Operation Choke Point

From Wikipedia, the free encyclopedia

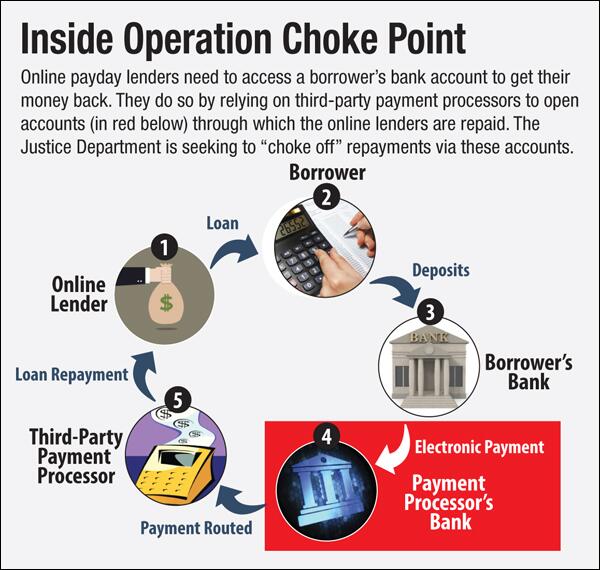

Operation Choke Point is an ongoing initiative of the United States Department of Justice that was announced in 2013,[1] which is investigating banks in the United States and the business they do with payment processors, payday lenders, and other companies believed to be at higher risk for fraud and money laundering.

This operation, first disclosed in August 2013 Wall Street Journal story [2] has been crtiticised for bypassing due process; the government is pressuring the financial industry to cut off the companies' access to banking services, without first having shown that the targeted companies are violating the law.[3][4][5][6] As reported by the St. Louis Post-Dispatch, critics believe "it's a thinly veiled ideological attack on industries the Obama administration doesn't like, such as gun sellers and coal producers."[7]

The operation itself is now under investigation by two federal agencies.[7][8]

Operation Choke Point - Wikipedia the free encyclopedia

The Justice Department’s “Operation Choke Point” initiative has been shrouded in secrecy, but now it is starting to come to light. I first heard about the program in January through this article and since then it has been difficult to discover details about it. It is so named because through strangling the providers of financial services to the targeted industries, the government can “choke off” the oxygen (money) needed for these industries to survive. Without an ability to process payments, the businesses – especially online vendors — cannot survive.

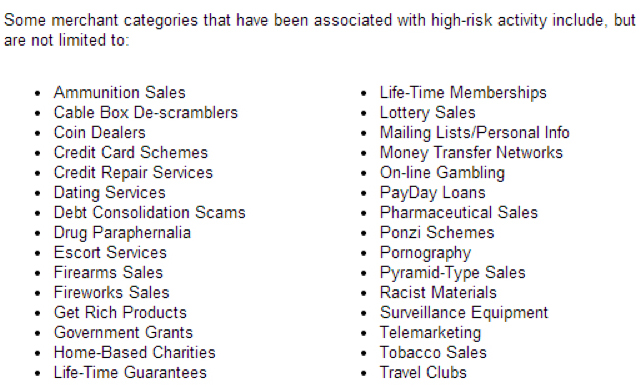

The general outline is the DOJ and bank regulators are putting the screws to banks and other third-party payment processors to refuse banking services to companies and industries that are deemed to pose a “reputation risk” to the bank. Most controversially, the list of dubious industries is populated by enterprises that are entirely, or at least generally, legal. Tom Blumer’s extremely informative post summarizing what is known to date about Operation Choke Point reproduces the list, which includes things such as ammunition sales, escort services, get-quick-rich schemes, on-line gambling, “racist materials” and payday loans. Quite obviously, some of these things are not like the other; moreover, just because there are some bad apples within a legal industry doesn’t justify effectively destroying a legal industry through secret executive fiat.

Especially ironic, of course, is that while the DOJ and bank regulators are choking off financial services to legal industries, they are also encouraging banks to provide banking services to illegal marijuana sales.

The ability to destroy legal industries through secret actions to deprive them of banking services has obvious political consequences. For example, it was reported last week that firearms shops are alleging that Operation Choke Point is being used to pressure banks into refusing to providing financial services. There are also reports that porn stars (and here) have had their bank accounts terminated for “moral” reasons related to the “reputation risk” of banking individuals in the porn industry. IRS officials must already be salivating about ways to apply Operation Choke Point to tea party groups.

In principle, of course, the logic of Operation Choke Point could be extended to groups not currently targeted. Notably absent from the FDIC’s hit list, for example, are abortion clinics, radical environmental groups, or, well, marijuana shops, for that matter. Something similar was done to cut off credit-card payments to support the operation of WikiLeaks.

8220 Operation Choke Point 8221 - The Washington Post