Dale Smith

Platinum Member

If you give the superrich tax cuts they then have more money with which to invent new products and create new jobs. You can't give the poor tax cuts because they don't pay taxes and what would be the point anyway since They don't invent new products that would help the economy grow and generating new jobsI agree. SCREW IT!!! Screw trickle down!!! Screw tax cuts for the super rich!!! Screw cutting science, education and infrastructure.

Fuck libertriainism in its nasty ass.

Yeah, the rich need tax cuts *shaking head*

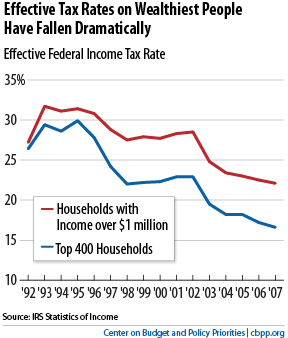

In other words, a person in the top 0.001 percent income bracket -- who would have an adjusted gross income of at least $62,000,000 -- pays the nearly same effective tax rate as somebody in the top 20 percent bracket who makes $85,000 in adjusted gross income.

As the rich become super-rich, they pay lower taxes. For real.

1945-1980 we had no jobs right? HOW ABOUT 1993-2000?

So, let me get this straight...I barter my labor in increments of an hour in order to accrue enough Federal Reserve Notes to exist on and you believe that the federal de-facto "gubermint" is entitled to 25 to 30 percent of my sweat equity due to the Chapter 11 Bankruptcy of March 1933???? Do tell???? Please tell me how you can justify that.......

"Chapter 11 Bankruptcy of March 1933"

LMAOROG, Sure Bubs, sure

HINT IT'S CALLED A SOCIETY!!!!

Taxes Are What We Pay for Civilized Society

Oliver Wendell Holmes

Taxes on our labor isn't "civilized" and I am going to "school" you about the Chapter 11 Bankruptcy of USA.INC via 1933 and 1950, what you refer to as your believed "gubermint".........I am gonna knock your ass so far out of the park that you will have to buy a ticket to get back in......make sure you chime back on this thread later today......I'm gonna lay some "truth bombs" on ya......