ilia25

I can do math

- Jan 12, 2012

- 1,859

- 100

- 48

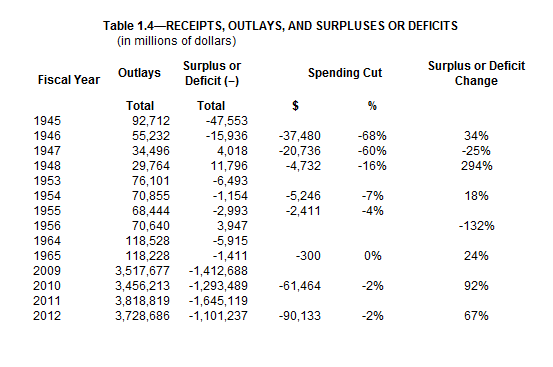

Political hacks are doing to the word "austerity" what they've done to the words "gay" and "marriage". Making up new definitions can give the illusion of discourse but it's a crock. Here's what most people say "austerity" means:Look at your own chart. The reason for current deficits is low government income (low, because the economy is depressed). Austerity will reduce the government receipts further......current deficits are extraordinary and Krugboy calling it 'austerity' is crazy.

This means that "austerity" brings lower deficits because of sever spending cuts and increasing revenue.AusterityA program in which a government drastically reduces spending and/or increases taxes or other revenue sources. A government launches austerity programs when their deficit and/or national debt become unsustainable. The IMF and the World Bank often require austerity programs in exchange for restructuring or refinancing a country's debt. Austerity is usually politically unpopular because it may involve cutting programs like food subsidies or national health care.

Farlex Financial Dictionary. © 2012 Farlex, Inc. All Rights Reserved

Those advocating austerity hope that it will bring lower deficits because of sever spending cuts and increasing revenue. The problem is that in a depressed economy slashing spending also brings the revenues down. So austerity makes depression worse, but has no immediate effect on deficit. Long-term it makes the debt problem worse by prolonging depression -- and big deficits.