Dad2three

Gold Member

YOUR LINK BUBBA

"What GAO Found United States Government Accountability Office Why GAO Did This Study Highlights Accountability Integrity Reliability

Highlights of GAO-06-24, a report to the Chairman, Subcommittee on Housing and Community Opportunity, Committee on Financial Services, House of Representatives

November 2005

MORTGAGE FINANCING

Additional Action Needed to Manage Risks of FHA-Insured Loans with Down Payment Assistance

The Federal Housing Administration (FHA) permits borrowers to obtain down payment assistance from third parties; but, research has raised concerns about the performance of loans with such assistance. Due to these concerns, GAO examined the (1) trends in the use of down payment assistance with FHA-insured loans, (2) the impact that the presence of such assistance has on purchase transactions and house prices, (3) how such assistance influences the performance of these loans, and (4) FHA’s standards and controls for these loans.

What GAO Recommends

The Secretary of Housing and Urban Development should direct the FHA Commissioner to implement additional controls to manage the risks associated with loans that involve down payment assistance. Such controls could involve considering the presence and source of down payment assistance when underwriting loans. Further, the FHA Commissioner should consider additional controls for loans with down payment assistance from seller-funded nonprofits. In written comments, HUD generally agreed with the report’s findings. HUD also commented on certain aspects of selected recommendations.

Almost half of all single-family home purchase mortgages that FHA insured in fiscal year 2004 had down payment assistance. Nonprofit organizations that received at least part of their funding from sellers provided assistance for about 30 percent of these loans and represent a growing source of down payment assistance. However, assistance from seller-funded nonprofits alters the structure of the purchase transaction. First, because many seller-funded nonprofits require property sellers to make a payment to their organization; assistance from these nonprofits creates an indirect funding stream from property sellers to homebuyers. Second, GAO analysis indicated that FHA-insured homes bought with seller-funded nonprofit assistance were appraised at and sold for about 2 to 3 percent more than comparable homes bought without such assistance.

Regardless of the source of assistance and holding other variables constant, GAO analysis indicated that FHA-insured loans with down payment assistance have higher delinquency and claim rates than do similar loans without such assistance. Furthermore, loans with assistance from seller-funded nonprofits do not perform as well as loans with assistance from other sources. This difference may be explained, in part, by the higher sales prices of comparable homes bought with seller-funded assistance."

OOOOOOOOOPPPPPPPPPPPPSSSSSSSSSSSS.....

So 10 years after its origination and when 43 made it painfully clear Clintoon had mortgaged the future for votes, GAO says FHA DPA has higher delinquencies? But this ideology of ZERO DOWNPAYMENT is good in '95 but bad in '04?

Besides VA loans, which I will add you had no real clue about, what mortgage loan other than FHA DPA existed before the Sub Prime Zero Down, No MI, 560 FICO loan rolled out?

So let me get this straight, you believe no significant revisions were made to CRA under the Clintoon Admin, correct?

Regulatory changes 1995[edit]

In July 1993, President Bill Clinton asked regulators to reform the CRA in order to make examinations more consistent, clarify performance standards, and reduce cost and compliance burden.[51] Robert Rubin, the Assistant to the President for Economic Policy, under President Clinton, explained that this was in line with President Clinton's strategy to "deal with the problems of the inner city and distressed rural communities". Discussing the reasons for the Clinton administration's proposal to strengthen the CRA and further reduce red-lining, Lloyd Bentsen, Secretary of the Treasury at that time, affirmed his belief that availability of credit should not depend on where a person lives, "The only thing that ought to matter on a loan application is whether or not you can pay it back, not where you live." Bentsen said that the proposed changes would "make it easier for lenders to show how they're complying with the Community Reinvestment Act", and "cut back a lot of the paperwork and the cost on small business loans".[36]

By early 1995, the proposed CRA regulations were substantially revised to address criticisms that the regulations, and the agencies' implementation of them through the examination process to date, were too process-oriented, burdensome, and not sufficiently focused on actual results.[52] The CRA examination process itself was reformed to incorporate the pending changes.[40] Information about banking institutions' CRA ratings was made available via web page for public review as well.[36] The Office of the Comptroller of the Currency (OCC) also moved to revise its regulation structure allowing lenders subject to the CRA to claim community development loan credits for loans made to help finance the environmental cleanup or redevelopment of industrial sites when it was part of an effort to revitalize the low- and moderate-income community where the site was located.[53]

During one of the Congressional hearings addressing the proposed changes in 1995, William A. Niskanen, chair of the Cato Institute, criticized both the 1993 and 1994 sets of proposals for political favoritism in allocating credit, for micromanagement by regulators and for the lack of assurances that banks would not be expected to operate at a loss to achieve CRA compliance. He predicted the proposed changes would be very costly to the economy and the banking system in general. Niskanen believed that the primary long term effect would be an artificial contraction of the banking system. Niskanen recommended Congress repeal the Act.[54]

Niskanen's, and other respondents to the proposed changes, voiced their concerns during the public comment & testimony periods in late 1993 through early 1995. In response to the aggregate concerns recorded by then, the Federal financial supervisory agencies (the OCC, FRB, FDIC, and OTS) made further clarifications relating to definition, assessment, ratings and scope; sufficiently resolving many of the issues raised in the process. The agencies jointly reported their final amended regulations for implementing the Community Reinvestment Act in the Federal Register on May 4, 1995. The final amended regulations replaced the existing CRA regulations in their entirety.[55] (See the notes in the "1995" column of Table I. for the specifics)

And this little blip also happened under Clintoon...

Legislative changes 1999[edit]

In 1999 the Congress enacted and President Clinton signed into law the Gramm-Leach-Bliley Act, also known as the Financial Services Modernization Act. This law repealed the part of the Glass–Steagall Act that had prohibited a bank from offering a full range of investment, commercial banking, and insurance services since its enactment in 1933. A similar bill was introduced in 1998 by Senator Phil Gramm but it was unable to complete the legislative process into law. Resistance to enacting the 1998 bill, as well as the subsequent 1999 bill, centered around the legislation's language which would expand the types of banking institutions of the time into other areas of service but would not be subject to CRA compliance in order to do so. The Senator also demanded full disclosure of any financial "deals" which community groups had with banks, accusing such groups of "extortion"

Yes I do own your dumbass...

Oh one more issue, you continue to avoid the USDA Census Tract question?

I thought you said you where an expert?

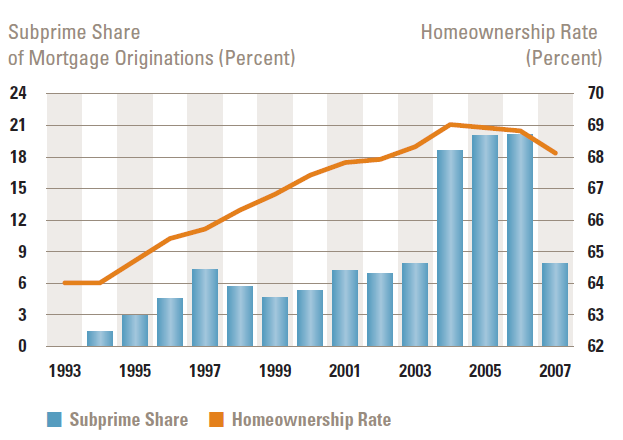

AGAIN, GOV'T BACKED LOANS PERFORMED 450%-600% BETTER THAN PRIVATE MARKET LOANS 2004-2007, HOW IS THAT POSSIBLE? lol

FACTS on Dubya s great recession US Message Board - Political Discussion Forum