Dad2three

Gold Member

The reality is CRA was instituted to force banks to lend in low income areas,..

this is true and it was 1 of 132 state and federal programs to get people into homes the Republican free market said they could not afford!

When people could in fact not afford the homes did the liberal Marxists blame the 132 programs? Of course not! They blamed capitalism even though the 132 programs had in effect eliminated capitalism.

Its just like Obamacare! We had to switch to it because capitalism was not working. In reality it was not working because there was no capitalism again thanks to Marxist liberals .

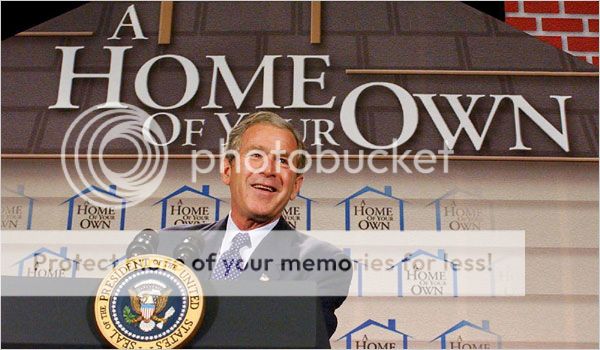

Right-wingers Want To Erase How George Bush's "Homeowner Society" Helped Cause The Economic Collapse

2004 Republican Convention:

Another priority for a new term is to build an ownership society, because ownership brings security and dignity and independence.

...

Thanks to our policies, home ownership in America is at an all- time high.

(APPLAUSE)

Tonight we set a new goal: 7 million more affordable homes in the next 10 years, so more American families will be able to open the door and say, "Welcome to my home."

“We can put light where there’s darkness, and hope where there’s despondency in this country. And part of it is working together as a nation to encourage folks to own their own home.” — President Bush, Oct. 15, 2002

From the 2000 GOP Platform:

“Implement the “American Dream Down Payment” program, which will allow a half million families who currently draw federal rental assistance to become homeowners, and allow families receiving federal rental payments to apply one year’s worth of their existing assistance money toward the purchase of their own first home, thus becoming independent of any further government housing assistance. This approach builds upon our long standing commitment to resident management of public housing and other initiatives.”

Passed: December 16, 2003 — American Dream Down Payment Initiative (ADDI)

ADDI aims to increase the homeownership rate, especially among lower income and minority households, and to revitalize and stabilize communities. ADDI will help first-time homebuyers with the biggest hurdle to homeownership: downpayment and closing costs. The program was created to assist low-income first-time homebuyers in purchasing single-family homes by providing funds for downpayment, closing costs, and rehabilitation carried out in conjunction with the assisted home purchase.

President: George W. Bush (R)

US House: Rep. Dennis Hastert (R)

US Senate: Sen. Bill Frist (R)

June 17, 2004

Builders to fight Bush's low-income plan

NEW YORK (CNN/Money) - Home builders, realtors and others are preparing to fight a Bush administration plan that would require Fannie Mae and Freddie Mac to increase financing of homes for low-income people, a home builder group said Thursday.

Home builders fight Bush's low-income housing - Jun. 17, 2004

Predatory Lenders' Partner in Crime

Predatory lending was widely understood to present a looming national crisis.

What did the Bush administration do in response? Did it reverse course and decide to take action to halt this burgeoning scourge?

Not only did the Bush administration do nothing to protect consumers, it embarked on an aggressive and unprecedented campaign to prevent states from protecting their residents from the very problems to which the federal government was turning a blind eye

In 2003, during the height of the predatory lending crisis, the OCC invoked a clause from the 1863 National Bank Act to issue formal opinions preempting all state predatory lending laws, thereby rendering them inoperative

Eliot Spitzer - Predatory Lenders' Partner in Crime

The banks have known for 30 years the risks involved on the loan products they sold. This is why they lobbied so hard to allow them to sell the bad products to investors so they would not be holding the bad paper or the risks. The developed the products like stated income stated assets then bundled them to make it appear they were blended risks and then sold them to multiple investors. Who bought these high risk loans? Mostly pension funds and Insurances seeking higher returns who lost almost half of the pension funds value and the public that depended on those funds for retirement.

Hey dumb dumb, how do you think we ever arrived at the thought Zero Down loans where okay?

Oh, BTW can you not answer my question in regards to USDA?

Just keep on believing the spoon feed drivel, you seem to be able to slurp it down in large amounts...

VA's had zero down for 50 + years, AND performs MUCH better than traditional mortgages? And?