similar threads

- Replies

- 41

- Views

- 572

- Replies

- 10

- Views

- 436

- Replies

- 139

- Views

- 1K

- Replies

- 9

- Views

- 132

- Replies

- 33

- Views

- 255

Latest Discussions

- Replies

- 65

- Views

- 263

- Replies

- 271

- Views

- 2K

Forum List

-

-

-

-

-

Political Satire 8043

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-