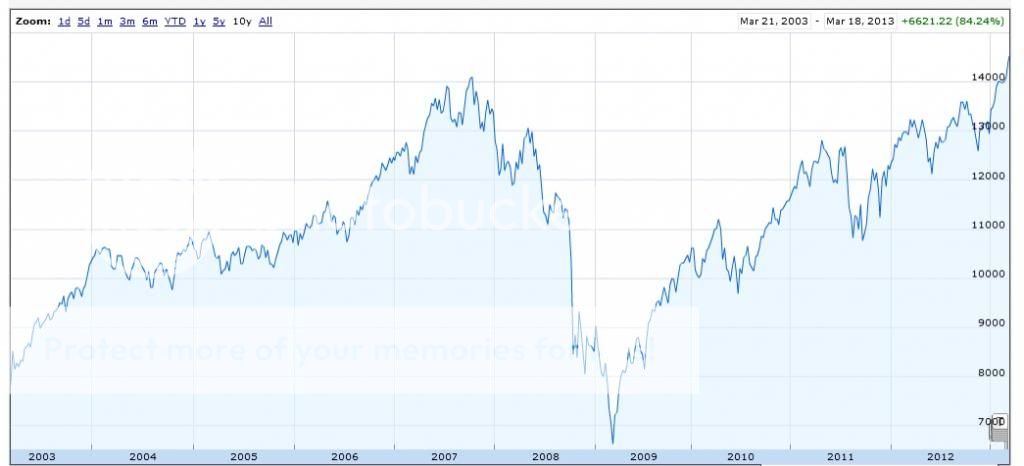

Investors should remain on the sidelines and wait for a market correction as a 4-year rebound comes to an end, Sandy Jadeja, chief market strategist at SignalPro said on Tuesday.

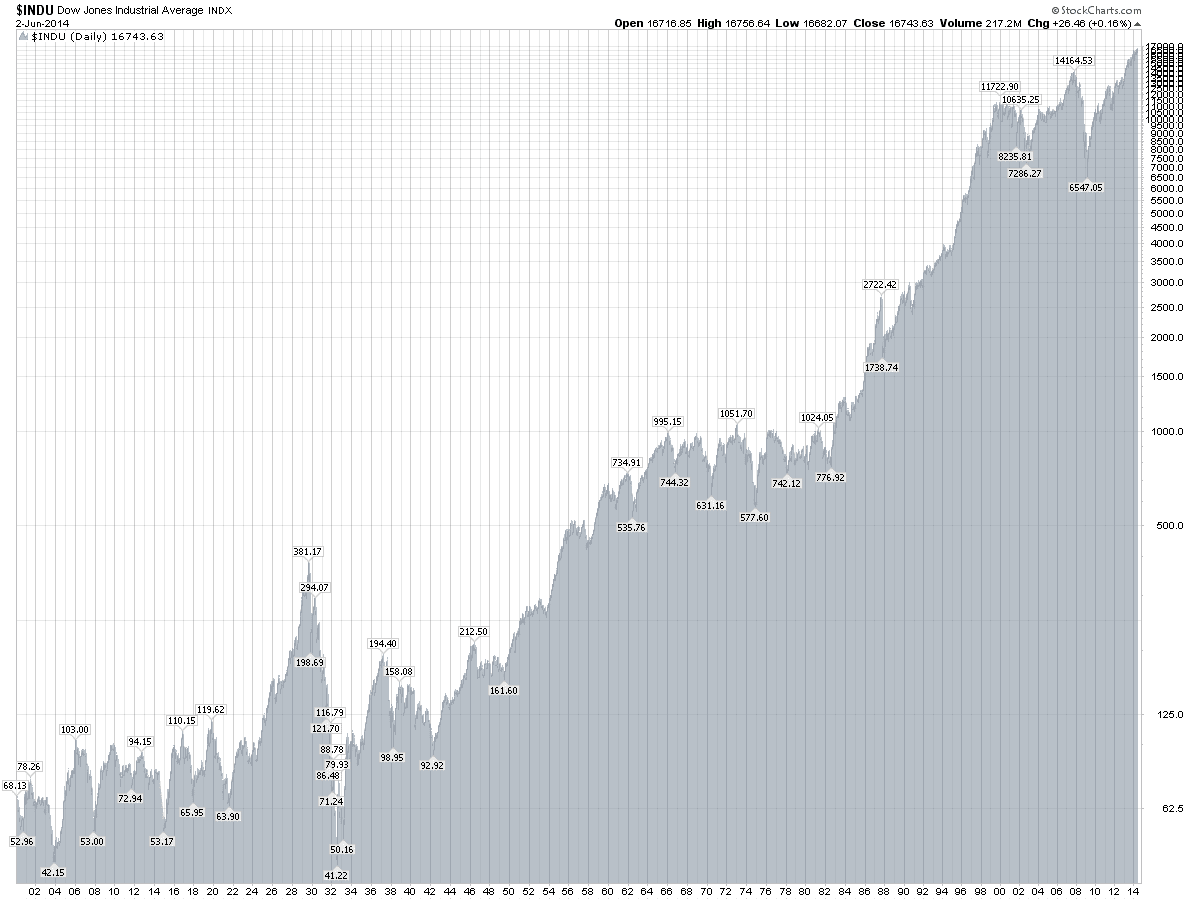

Investors should remain on the sidelines and wait for a market correction as a 4-year rebound comes to an end, Sandy Jadeja, chief market strategist at SignalPro said on Tuesday.Jadeja said the current market cycle showed "extreme similarities" with 1929.

"If you take a look at the patterns which repeat themselves through the years, they are re-emerging. So what it's suggesting is: it isn't all good out there," he said.

He said the historical comparison showed that the S&P as a leading indicator of the broader market was forewarning investors. While the "small speculators" had pushed the Dow to new highs, the S&P had not broken those record levels.

Copper prices were also a sign that markets were getting ahead of themselves and that economic growth is not as strong as some investors anticipate.

As it is used in construction, automobiles and the electronics industry, copper is a leading indicator of economic growth.

"It is really warning us, like a weather pattern. It's saying there is a storm out there," he said.

"Watch copper prices. If we start to see a continuation to the downside (in copper) you're going to see the Dow and the S&P start to catch up," he said.

He did not expect a 30-40 percent decline but recommended investors "stand aside".

Grapes of wrath ?