EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

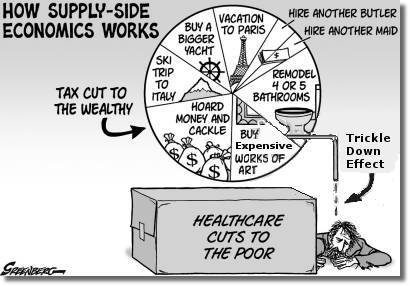

conservative economic policy is capitalism. China just switched to Republican capitalism and instantly eliminated 40% of all the planet's poverty!! Ever heard of East/West Germany, Cuba /Florida??CONservative economic policy NEVER works as promised, weird soooooo many right wingers don't understand how an economy works (DEMAND)...