bripat9643

Diamond Member

- Apr 1, 2011

- 170,170

- 47,328

- 2,180

Nothing is equal about it. Hence why NO ONE supports it, except for idiots such as yourself.

Plenty of people support it, dipshit.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Nothing is equal about it. Hence why NO ONE supports it, except for idiots such as yourself.

If only we increased taxes on the wealthy, greedy corporations, estates, capital gains, and profits more the economy would improve dramatically........

Just think of all the jobs govt would be able to "create" with all that tax revenue LOL

You're right. We need to end the horrific Bush tax cuts to the rich and go back to the wildly successful Clinton plan, which did just that.

The "Clinton plan" did not create tax revenue in an economic environment anything LIKE what we now find ourselves in. The so called Dot Com Boom is what created all that tax revenue during the Clinton years. Raising taxes NOW...during an economic slowdown is counter productive...something that even Clinton himself admitted before the Obama White House put the screws to him to change his tune. This progressive "notion" that the rules of economics no longer apply because they choose to ignore them guarantees us years more of economic stagnation or worse.

You're right. We need to end the horrific Bush tax cuts to the rich and go back to the wildly successful Clinton plan, which did just that.

The "Clinton plan" did not create tax revenue in an economic environment anything LIKE what we now find ourselves in. The so called Dot Com Boom is what created all that tax revenue during the Clinton years. Raising taxes NOW...during an economic slowdown is counter productive...something that even Clinton himself admitted before the Obama White House put the screws to him to change his tune. This progressive "notion" that the rules of economics no longer apply because they choose to ignore them guarantees us years more of economic stagnation or worse.

The budget went from a 255 billion deficit to a 69 billion dollar surplus from 1993 to 1998.

btw, the dot com bubble to even have happened required massive amounts of investor capital to flow into the market.

That destroys the argument that raising taxes is certain to kill investment.

You're partially correct. What the nation needs is fair tax rates along with cuts in spending. This was achieved under Clinton and lead to the booming economy, where the reverse was done under W causing the nation's collapse.

Luckily the nightmare in Iraq is over, but Afghanistan needs to be stopped as well.

The GOP has been frothing at the mouth to go to war with Iran, and propose even more insane military spending.

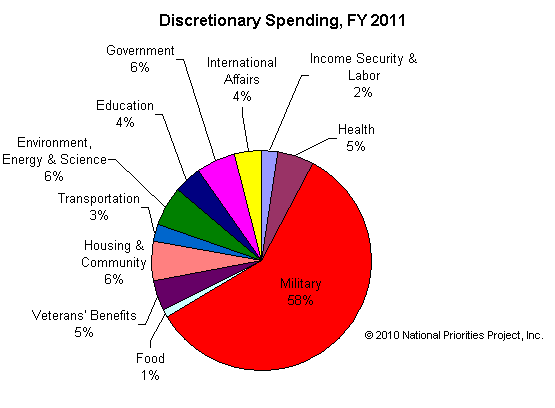

Now take a look at this map and tell me where the cuts need to be. The latest stunt from the GOP is going after food stamps,..

A flat tax of 20% would be more then enough confiscated tax dollars to waste on bureaucrats mindless schemes..................

Although it might not satisfy the looters demands for the fiction of "social justice"

Tons of Logik AND Reazon in this post.

What would taxing 20% of someone who is struggling to make ends meet mean? Prosperity and the path to riches of course.

It would mean paying their fair share. It might also mean a better paying job since a flat tax would be far better for the economy.

Now... you and ones like you also love to complain when the 'evil rich' only pay around 15% because they only pay capital gains... well, a 20% flat tax with zero exceptions, zero deductions, and zero loopholes should make you happy then

Name one politician/public figure who supports your ridiculous idea. Oh thats right, you can't because it's......ridiculous.

Since when have politicians been noted for being sound judges of economic theory? Mostyly they are economic ignoramuses, especially liberal politicians.

Nothing is equal about it. Hence why NO ONE supports it, except for idiots such as yourself.

Plenty of people support it, dipshit.

Tons of Logik AND Reazon in this post.

What would taxing 20% of someone who is struggling to make ends meet mean? Prosperity and the path to riches of course.

It would mean paying their fair share. It might also mean a better paying job since a flat tax would be far better for the economy.

False AND False. Try again.

Nothing is equal about it. Hence why NO ONE supports it, except for idiots such as yourself.

Plenty of people support it, dipshit.

Not anyone with a brain.

It would mean paying their fair share. It might also mean a better paying job since a flat tax would be far better for the economy.

False AND False. Try again.

Well, the bottom 50% of wage earners pay NO federal income tax. Does that sound fair to you?

Loser.

It would mean paying their fair share. It might also mean a better paying job since a flat tax would be far better for the economy.

False AND False. Try again.

Well, the bottom 50% of wage earners pay NO federal income tax. Does that sound fair to you?

Loser.

Punish the achievers and the people who risk capital to expand and hire people who make the things we need. That's what passes for logik/reason in today's union educated left.

False AND False. Try again.

Well, the bottom 50% of wage earners pay NO federal income tax. Does that sound fair to you?

Loser.

Right, just like I said in the 2nd post of this thread. The way to solve our countries problems is by raising the taxes on the poor and middle class while decreasing them for the rich. That HAS TO equal an economic boom for the poor and middle class.

False AND False. Try again.

Well, the bottom 50% of wage earners pay NO federal income tax. Does that sound fair to you?

Loser.

yes, if they are that poor they have the tax breaks, just like the rich and corporations get thiers also.

Well, the bottom 50% of wage earners pay NO federal income tax. Does that sound fair to you?

Loser.

Right, just like I said in the 2nd post of this thread. The way to solve our countries problems is by raising the taxes on the poor and middle class while decreasing them for the rich. That HAS TO equal an economic boom for the poor and middle class.

we have already done that, and the gap got bigger.

Well, the bottom 50% of wage earners pay NO federal income tax. Does that sound fair to you?

Loser.

yes, if they are that poor they have the tax breaks, just like the rich and corporations get thiers also.

Not poor. They are the lower 50% of income earners. They could certainly afford to pay something, right?

False AND False. Try again.

Well, the bottom 50% of wage earners pay NO federal income tax. Does that sound fair to you?

Loser.

Right, just like I said in the 2nd post of this thread. The way to solve our countries problems is by raising the taxes on the poor and middle class while decreasing them for the rich. That HAS TO equal an economic boom for the poor and middle class.

yes, if they are that poor they have the tax breaks, just like the rich and corporations get thiers also.

Not poor. They are the lower 50% of income earners. They could certainly afford to pay something, right?

So you were opposed to the Bush Tax cuts I take it?

Well, the bottom 50% of wage earners pay NO federal income tax. Does that sound fair to you?

Loser.

Right, just like I said in the 2nd post of this thread. The way to solve our countries problems is by raising the taxes on the poor and middle class while decreasing them for the rich. That HAS TO equal an economic boom for the poor and middle class.

Yes, sharing the tax burden will work wonders for fiscal responsibility.

It's amazing. When you mock what you think of as conservatives you actually sound like you know something. When you answer on your own you sound like the uneducated doofus you are.