TakeAStepBack

Gold Member

- Mar 29, 2011

- 13,935

- 1,742

- 245

Housing prices have been in a decline for years now,

Yes, since the bubble pop in 2008. Thats the point.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

Housing prices have been in a decline for years now,

He says very very clearly in his book that the government should spend money exactly like it did when WW II started to end this current depression the way it ended the Great Depression.

On page 89 of The Great Unraveling, Krugman specifically says that WWII ended the GD only because "world war" was sufficiently motivating, that the American people supported, a super-large super-stimulus. He specifically says that the size of the stimulus matters, not (directly) what the money is spent towards. (Comparatively) low Taxes, and high spending, employs all the businesses & workers who get the Government contracts (for the new Public goods & services produced).World War II was the ULTIMATE in stimulus spending. Put everyone to work. So, yes, there is no doubt that putting people to work on that scale would end the unemployment issue.

Money spent on used goods, stocks & bonds, & real-estate is not considered GDP. Perhaps "easy credit" fueled speculation, in securities & housing, without affecting nominal GDP spending ? Large amounts of money can move, without showing up in GDP.Well if it was excessively loose to spur spending, then we should have seen spending rise above trend!

I'm sure that's what Krugman meant. He might have used the example of weapons production for comparison purposes but there is absolutely no reason why he would recommend that as a specific objective.No chance he might have meant, say, rebuilding America's crumbling infrastructure?

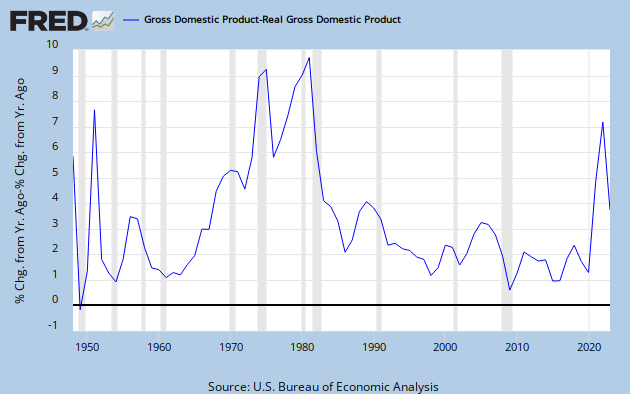

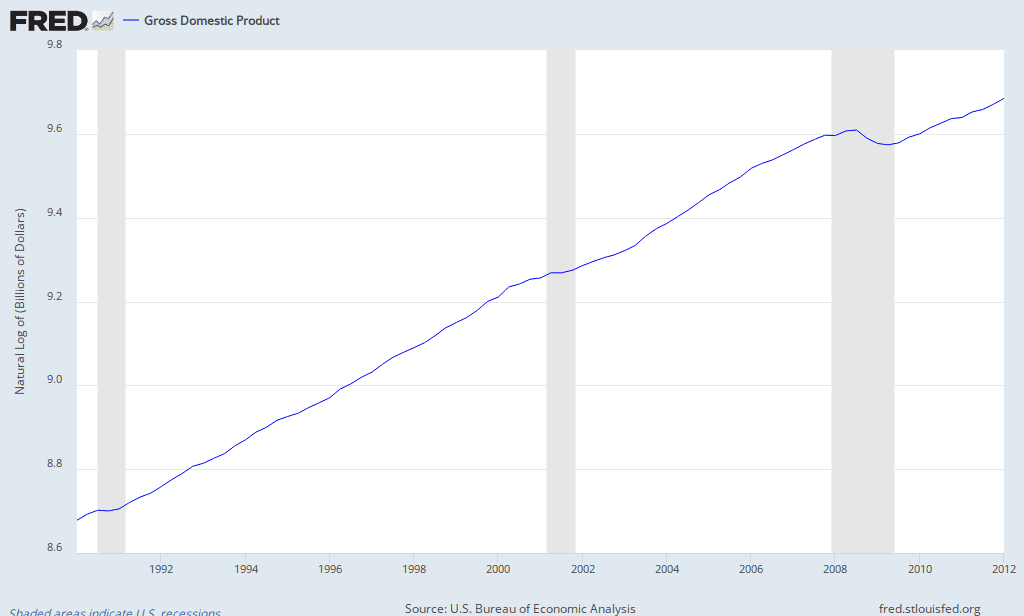

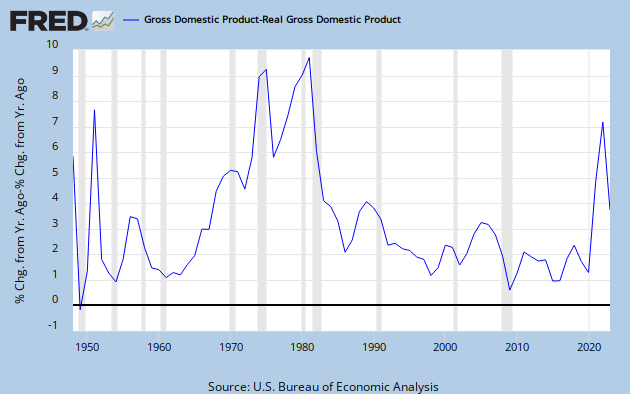

From 2002-2006, nominal GDP grew by 5-7% per year; in 2008, it fell by 3%. That is the "9% below trend" of which you speak?... the key variable is nominal spending... If NGDP (total nominal spending) is rising above trend, then we've got the bad inflation. If NGDP is falling below trend, we've got the bad deflation. Now when we look at NGDP though (i'm sure you can do this yourself on FRED), there was no "inflation binge". Money wasn't excessively loose... NGDP went on to fall 9% below trend. Excessively tight money.

Money spent on used goods, stocks & bonds, & real-estate is not considered GDP. Perhaps "easy credit" fueled speculation, in securities & housing, without affecting nominal GDP spending ? Large amounts of money can move, without showing up in GDP.Well if it was excessively loose to spur spending, then we should have seen spending rise above trend!

From 2002-2006, nominal GDP grew by 5-7% per year; in 2008, it fell by 3%. That is the "9% below trend" of which you speak?... the key variable is nominal spending... If NGDP (total nominal spending) is rising above trend, then we've got the bad inflation. If NGDP is falling below trend, we've got the bad deflation. Now when we look at NGDP though (i'm sure you can do this yourself on FRED), there was no "inflation binge". Money wasn't excessively loose... NGDP went on to fall 9% below trend. Excessively tight money.

From 2002-2006, inflation was 2-3% per year, higher than since the 1980s. Perhaps there was some "inflation binge"?

The term "Fiscal stimulus" means Government runs a budget deficit, with Government expenditures (G) exceeding Tax revenues (T) by a wide margin (G >> T; G-T >> 0). The housing bubble was not (to my knowledge) financed by Government expenditures. Government policies played a part, but not expenditures (on new final goods & services in GDP).putting it[idle money] to work is what the government can do to help the economy.

Libertarians have dismissed that for 100 years as mal-investment, bubble, make-work, bridge to no where, Solyndra , soviet spending... We're in a housing depression because liberal bureaucrats did put the money to work in housing

nominal interest-rates are the price of credit, reflecting the ratio of supply to demand. So, if interest-rates are zero, then there is zero demand for credit. And so, any new base money that enters the banking system will not be on-lent, but will simply get stuck in bank vaults?If interest rates are stuck at zero, printing more money does nothing.

what about the Classical Dichotomy ? You have an economy, with some price-level (P) and output-level (Q); the nominal spending is (PQ). The economy recesses. You level target. The economy rebounds, nominally, at higher-price levels, and lower output-levels. But in real terms, the economy has shrunk; and if money is neutral, then a shrunken economy can't be equivalent to, nor just as good as, a larger one. Inexpertly, real variables, like real output (Q), seem much more important.So then he concludes with the idea that if interest rates are stuck at zero, a "liquidity trap", then government should try to affect output with fiscal stimulus... The only way fiscal policy is justifiable (and Krugman understands this) is if monetary policy can't do anything...

I was talking about targeting the level. Specifically, targeting the level of nominal spending... just return the level of nominal income back near its pre-recession trend line.

i.e. printing currency and inflating the money base ?there's no such thing as "the liquidity trap". To quote Ben Bernanke, it's a "self-induced paralysis". It's not that monetary policy can't be expansionary at the zero lower bound, it's that the central bank is unwilling to engage in expansionary monetary policy.

In a liquidity trap, with zero interest-rates, money actually is idle in banks, and the Public could borrow the money, for Government expenditures, without crowding-out any potential private sector borrowers.It doesn't work because Gov't doesn't have money in the bank to spend on projects. It must coerce that money from somewhere. So for every person who benefits there is another somewhere else who suffers.

nominal interest-rates are the price of credit, reflecting the ratio of supply to demand. So, if interest-rates are zero, then there is zero demand for credit. And so, any new base money that enters the banking system will not be on-lent, but will simply get stuck in bank vaults?

what about the Classical Dichotomy ? You have an economy, with some price-level (P) and output-level (Q); the nominal spending is (PQ). The economy recesses. You level target. The economy rebounds, nominally, at higher-price levels, and lower output-levels. But in real terms, the economy has shrunk; and if money is neutral, then a shrunken economy can't be equivalent to, nor just as good as, a larger one. Inexpertly, real variables, like real output (Q), seem much more important.

Fiscal stimulus makes do with already-existing money, left idle by the private sector, at low interest-rates (cheap credit is the best time to borrow).

i.e. printing currency and inflating the money base ?

the trend was about +6% per year; spending in 2008 was about -3%; for a total swing from trend of about 9% ?You know what "below trend" means right? You're quoting fall from the level of a previous year; I'm talking about the fall below trend.

Supply-side inflation is "stagflation", where supply shocks drive up costs; prices (P) rise, whilst outputs (Q) fall. Conversely, demand-side inflation is where prices rise, motivating more output. Before 2008, both P & Q were rising, telling me 'twas demand-side inflation ?Was it the efficient supply side inflation, or was it the dastardly demand side inflation? How do you tell?

the trend was about +6% per year; spending in 2008 was about -3%; for a total swing from trend of about 9% ?

Supply-side inflation is "stagflation", where supply shocks drive up costs; prices (P) rise, whilst outputs (Q) fall. Conversely, demand-side inflation is where prices rise, motivating more output. Before 2008, both P & Q were rising, telling me 'twas demand-side inflation ?

The housing bubble of the late 1980s, the dot-com bubble of the late 1990s, and the housing bubble of the late 2000s, all show up, in spending, as (moderate) inflation bubbles. Meanwhile, Pres. Clinton's "austerity" or "Fiscal consolidation" was apparently (comparatively) deflationary.

The housing bubble of the late 1980s, the dot-com bubble of the late 1990s, and the housing bubble of the late 2000s, all show up, in spending, as (moderate) inflation bubbles. Meanwhile, Pres. Clinton's "austerity" or "Fiscal consolidation" was apparently (comparatively) deflationary.

Looking at growth rates doesn't tell you anything. You need to look at it's position relative to trend. I don't know if you have any econometrics packages, but it'd be a more informative to go and detrend the series for NGDP with an HP-filter.